Vijay Kedia was the first to link NAMO’s humiliating defeat in the Bihar elections with the early passage of the GST Bill. He prophetically predicted “In my view the positive impact of Mr. Modi’s defeat in Bihar will surprisingly lead to passing of the GST bill very soon.”

Since then, some water has flown under the bridge. Today, there was great excitement over the fact that NAMO has invited Sonia Gandhi and Manmohan Singh for a discussion on resolving their concerns relating to the GST Bill.

Everyone was confident that NAMO will turn on his charm and woo the duo into signing on the dotted line. NAMO knows how to win friends and influence people.

In fact, evidence of this can already be seen as reported by Abhijet Majumdar, the editor of Mail Today:

Shocking civility between BJP and Congress as Sonia meets Modi over GST 🙂

— Abhijit Majumder (@abhijitmajumder) November 27, 2015

Rahul Gandhi also had a conciliatory tone:

We have our differences but we want the GST to be passed, says Rahul Gandhi

— Times of India (@timesofindia) November 27, 2015

It is also significant that Mayawati, the boss-woman of the Bahujan Samaj Party (BSP), has pledged her support for the GST.

Samir Arora, the whiz-kid fund manager with Helios Capital, was so enthused that he impromptu composed a poem to commemorate the event:

GST ka khayal

Modi ji ke dil main aaya hai

Isiliye Sonia Manmohan ji ko

Chai be bulaya hai

— Samir Arora (@Iamsamirarora) November 27, 2015

Barkha Dutt, who is known for her astute reading of political affairs, was also gung ho about the situation:

Pitch perfect note of conciliation and consensus by @PMOIndia in Parliament today. Building bridges with Opposition ?

— barkha dutt (@BDUTT) November 27, 2015

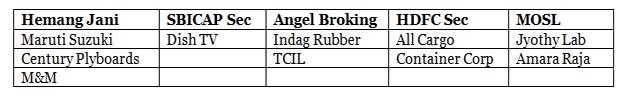

Now, as to the all-important question of which stocks will benefit the most from the GST, Kshitij Anand of ET has done all the hard work by contacting the experts and collating their stock picks. He has identified the following top 10 stock picks:

(1) Maruti Suzuki India: There are very few pockets where you will have very strong visibility of earnings with better margin profiles. Maruti is one stock that is likely to gain from both GST as well as the Seventh Pay Commission recommendations. In terms of valuations, it looks expensive, because a lot of people own it. So there is going to be that scarcity premium. It is going to be a crowded trade, but that is where people want to be in. Some of models launched have been quite good. Baleno has met with a lot of success, so Maruti is a good buy from a one-year perspective.

(2) Century Plyboards: The company is a dominant player in the plywood and in the laminate segment. There is going to be an increase in the urban spending over the next one or two years, and that fits into that particular theme. Most importantly, if the GST bill gets passed, one of the key beneficiary will be players which draw people who are not paying taxes. The introduction of the goods and services tax would create a level-playing field for organised players. Their competitive positioning will get much better, and the overall growth in the plywood segment is going to be about 12-14 per cent.

Unorganised players are currently out of the tax net and thus enjoy lower costs by evading taxes. After the introduction of GST, the tax advantage enjoyed by the unorganised players would diminish sharply and the market share of the organised players is likely increase significantly, benefiting Century. The margin profile and earnings profile of the company is looking much better. In terms of valuation, it might be a little expensive, but given the overall market share they have, it justifies this kind of a premium valuation.

(3) Mahindra & Mahindra: M&M has actually been an underperformer for the last six months or so and it has lost market share in the SUV space, because of increase in competition. But at this price point, Mahindra is looking good valuation wise.

As far as rural demand is concerned, there is not going to be any significant improvement. It has stabilised, and over the next 6 to 12 months there will be some kind of an uptick there. And if GST is implemented, companies that outsource from smaller players are going to be big beneficiaries. So M&M completely fits the bill within that theme.

(4) Dish TV: The stock currently trades at an EV/Ebitda of 11.7 times/9.6 times /7.7 times F16e/F17e/F18e Ebitda. The brokerage expects steady improvement in Dish TV’s financials in the coming quarters, considering a) the differential between DTH and Cable ARPUs are narrowing, boosting DTH adoption and also give scope to raise prices, b) anticipated margin improvement on implementation of GST and TRAI recommendations on DTH license renewal, c) maintaining/improving market share on back of diverse offerings/presence and d) improving cash flows.

(5) & (6) Allcargo, Container Corporation: Goods logistics companies like Allcargo should be one of them to benefit from implementation from GST, or say Container Corporation for example. They always benefit out of this dedicated freight corridor also. Whenever GST is announced or some announcement related to GST comes, these stocks will go up.

(7) Jyothy Labs: Jyothy Labs (JYL) is aiming to double its profits in three years and sales in four years. Focus on power brands, extension of product portfolio, distribution expansion and premiumisation coupled with benefits from continued benign RM cost dynamics will be the key growth drivers.

Barring Ujala where it enjoys dominant positioning with 76% market share, JYL’s market share in rest of the portfolio – Mosquito Repellant, Dish-Wash, Soaps, and Detergents – offers scope for expansion.

Given the recent correction in Crude prices, earlier guidance of 400bp gross margin expansion has upside in our view. GST will add 150-200bp to Ebitda margins. However, it will help reduce the complexity of doing business – e.g. litigations pertaining to tax classifications by various state governments will no longer be there if GST is implemented.

(8) Amara Raja Batteries: FY16 is an inflection year for Amara Raja Batteries, with new capacities driving top line and benign lead prices driving margins (+240bp by FY17), translating into 34 per cent EPS CAGR (FY15-17) after muted FY15. Stable competitive environment, significant FCF generation (Rs 700 crore over FY16-17) and improving RoE (4pp by FY17 to 31 per cent)-coupled with potential shift from unorganized to organized players due to GST-would continue to drive stock re-rating.

(9) Indag Rubber: The current tread manufacturing industry’s size is of Rs 3,200cr, almost equally shared by unorganized and organized players. The tread manufacturing industry grew at a CAGR of 5 per cent over FY2011-14. Going forward, the industry would outperform its historical growth, owing to improved economic activity and an increase in penetration levels considering that the current penetration levels are lower than in developed countries.

Further, the organized sector would gain market share from unorganised players due to a shift in consumer preference for quality retreading products. Also, implementation of the GST, going forward, could reduce the pricing gap between organized and unorganized players, thereby rendering the organized players’ pricing equally attractive.

(10) Transport Corporation of India: Transport Corporation of India (TCIL) benefits from its pan-India scale, which gives it competitive advantage in higher margin segments of the logistics industry; as well as from its asset-light business model which cushions its profitability in cyclical downturns and gives it an attractive ROE profile. The company is well-placed to be a key beneficiary of the anticipated implementation of the GST. On its implementation, there will be a more pronounced requirement among companies for reliable pan-India logistics players to manage their hub-and-spoke supply chains.

Now, it will be interesting to see which of these ten stocks emerges the winner! Any guesses?

Hi guys. A good pick of stocks. But look out for the logistics sector. A company that can handle large warehouses will benefit the most as all companies will look to streamline their services. With added tech portfolio and lowering of costs, ease of moving items will seal the deal. In about 1 year we will see the benefits. But the real benefit will come if management can see the opportunity and grab it. Look for the company where management discusses the implementation of GST. Take care Indians.

Thanks for the valuable research and information. Shall definitely help my site visitors. Bye

Unless these announcements come into operation, investing in anticipation will have no control on time frame wise returns. It can by by April16 or April’17.

Consider elgi rubber also.

Positive developments are going on.

It can be a multbagger from hereon. Far better than indag rubber at this price point.