Ian Cassel’s profile is not familiar to us because he does not invest in Indian stocks. However, his credentials as a whiz-kid investor are established by the fact that Prof Sanjay Bakshi, the authority on value investing, has heaped lavish praise on him. The Prof complimented Ian Cassel for dispensing “wisdom through wonderful tweets”. He also said that he is “overwhelmingly in sync with Ian’s thoughts on investing”. “I think you are doing a wonderful service to the investment community by telling them in a very articulate manner why it make sense to invest with great, yet to be discovered, businesses and entrepreneurs. I love your ideas on illiquidity and inactivity too” the Prof said.

Now, it is quite evident that after such a glowing testimonial from the Prof, we have to keep a hawk eye on Ian Cassel and his sayings.

Ian Cassel has lived up to the confidence reposed in him by the Prof by producing a masterful guide to the fine art of discovering micro-caps which are on their way to becoming block-buster multi-baggers.

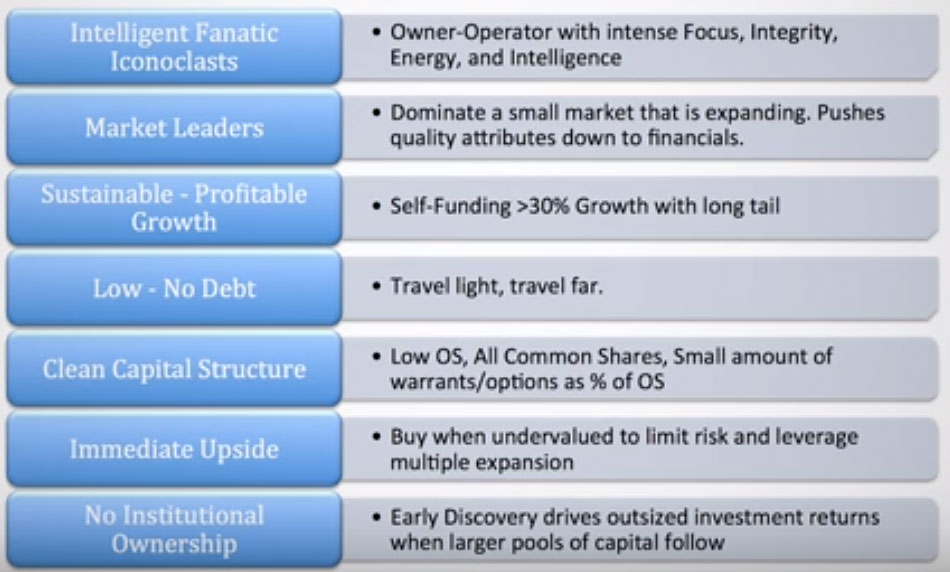

In the guide, which is in video, Ian has gone about the task in a systematic manner. He has first explained why it makes sense to invest in micro-cap stocks as compared to their large-cap counterparts. He emphasizes that micro-caps have the potential to out-perform their larger peers and give far greater returns, partly due to their illiquidity and consequent mis-pricing. He has then identified the characteristics that a successful micro-cap stock exhibits. These characteristics are:

(i) The Company is run by an “intelligent fanatic”;

(ii) It is a market leader and dominates the small but growing market;

(iii) It is highly profitable with a ROE in excess of 30%;

(iv) It is debt-free or has low debt;

(v) It has a small equity base and does not indulge in equity dilution;

(vi) It is undervalued and

(vii) There is little institutional ownership.

Thereafter, Ian has painstakingly explained where we can spot such companies and how to analyze them. He has also given important pointers on when we should sell these stocks.

At the end of the dissertation, Ian Cassel has exemplified the theory by reference to real-life case studies of a few stocks.

Now, the onus is on us to put the theory into practice and identify micro-caps which fit into Ian Cassel’s formula. In my view, some micro-caps which do fit into the formula include Camlin Fine, TCPL Packaging, Vidhi Dyestuffs, Vishnu Chemicals, Heritage Foods etc. Each of these stocks have been “discovered” by our favourite whiz-kid investors like Dolly Khanna, Vijay Kedia, Ashish Kacholia, Kamal Kabra etc and given the green signal of safety. However, these stocks are still “unknown” to the hoi polloi and the institutional investors. If we pile on to these stocks and hold on tight, we have a chance of pocketing a few mega bucks!

How can u miss Cupid in list, just coz no big name holding now. It has all the qualities mentioned above.

cupids arrow by sumit not to be missed

Sir ,

Rule (iv) It is debt-free or has low debt;

All of picks given by you fails on this criteria .

Rules are exact same as CAN SLIM investing by William O’ Neil, which means Ian Cassel looks only for growth stocks