Vijay Kedia has hand-picked a fail-safe blue-chip small-cap stock which is on a disruptive...

Heritage Foods

Kenneth Andrade of Old Bridge Capital has sent the wake up call that we...

Vijay Kedia’s birthday was celebrated with much gusto by his legion of fans and...

Shyam Sekhar’s latest pick is a small-cap stock with excellent credentials. We need to...

Mudar Patherya has recommended a buy of Vijay Kedia’s favourite stock. His conviction in...

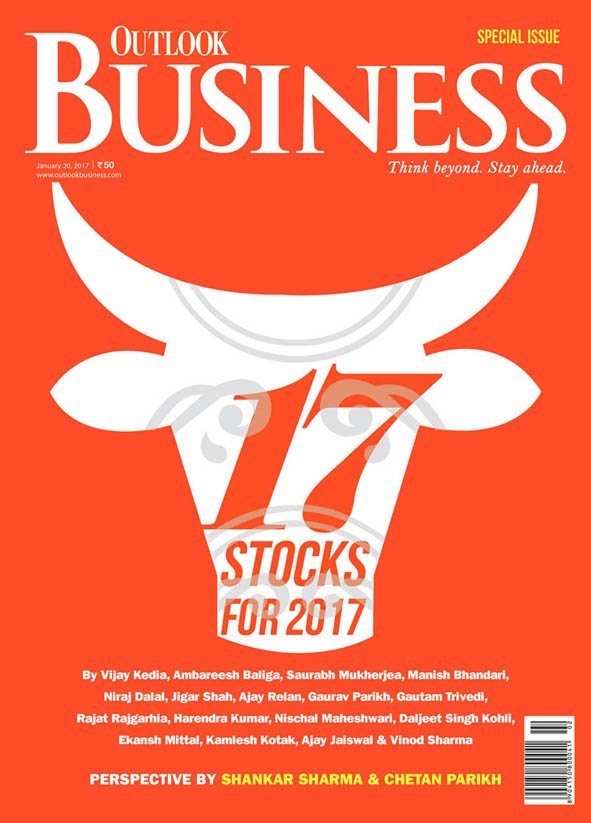

17 eminent stock wizards have recommended 17 top-quality stocks with the confident assurance that...

It is a matter of common sense that a stock backed by the troika...

Vijay Kedia & Porinju Veliyath have recommended two top-quality stocks which have the potential...

A stock which has been condemned as a “fallen angel” has suddenly become the...

Leading experts have put the spotlight on top-quality dairy stocks. It is claimed that...