First, we must compliment Carl Icahn for recently netting a profit of Rs. 13,000 crore ($2 Billion) from the sale of his entire holding of Apple stock. He bought the stock three years ago and had then called it an “undervalued” “no-brainer” with “great barriers to entrance”. Carl has now revealed that he sold Apple because he anticipates that the Company will have serious problems with China’s policies.

Second, we must compliment Carl Icahn for an incredible investing track record which surpasses that of Warren Buffett.

Bryan Rich of Forbes has revealed in his article “Billionaire Carl Icahn’s Winning Traits” that Carl Icahn has compounded his wealth at an incredible CAGR of 31% since the year 1968. Carl’s return since the year 2000 is an impressive 20%. He beat the S&P 500 by 4 to 1 over the period.

In contrast, Warren Buffett has compounded his wealth at a relatively modest CAGR of 19.5% in the same period from 1968 onwards.

In practical terms, if we had invested $1,000 with Warren Buffett, it would be worth about $5 million today. The same sum invested with Carl Icahn would be worth an eye-popping $400 million today.

This makes it clear that Carl Icahn has “superior skill” as compared to Warren Buffett and is “THE greatest investor of all-time” Bryan Rich says.

Bryan Rich adds that though Carl Icahn has amassed a net worth of $21 billion (Rs. 136,500 Crore) from his investing prowess, investors will find an analysis of his stock picks “very surprising”.

(Image Credit: Forbes)

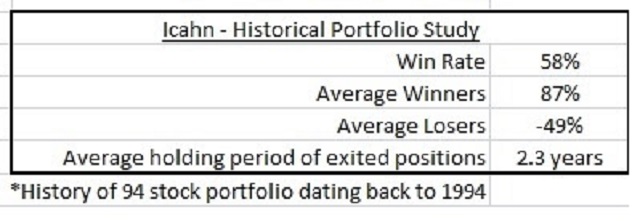

Rich has analyzed Carl Icahn’s investments from the year 1994 onwards and deduced that the Billionaire’s “Win Rate” is merely 58%, which is almost equal to the result one would get from the toss of a coin. Out of the almost 100 stocks that Icahn purchased over the past 20 years, only a little more than half have been profitable.

However, what has made the difference to the ultimate result is that Icahn has put himself in the position where a winning stock has delivered disproportionate result. The winners are almost twice that of his losers. While the average winner is +87%, the average loser is -49%.

This reminds me of Mohnish Pabrai’s investment doctrine of “Heads I Win, Tails I Don’t Lose Much”.

The same doctrine is followed by Rahul Saraogi of Atyant Capital that a stock is worthy of investment only where the risk of loss is low and the prospects of gains are “asymmetrical”.

Prof Sanjay Bakshi, the authority on value investing, has expounded on this concept and provided valuable insights (See Prof Sanjay Bakshi Tutors Ace Investor Samir Arora On Core Investment Doctrine Of Warren Buffett).

Bryan Rich has formulated four takeaways of Carl Icahn’s investment philosophy:

Takeaway 1 – An investor need not have a high win rate. What he requires to ensure is that he does not lose much on his losing stocks and wins more on his winning stocks:

This is best exemplified by George Soros’ immortal quote: “it’s not whether you’re right or wrong, but how much money you make when you’re right and how much money you lose when you’re wrong.”

Takeaway 2 – Make concentrated bets where you are certain of winning big:

This principle is exemplified by Warren Buffett’s classic advice that we should not swing at every ball that is thrown to us but should wait for the “right pitch”. When the “right pitch” comes, we must swing at it with all our might.

Warren also advised that we should invest as if we are limited by a punch card with 20 slots in it. Every investment decision must be thoroughly thought of before being implemented.

Takeaway 3 – Be patient:

There is no better way to explain this than to see Carl Icahn’s interview where he revealed the “real secret” behind his success is the fact that he has held on to stocks for as long as 31 years.

“The real money that I made over the years is holding companies for 7, 8, 9 years and keeping them ….. You got to buy them when nobody wants them really …. That’s the real secret …. It sounds very simple but it is very hard to do … when everybody hates it, you buy them … and then when everybody wants it, you sell it to them … And that’s what we do” Icahn said.

Takeaway 4 – Don’t be afraid to take risks or to suffer losses:

Rich emphasizes that Icahn has multiple stocks over the past 20 years that have gone to zero and become full losers. However, this has not been an impediment to Icahn’s progress because he has had a portfolio of big winners which have more than made up for the losers.

We can implement Carl Icahn’s technique by adopting a “portfolio approach” and not obsessing over the losses of individual stocks.

We should also bear in mind the revolutionary advice offered by Prof Sanjay Bakshi that “Loss aversion turns us into reckless gamblers“.

Takeaway 5: Stay alert to changing circumstances and churn the portfolio.

One more takeaway that can be added to the four takeaways listed above is that one must keep one’s eyes and ears alert to changing circumstances.

This is exemplified by Carl Icahn’s action towards Apple. Though he described Apple as a “no-brainer” and an undervalued stock with great potential, he did not hesitate to dump his large holding over concerns that the political hostility in China towards the Company does not auger well for its prospects (See Why Apple’s China problem is likely to get much, much worse).

Very nice article and informative. And very “easy” to implement too, if we get the basics right.

anybody who Really knows Icahn would not say “easy”. Read “king Icahn” book, and you would know what I mean. He started as corporate raider, not as investor.

good article..really inspiring ..carl ichan’s name is heard for the first time making bigger gains than buffet over time

A good managed penny stock company will be victorious after 10-15 years. My personal experience.

#Niveza #Review on #Share #Market #News ::

Interestingly, Carl Icahn has bitten great Warren Buffet in terms of CAGR growth of wealth in last 2-3 decades. Because Warren Buffet had more money when he started investing and since then he is richest investor. Stock market great returns require conviction and patience.

Great investors such as Carl Icahn, Rakesh Jhunjhunwala always have strong conviction about their stocks, no matter what does other investors or anybody else is doing with them. Great returns are reward of that strong conviction and patience. Unnecessary portfolio switching sometimes can cause erosion of wealth because investors try to time the market which is not always possible. Instead better way should be select few stocks and be 100% sure about their visibility over the next few years and keep adding it on declines, by doing that one can create a strong wealth in 5-`10 years time frame.

What I would like to say is we too have Carl Icahns here but they are invisible. Most Indians do not speak about their accomplishments. We know only RJ, Ramesh Damani, Vallabh Bhansali, Motilal Oswal because they come to the front and are visible to people. I am pretty sure there are several more in the list. We may pass by them crossing the road, not even casting a second look at them. I know of my own boss in the company I used to work for, in the early ninetees bought Shree Cement, 63,000 shares at three rupees each, because his broker told him it will do well. Both of us moved on in life to our separate destinations, lost touch. Of course I dont know whether he held on to the stock, but those who held on to such zero to hero stocks should be the Carl Ichans of India.

There maybe many Icahns here, if you look at just one part of it – identifying and buying a good scrip. But the more important part of Icahns, Buffets etc is long term holding. And here the winners are separated from losers (I have been a loser for a long time, only in the last 5 years I could change my investment attitude). For example, I had bought 100 Infy at Rs 40000 in 1994 – few months after their IPO and few months before their first 1:1 bonus. That investment, if held, would have been worth around Rs 12 crores today! Well, that was not to be! I booked 200% profits in 1996 and exited! Same goes for a few other good scrips that I could identify and buy, but did not hold! Now I have become wiser, identified and bought a few good ones, Will have to hold on to the patiently for a long time.

So, the most important point here is, HOLDING LONG which most of us miss. We hold long only the bad ones, but we get itchy to book profits on good buys when we see some small drops in prices.

Interesting – in fact I recently got to know about Carl’s incredible achievement. I was under the impression that Buffett’s record of 20% CAGR was the best.

Thanks a ton to Arjun and team for bringing this to us… for last several months I have been reading every article on this site so informative and useful… thanks again.