Daljeet Kohli is the Head of Research of IndiaNivesh Securities. He is highly acclaimed for his in-depth and objective research. He has several hits to his credit. He also has his fair share of flop stock picks.

HSIL has always been one of Daljeet’s favourite stocks. He never misses an opportunity to recommend the stock. The stock has rewarded his well over the years though in recent times it is in the doldrums owing to the slow-down in the real estate sector.

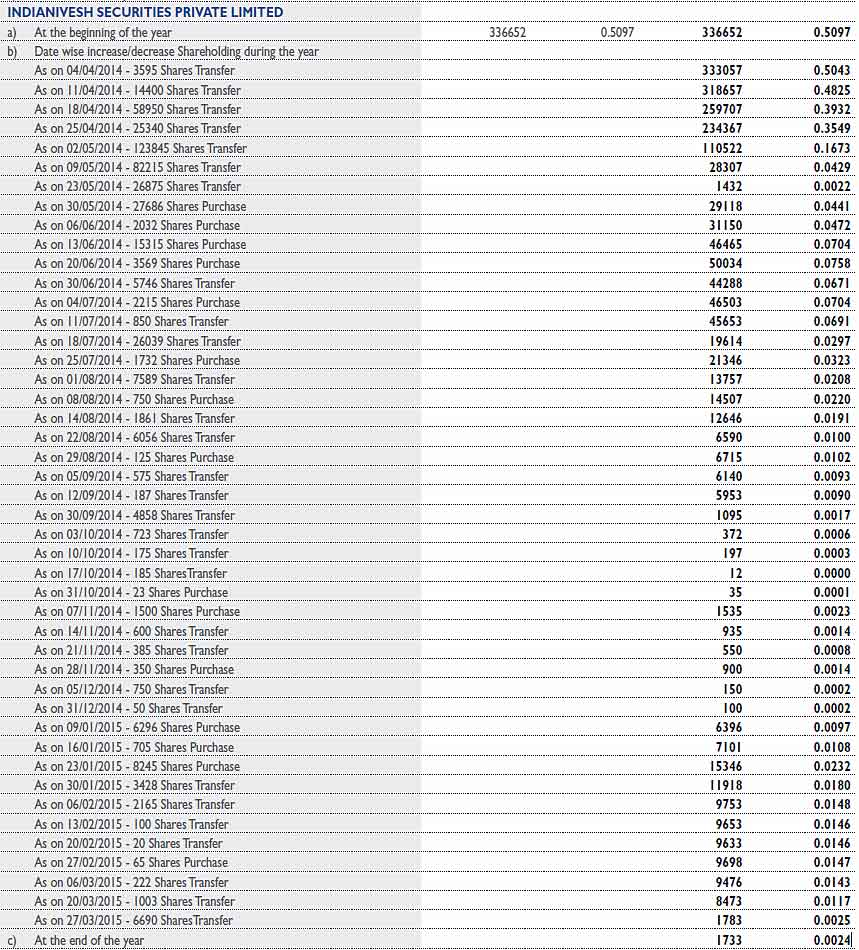

Information has now emerged which shows that throughout FY 2014-15, IndiaNivesh Securities systematically got rid of its large holding of HSIL stock.

As of 01.04.2014, IndiaNivesh had 336,652 shares of HSIL to its credit. Thereafter, it intermittently sold its holding in small lots. On a few occasions, it also bought a few shares. As of 17.10.2014, the holding plunged to a paltry 12 shares. On 31.03.2015, the holding was 1733 shares.

As it turns out, the decision to sell HSIL was a prudent one because after 01.04.2015, the stock has been on a steady decline. In fact, IndiaNivesh timed their sales perfectly. They sold when the stock price was rising. The stock was at Rs. 131 on 01.04.2014. It surged to Rs. 355 on 30.09.2014. By 31.03.2015, the stock had surged to Rs. 447. Thereafter, the stock slumped steadily. The CMP is Rs. 263.

This means that whoever in IndiaNivesh engineered the sale of the stock had the correct sense that HSIL was peaking. He skimmed off the gravy and got off the train just as it began its downhill journey.

At this stage, we must note that there is nothing to be alarmed about the fact that a securities firm may, in respect of its proprietary holding, do the opposite of what its research section may be advising. Most well-managed securities firms have a “Chinese wall” which virtually separates the various sections of the firm. In a typical situation, the research desk may not be aware of what the trading desk is doing, and vice versa.

If we objectively evaluate HSIL on its own merits, we cannot fault Daljeet’s recommendation to buy HSIL. It cannot be denied that HSIL has a “strong brand, variety of product portfolio, and very strong distribution network across the country” and that the “bleak demand scenario is a short term phenomenon”. In fact, the same buy advice has been offered by Emkay and Vikas Sethi as well. Even Porinju Veliyath recommended HSIL as one of the top five value picks recently.

Every securities firm gives a buy call when they want to dump the stock. After that they will give a sell call and start buying.

How can you seriously take these guys buy and sell recommendations seriously. If ever there was evidence of horrific manipulation of stocks then this is the evidence. I have looked at HSIL and would not invest. No discussion. Now Daljeet Kholi picks a few stocks because he has the cash to do it, a few work out to be successful, and he claims he is a great stock picker. Here is a piece of advice, the best way to gauge a successful investor is when they do it with their own money. Look at Sanjay Bakshi, Buffet, Dolly. Then you will realize.

let me add more.. ashish kacholia, ashish dhawan, vijay kedia.. wizards..

Let IN be investigated or audited to establish the fact of trading desk was ignorant of research desk reco. Had never seen a scenario that research desk gives the call of sell and the trading desk went ahead with sell. These contrarian calls are nothing but trapping the unsuspecting investors.

Do you seriously believe that there are Chinese walls between trading and research desks. C’mon…either you are too naive or you are trying to rationalize the story since Daljeet is one of your heroes.

It is not a coincidence that the shares are sold when the research head is giving a buy recommendation. The share prices are bid up after they are bought by the trading desk, and sold when the prices have been pumped up by the sales guys.

He could have done the same with Meghamani Organics.

isn’t this bought by Dolly Khanna (Rajiv) ?

there is huge shift coming from darling sectors like pharma, IT towards textiles, chemicals.. you can sense something big coming the same what happened with textile companies. the less china manufactures, the more indian companies will shine.. eg. meghmani; doly khanna

sudarshan chemicals: vijay kedia

RCF : vijay kedia

please add more if anyone here is aware of..

Dai ichi karkaria chem- dolly khanna.

I don’t believe the claims of chinese wall that would be absurd for a small firm like indianivesh, it can afford to go bust by not listening to it research desk. After all its one company and their primary objective is to make money .. even if its at the cost of others.

Everyone should tread cautiously with any kind of recommendation or articles.

Moral of the story is ‘recommendations’ have their own vested interest, most of the time (not all the time).

Well said my friend. Superb statement.

all are in the game – none to be blamed than ourselves

It seems that they forgot that as per new Sebi rule, their actions will be reflacted in balance sheet, under top 10 share holders?

We have been telling investing community not to follow them blindly. An ideal example of recommend and dump strategy to their advantage.

only chinese wall is that of the joint selling hakka noodle near their office

First Porinju comes with a demerger story. Co. obliges few days later. Amitabh Bachchan buys Nitin Fire and within hours co. declares results much better than any body’s wildest imagination. WE start shouting from roof tops what a great “STOCK PICKER” he is. Daljeet recommends Meghmani, it shoots up only to be back where it started from. India Nivesh piles up on HSIL. Daljeet starts recommending strongly. All of us buy like crazy. Price shoots up. Daljeet becomes a “HERO STOCK PICKER”. India Nivesh dumps slowly but steadily. HSIL is now 261, having lost 45% from its peak. Now Porinju has started recommending it. We will ride the band wagon sooner or later and again loose because Porinju and his like recommend “BUY” DHOL PEETKE but get out quietly leaving “TOPI” on our heads. As long as we are willing last “HEAD” for these “TOPIS” in our “Kachha Baniyan”, this brand of “ACE STOCK PICKERS” will thrive.

lol. super like this comment..

Hahaha….well said!!

Comments reflects the truth !!

But then thats how stocks market works by foolling gullible .

Regard

Surprising to see Arjun supporting n showcasing excuse for IN when they shd b blamed seriously.Arjun- u r really doing a gr8 job through this site..lots of retail investors depend n takes decision from the articles posted here. So, u shd think twice when supporting this bloody things by IN…Sebi shd investigate it seriously…may we lodge a complaint to sebi regarding this?

Definitely disappointing and will be more so when I take seriously the buy calls.

Dear Investors, Pls. do technical analysis before buying any stock suggested by so called Experts in this platform.