Theory coupled with practicals

Novice investors like you and me have onerous responsibilities. It is not sufficient that we are free-loading on multibagger stocks that are generously handed over on a platter to us by eminent gurus.

Instead, we are expected to also study the theoretical aspects of finding multibagger stocks.

Thankfully, the Gurus are ensuring that we get an appropriate dosage of both.

(Image Credit: Bloomberg)

Best stocks to buy for 2017

A few days ago, we were rewarded with 17 top-quality stock recommendations from four well-known stock pickers. The stocks have been chosen carefully to ensure that our capital is not put to unnecessary risk whilst simultaneously compounding gains at a reasonable pace.

It is notable that some of the stock recommendations for the year 2016 have yielded magnificent gains of up to 89% with no risk to the capital.

The stock recommendations for 2017 are of the same mettle and can be expected to shower hefty gains on us.

“Grandmother of all bull markets” is coming. Invest now to avoid “massive regret” later

Ridham Desai has already issued the inspiring battle cry that “India is on a structural upward path” and that “the next 10-15 years are likely to be a golden period for India”. He has also assured that the “Grandmother of all bull markets is coming” and issued the chilling warning that investors who defiantly stay out of stocks will “massively regret” their foolishness.

“Secret Mantras” for finding multibagger stocks

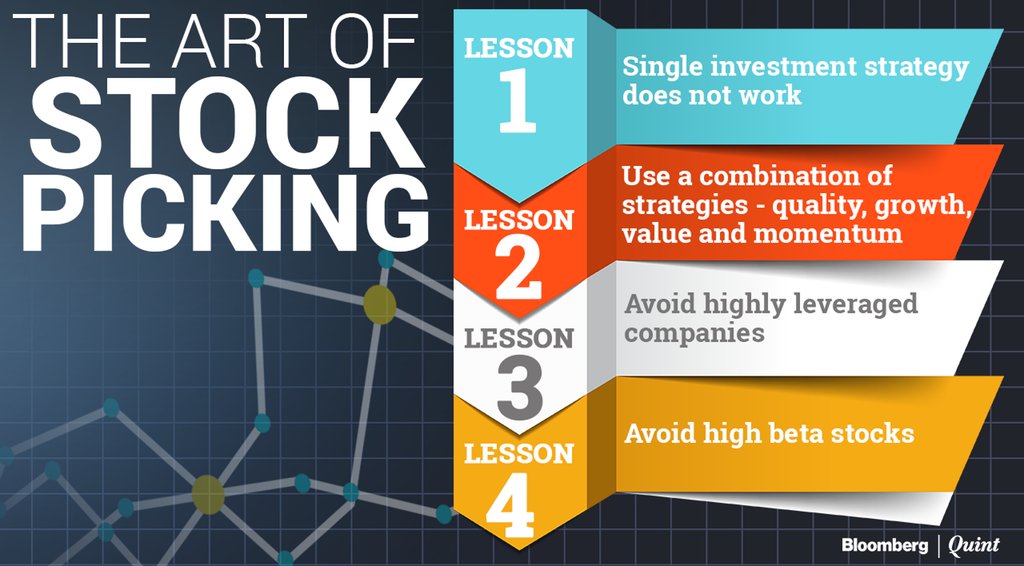

Ridham Desai has now written an article in Bloomberg Quint titled “How To Be An Ace Stock Picker” in which he has explained in the simplest possible language all the techniques for finding multibagger stocks. He has referred to the techniques as “secret mantras”.

(Image Credit: Bloomberg)

Ridham’s “secret mantras” can be summed up as follows:

(i) Don’t be dogmatic about adopting a single investment strategy such as buying only “quality” stocks or buying only “deep value” stocks. Instead, adopt a strategy which straddles all investment strategies such as quality, growth, value, and momentum;

(ii) Avoid stocks with excessive financial leverage (debt);

(iii) Avoid “high beta” stocks. High beta stocks are popular amongst the hoi polloi which leads to the hurdle rate being raised and the returns being lowered;

(iv) Find stocks that combine the following attributes:

(a) Strong growth – EPS, book value, and dividend growth;

(b) Positive change in return on capital ratios (return on equity and return on capital employed);

(c) Low EV/EBITDA;

(d) Conservative capital structure;

(e) Falling financial leverage (if it has been high);

(f) Positive free cash flows;

(g) Beta < 1.1;

(v) Focus on stocks that exhibit “sustainable growth” instead of obsessing only on quality, low financial leverage, positive free cash flow, positive change in return on capital (RoE, RoCE) etc;

(vi) Bear in mind the following mantras:

(a) Starting level of RoE and RoCE does not affect returns; what matters is the positive change in the level of the two ratios;

(b) Dividend payout is an important signal of a company’s growth strategy and authenticity of profits, but it does not necessarily help predict stock returns;

(c) At different levels of positive FCF/sales, returns do not vary. That said, when FCF/sales is negative, there is a positive correlation between the level of FCF/sales and returns;

(d) Fall in financial leverage matters more than its level;

(e) Starting points of price-to-equity and price-to-book did not affect returns;

(f) Starting point of beta matters for long-term returns;

(g) Small-cap stocks give the maximum returns.

Ridham adds that to win at stock picking, we need the stock of a company with a moat, good governance, supportive macro environment, robust corporate strategy, and execution leading to above-average return on capital and growth, all available at a reasonable price. If any of these are missing, making money becomes onerous, he states.

He cautions that the “secret mantra” presumes that the financial performance of companies will be accurately forecast. Forecasting financials is tougher than forecasting almost anything else in this world and this is where the struggle begins, he adds.

Conclusion

The criteria stipulated by Ridham for a stock to be investment-worthy appear difficult to satisfy at first glance. There are a number of daunting requirements. However, it is certain that there are actually several stocks which meet these criteria. We need to roll up our sleeves and start hunting for them ASAP!

Thank you for this article. It is very informative.

This is google illustration…..

but which stocks???

Generally RJ comes with some recommended stocks based upon various criteria set by different Gurus at different points of time.

I think RJ would come with such list based upon “secret mantra”.

Well known investors like Warren Buffet and Rakesh Jhunjhunwala are not traders but long term investors. Once they identify good multibagger stocks; they keep it for few years in their portfolio to gain maximum out of it.

Understanding all the fundamentals is crucial while picking long term stocks, parameters such as compounded growth rate of sales and profits, growth of the company compared to industry, margins, capital expenditure and utilisation, market share, good balance sheet and proper valuation are some of the very important criteria.

Remember this quote ..

“Price is what you pay; value is what you get.’ Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

“Great investment opportunities come around when excellent companies are surrounded by unusual circumstances that cause the stock to be misappraised.”

Few of the parameters to remember prior choosing a good multibagger stock:

Business model of a company: Try to understand the entire business. Get the idea about its various revenue generations and other aspects. Invest as if you are buying that business and not just stock.

Industry in which company operates: Its very important to understand the industry in which your identified company is operating. Understanding of industry will give you the long term view about it, its possible ups and downs you can identity, there are certain cycles in certain industries which if you can identify will benefit you. Understanding the industry throughout will give you an edge over the others, you can easily identify what are the Govt and other regulations which can impact the industry. Take an examples of pharma companies and possible effects of USFDA warnings to its stock prices..or Sugar industry or metal stock and certain govt announcements.

Cost factors : Try to identify all the costs of the company. Which are its major costs how economic and industry cycles will impact its costs and how company can benefit out of it.

Revenue visibility and growth: Its very important to understand revenue visibility of the company in the long run if you are identifying multibaggers. You should able to see its future beyond 2-3 years. If you feel confident about its future and clear revenue visibility for next few years or a decade then you are going in right direction.

Financials of the company: Well you need to have some knowledge of understanding and interpreting Balance sheets, P&L and Cash flows of the company. Further there are n number of parameters and ratios you can check for evaluating performance of your company.

Valuation: Most important is at what value you are buying a stock. There are n number of parameters when it comes to valuation of stocks, one may look at its intrinsic value, DCF model, Dividend discount model, P/E – P/B multiples, EV multiples with different ratios. Etc. Again think as if you are buying a business and think from longer point of view.

Promoter and management: One of the most important point when we look for long term investment is company promoters and management team. Because ultimately other than all factors its the promoter and management team which decides vision and mission of the organisation and they always take a front seat of driver to drive the company is a right direction and speed to reach desired destination. Many cases we find where the promoters and their past record is shady, there are some past cases of Balance sheet and other frauds in the company. So identifying multibagger has also to do with identifying right promoters and management team. We have to do a bit of due diligence with promoters and their back ground. How much domain knowledge and focus they have towards the business? How much passionate they are about running their business? Are there any instances of any fraud in past related with them?

Well..there are certain more parameters also such as current micro/macro environment, Revenue vs EPS growth, competitors and their impact, pricing and bargaining power of a company, market share, geography of operations and so on….

The way it is explained for identifying value stock is excellent.

However we are small investor. We need your help.we require specific name. Kindly provide us some numbers of specific name.