Doomsday Pundits have spread fear amongst investors

Some Pundits on Wall Street and on Dalal Street have made it a habit to be pessimistic and constantly spout doomsday theories.

Gary Shilling, an eminent expert and academician, is one of them.

He has been warning since time immemorial that “stocks are poised for a big drop“.

Stocks could be poised for a big drop, according to financial analyst Gary Shilling. https://t.co/vTDgi2hngA

— CNBC (@CNBC) July 11, 2020

David Einhorn, also an eminent Pundit on Wall Street, has been bearish about the stock markets since 2016.

He has now formulated 10 reasons why the stock markets are in a “bubble” and likely to crash soon (see Top 10 Reasons Why Stock Markets Are In A Bubble & Will Crash Soon: Billionaire Investor David Einhorn).

Billionaire investor Jeff Gundlach has also formulated a similar theory.

“I do think that within 18 months it’s going to crack pretty hard. When the next big meltdown happens, I think the US is going to be the worst-performing market,” he has warned.

Yet another investor shorted the market and described himself as an “obliterating moron” in anguish as the markets continued to surge and the losses mounted.

I, Who Hates Shorting, Just Shorted the Entire Stock Market. Here’s Why. For your entertainment so you can hail me as the obliterating moron that shorted the greatest stock market rally floating weightlessly above the worst economic & corporate crisishttps://t.co/9Y9RrjnxDS

— Wolf Richter (@wolfofwolfst) June 19, 2020

If 87% of the people fear that there is a “Bubble“, it means there is none

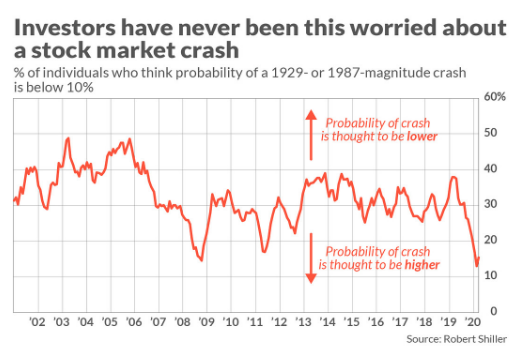

Robert Shiller, a Nobel laureate and professor at Yale University of finance, has formulated a “U.S. Crash Confidence Index“.

The Index shows the percentage of individual investors who think that a crash is probable.

According to the latest reading, the U.S. Crash Confidence Index (CCI) is at a record low of nearly 13%, which means that 87% of respondents believe that the probability of a crash is greater than 10%.

(Image Credit: MarketWatch.com)

According to Mark Hulbert of MarketWatch, “Widespread pessimism is a contrarian indicator“.

He has opined that the fact that individual investors are so worried about a stock market crash is “great news” because investor sentiment is a contrarian indicator.

He has pointed out that the Confidence Index had plunged to a similar low level in 2009 when the markets had crashed in the wake of the Lehman / Bear Sterns sub-prime crisis.

That was a great time to invest because the markets started surging immediately thereafter.

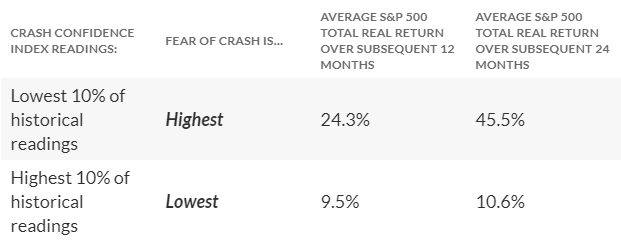

He has also analyzed the data to prove that there is an inverse relationship between the confidence of investors and the performance of the stock markets.

When investors are exuberant and gung-ho, the markets tend to crash.

However, when investors are wary and anxiety-ridden, the markets flourish.

(Image Credit: MarketWatch.com)

Stocks always go up in the long run

According to Bill Miller, an illustrious investor, the fear of a crash should not discourage us from buying top-quality stocks at reasonable valuations because the stock markets are, in the long run, always on an upward trajectory.

“Stocks go up most of time because the economy grows most of the time, about 70% for both time series. So if you knew nothing else and someone asked what the chances were that stocks would be higher in any given year, the answer would be 70%+,” he advised.

This view is corroborated by Ramesh Damani. He explained that despite the numerous calamities and trials & tribulations that the Country has passed through over the decades, the stock markets have flourished.

When I came to the stk mkt in 1989, the Sensex was about 800 at that time. Today it is closer to 36k, gone up 50-60X. All kind of events have taken place in last 30 yrs, from Kargil to DeMo to fin crisis. But the index always finds its way higher – Ramesh Damani#indexfunds

— India ETFs & Index Funds (@IndiaEtfs) February 5, 2019

Bill Miller also pointed out that investors are sitting on massive levels of cash and have no avenue to invest in other than stocks.

“The result of the panic out of stocks in March is that there is now all-time record cash in money market funds, and bond funds have seen huge inflows even as rates hover at levels not seen for thousands of years … The S&P 500 yields 3x what the 10-year Treasury does, and dividends grow over time while treasury payouts do not,” he said, meaning that even risk-averse investors have no option but to prefer stocks to Bonds.

This also implies that every correction will be bought aggressively and so the much-feared crash may never happen!