(Image Credit: Outlook)

(Image Credit: Outlook)

About PI Industries Ltd:

Incorporated on 31st December, 1946, PI Industries focuses on Agri-Input and Custom Synthesis with strength of over 1,500 employees, PI Industries currently operates three formulation and two manufacturing facilities as well as five multi-product plants under its three manufacturing locations across Jammu and Gujarat. These state-of-art facilities have integrated process development teams with in-house engineering capabilities. PI Industries is into the following markets:

Domestic Agri-Input

PI is one of India’s leading players in the Agri-Input industry, primarily dealing in agro-chemicals, specialty fertilizers, plant nutrients and seeds. This venture is the flagship business for which PI enjoys tremendous brand recognition across several industry leading products. The Company has exclusive rights with several global Corporations for distribution in India and is constantly evaluating prospects to further expand its product portfolio. Given the inevitable surge in demand for food grain production in the agriculture sector, the opportunities for Agro-Chem Companies are innumerable. PI Industries is favorably positioned to contribute to the growth in this space by leveraging its long-standing association with business partners and intensive network of distributors across

India.

Custom Synthesis Exports

Here PI focuses on Custom Synthesis, which entails dealing in custom synthesis and contract manufacturing of chemicals including techno commercial evaluation of chemical processes, process development, lab & pilot scale up as well as commercial production. The Company has an impressive product portfolio as result of exclusive tie-ups with leading agro-chemical, pharmaceutical and fine chemical companies around the world. PI has made substantial investments in building state of art process research and manufacturing facilities of chemical intermediates and active ingredients with special focus on strong process R&D capabilities. Custom Synthesis is expected to be the primary growth driver with strong revenue visibility for P I as India continues to be a preferred destination for outsourcing Custom Synthesis and contract manufacturing related projects. With exceptional growth opportunities in the offing, this segment is poised for great success.

PI Industries To Be A Billion-Dollar Company:

There is an interesting article in Business Today which traces the history of PI Industries and its future plans. The report says:

“PI Industries plans to emerge as a billion- dollar player from gross revenue of Rs 1,837 crore and net profit of Rs 183.73 crore that it posted in 2013/14. In the custom synthesis business, it hopes to go beyond agro chemicals and get into other streams, such as textiles, electronics or pharma. The story that began just before the country’s independence appears well poised to begin a successful new chapter in its journey.”

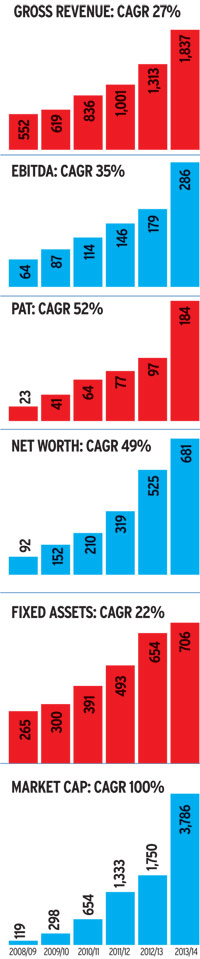

PI Industries’ Core Financials:

| PI Industries’ Financial Overview | |||

| Figures in Rs crore | 2014 | 2013 | 2012 |

| Net Sales | 1760.95 | 1245.43 | 954.90 |

| Operating Profit | 303.32 | 189.68 | 178.17 |

| Profit After Tax | 183.74 | 96.34 | 100.54 |

| Share Capital | 13.61 | 13.55 | 12.52 |

| Reserves | 669.48 | 511.05 | 306.68 |

| Net Worth | 683.09 | 524.60 | 319.20 |

| Loans | 142.06 | 234.15 | 261.71 |

| PI Industries’ Ratios | |||

| Figures in Rs crore | 2014 | 2013 | 2012 |

| Debt-Equity Ratio | 0.28 | 0.56 | 0.93 |

| Operating Margin (%) | 16.43 | 14.45 | 14.90 |

| Net Profit Margin (%) | 9.95 | 7.34 | 7.95 |

| Return on Capital Employed (%) | 34.42 | 25.13 | 25.45 |

| Return on Net Worth (%) | 30.52 | 22.93 | 30.73 |

| Dividend Payout | 27.29 | 13.59 | 12.52 |

PI Industries’ Q4FY15 Results:

| PI Industries’ Quarterly Results | ||||

| Q4 FY15 | Growth (%) | FY15 | Growth (%) | |

| (Rs. in Crore) | (Y-o-Y) | (Rs. in Crore) | (Y-o-Y) | |

| Revenues | 537.0 | 48.0% | 1,939.7 | 21.6% |

| EBITDA | 95.3 | 83.5% | 370.0 | 29.5% |

| PAT | 60.3 | 33.5% | 243.3 | 32.4% |

Continued momentum from custom synthesis exports (23.5% growth) together with 19.1% improvement in domestic agri inputs gave revenue increase of ~22% on a blended basis in FY15. Exports saw robust growth, as planned through H2, as commercialised molecules saw enhancement in deliveries. Domestic business performance leveraged the strength of the IPR-focused business model, superior product portfolio and ongoing efforts towards building sustainable brand positions.

Performance was mainly driven by strong growth of new products launched in the last 2-3 years.

EBITDA

EBITDA during FY15 was at Rs. 370 crore, with corresponding margins of 19.1%, reflective of a 110 bps expansion YoY. Earnings are primed for sustainable level of growth reflective of the quality of operations.

Pre-tax Earnings

Profit Before Tax stood at Rs. 353 crore in FY15, up 37% on the back of robust increase in revenues in line with expected trend. Share of exports in driving earnings growth continues to increase whereas domestic business is benefiting from sustained investment in building profitable brands.

Post-tax Earnings

Profit After Tax in FY15 stood higher by 32% at Rs. 243 crore. The Basic EPS during the period was at Rs. 17.84 from Rs. 13.52 per share previously.

Strong balance sheet

Enhanced business performance has continued to drive robust cash flows from operations, thereby resulting in a stronger balance sheet position. Debt equity ratio further improved to 0.02. Net working capital position witnessed an increase aligned to business growth.

Outlook for the future:

In an interview to CNBC TV18, Mayank Singhal, MD & CEO, PI Industries, discussed the company’s performance for the fourth quarter and future outlook.

The overall industry environment is expected to remain subdued in FY16 both in domestic and global market place. However, PI’s FY16 performance to reflect continued growth momentum although at a moderated pace on the back of a larger base now.

• The driving factors in the domestic operation will be:

o Pattern and distribution of the upcoming annual monsoon rainfall

o Expected upsides from the product launches made in last few years and also 1-2 new products slated for introduction in FY16

• And in the exports business:

o Scale up in sales volumes of commercialised molecules

o Commercialization of 2 new products

o Commissioning of second phase at Jambusar, which remains on track

Opinion of whiz-kids:

Saurabh Mukherjea of Ambit Capital recommended PI Industries on the basis that this agro-chemical company has considerable earnings visibility going into a difficult FY16. He explained that as the government pushes back on the minimum support price (MSP) rise on wheat and rice, farmers will start switching towards fruits and vegetables and this will be positive for the stock. He also emphasized that 60 per cent of PI’s earnings come from exports.

Madhusudan Sarda of Vallum Capital Advisors recommended PI Industries on the ground that it is a safe bet among agri-based stocks. He said:

“PI Industries is a safe bet due to its de-risked business model. It is dependent on domestic market and has a substantial presence in contract research and manufacturing services (CRAMS). The company makes special molecules for innovators; they do CRAMS for them. That is a stable business, which takes care of the earnings when the monsoon season is not that good.

So, the company is substantially safe in terms of performance and the CRAMS space in India has been fairly successful.

Therefore, if you look at CRAMS in the pharma space, it seems to be an area where a lot of growth has happened over years. We feel agri is a segment where a lot of growth will happen as far as the CRAMS is concerned.”

PI Industries’ Research Reports:

HDFC Securities – Value creation continues

“PI Industries reported another strong result led by robust growth across the segments. Revenues stood at Rs 5.4bn (+48% YoY). Lower other expenses led to an EBITDA margin of 17.7% (+342 bps) and EBITDA grew to Rs 953mn (+83%). Higher tax rate (year-end adjustments) and higher depreciation (change in policy) abated APAT growth to Rs 569mn (+24%).

Commercialisation of new molecules is clearly visible in CSM as the segment’s revenues jumped to ~Rs 3.5bn/qtr in 2HFY15 vs ~Rs 2.3bn in previous 7 qtrs. Strong order book (3.2x FY15 revenues), first mover advantage & successful execution history kept PI ahead of its peers in CSM biz. With regular capex, we see PI as a multi-year compounding story. Mgt has guided for commercialization of 1-2 new molecule every year. Agri-inputs segment with a focus on in-licensing model (68% share) and 1-2 new product launches per year should also grow at 15-20%.

Strong financials further strengthens PI story : (1) Zero leverage (2) Positive FCF despite an aggressive capex of Rs 1.5bn/yr to sustain growth (3) Strong RoE/RoCE of 26-28%.

Robust growth and tax benefits should lead to a PAT CAGR of ~25% over FY15-FY17E. Stock price rose by ~45% post 3Q results. There might be near term pressure owing to monsoon uncertainty and muted agri commodity prices. However, we maintain BUY led by strong fundamentals and robust growth trajectory. TP revised to Rs 800/sh (30x FY17E EPS).”

“At the current market price of Rs. 677.35 the stock P/E ratio is at 35.22 FY16E and 31.79 x FY17E respectively. Earnings per share (EPS) of the company for FY16E and FY17E are seen at Rs. 19.23 and Rs. 21.31 respectively. Net Sales and PAT of the company are expected to grow at a CAGR of 21% and 32% over 2014 to 2017E respectively. On the basis of EV/EBITDA, the stock trades at 21.49 x for FY16E and 19.21 x for FY17E. Price to Book Value of the stock is expected to be at 8.41 x and 77.03 x respectively for FY16E and FY17E. We recommend ‘BUY’ in this particular scrip with a target price of Rs. 760.00 for Medium to Long term investment.”

Emkay – Revenues beat estimates:

“Momentum in the CSM business & agro chemical business to be driven by ramp up in volumes of existing products and 1-2 new product launches. Revenue growth guidance for FY16 tapered to 18-19% on the back of higher base and commissioning of new plants only towards the end of FY16. We have revised our target price upwards to Rs 684 while reducing our rating to Hold from Accumulate”

So, there you have it. All the core information neatly arranged on a platter. Now the onus is on you to decide what you want to do in the matter.

BM too jumped aboard

of late, BM’s recommended stocks are bigtime underperforming except Page Industries.

Why would they want to get into other streams, such as textiles, electronics or pharma..Is it diversification or diWorsification ??