It is notable that HNI investors have developed a strong appetite for Portfolio Management Services (PMS). The demand for these services is not surprising because PMS providers are unfettered by the rules that mutual funds are subject to and are able to deliver returns which are far more attractive than that generated by humble mutual funds. The PMS provider has a strong incentive to perform and deliver superior results because he gets a share of as much as 20% of the excess returns as his fee.

The PMS concept is a popular one in developed countries. The PMS providers there (called Hedge Fund managers) like Carl Icahn, Bill Ackman, Nehal Chopra (an ex-Mumbaikar) etc have become billionaires in their own right.

In India as well, a number of providers have risen to the occasion to provide PMS services. Bharat Shah’s ASK PMS rules the roost with a massive Rs. 6,000 crore as AUM. Motilal Oswal is close behind with Rs. 5,500 in its kitty. Hiren Ved’s Alchemy Capital has roped in Rs. 2,470 crore. In the sub-Rs. 1,000 crore category, there are a number of players such as Kaplraj & Ravi Dharamshi’s ValueQuest, Porinju Veliyath’s Equity Intelligence, Prof Sanjay Bakshi’s Value Quest Moat Fund, Basant Maheshwari etc.

| PMS | Nos of clients | AUM (Rs Cr) |

| ASK Investment Managers | 6,803 | 6,006 |

| Motilal Oswal AMC | 13,295 | 5,500 |

| Alchemy | 2,017 | 2,470 |

| ValueQuest Investment Advisors | 301 | 566 |

| Equity Intelligence | 903 | 539 |

| Value Quest India Moat Fund | NA | 162 |

| Basant Maheshwari | 40 | 45 |

The large number of investors who have signed up for these services provides an idea of the extent of deep pocketed investors that are there in the Country. This also implies that there is scope for poaching clients from rival providers and taking ‘market share’ by showing superior performance.

Kenneth Andrade’s Old Bridge Capital Management PMS:

Kenneth Andrade, the whiz-kid former fund manager with IDFC MF, is the new kid on the block. His PMS is called “Old Bridge Capital Management”.

Ace team of investment professionals:

Kenneth has done the sensible thing of creating a team of top professionals to assist him in the arduous task of finding winning stocks. His team has three top notch professionals named Sanjay Dam, Gauri Anand and Rupanjana Sur. Each has rich experience in finding winning stocks. Sanjay Dam learnt the ropes of investing at Hiren Ved’s Alchemy Capital and Motilal Oswal. He is said to be an expert in picking small and mid-cap stocks across sectors. Gauri Anand was VP at Phillip Capital and is a specialist in chemical stocks. Few are aware that she has won the prestigious ‘top analyst award for the chemicals sector’ of Thomson Reuters. Rupanjana Sur left her cushy job as a credit analyst at Dun & Bradstreet to get her hands dirty in digging for hidden gems. She has mastered the nuances of FMCG and Media stocks and knows them like the back of her hand.

Investment strategy & favourite stocks:

Obviously, Kenneth Andrade cannot be expected to reveal to freeloaders like us the secret formula that enabled him to home in on multi-bagger stocks like Page Industries, MRF, Blue Dart, SKS, Bata, Va Tech Wabag etc.

However, he has made it amply clear that he is now super-bullish about the rural/ agri space. He has stated that the Government’s intent to double farm income by the year 2022 means that there will be a 12.5% CAGR in per capital income. Also, the Government’s game plan of Direct Transfer of Subsidy to the farmers/ end-users means that the corporate manufacturers will be freed from the rigors of price control.

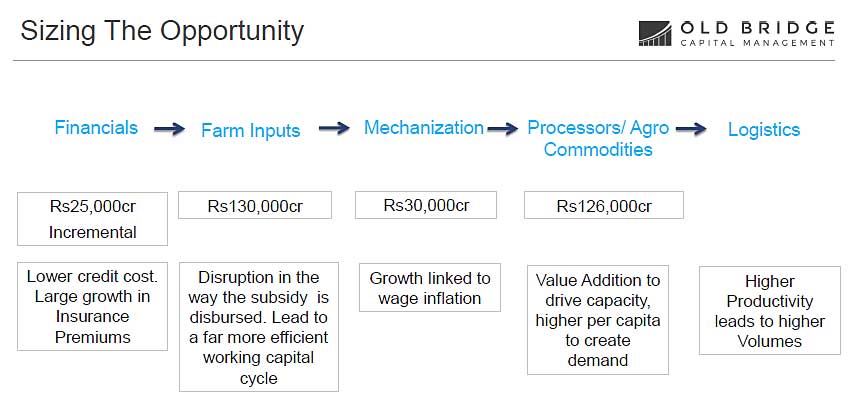

Kenneth has helpfully provided a chart which tells a story of its own.

A careful study of the chart reveals that a massive incremental growth of Rs. 1,30,000 crore will come with respect to “farm inputs”. About Rs. 1,26,000 crore will come with respect to “value addition” of “processors/ agro commodities”.

Now, the simple thing for us to do is to find companies which are engaged in providing the said “farm inputs” and “processors/ agro commodities”.

For this, we have to peep into the portfolios of the IDFC Premier Fund and the other funds which were being personally managed by Kenneth in his old avatar.

There, we find stocks like Coromandel International, Kaveri Seeds, VST Tillers, Swaraj Mazda etc. All of these stocks have top-quality management, are well-managed stocks and are available at reasonable valuations. These stocks will be the first beneficiaries of any reforms undertaken by the Government for the rural sector.

In fact, to make things really easy for us, Kenneth has also made a public recommendation of a top-quality blue-chip mid-cap stock and given cogent reasons why the time is absolutely ripe to tuck into it.

Two PMS Schemes:

The Old Bridge PMS will have two schemes. The first is an “All Cap Strategy”. This will be a diversified portfolio with up to 20 stocks in it. The maximum sector concentration will not exceed 30%. There is an exit load of 3% for redemptions within 18 months.

The “Thematic Portfolio” has stiff exit loads of up to 5% to 3% for redemptions within one to three years. The reason for this is because the portfolio will be a concentrated one with an average of 10 and maximum of 20 stocks.

Ticket size & Fee structure:

The minimum investment amount is not indicated in the scheme document. My guess is that Kenneth may go the Basant Maheshwari route and specify a minimum ticket size of Rs. 1 crore. This strategy will keep the riff-raff out and also give a premium feeling to the offering. Deep pocketed investors are more inclined to join such services because they get personalized service from the fund manager.

The fee structure is also not indicated. Generally, PMS providers provide for a hurdle rate of 12% and pocket 20% of the excess above that. These terms ensure that the investor does not feel short changed while providing an incentive to the PMS manager to put in the effort to out-perform his peers. Both parties prosper this way!

Reading it all does not seem good for an investor wanting to start afresh investment or maybe even transfer his pms account or existing investments.

there are better pms providers with whom you can start small and grow big. i am invested with them and happy given they have a good consistent track.

There are advisory services giving far better performance than most of the PMS.

You know it very well.

hi mohit,

i had a discussion with 2-3 other people who are also subscribed to this advisory and they are not able to buy at recommended levels in last 2-3 rounds.

I have always bought in the range. Isn’t this sufficient.

Dear Rishabh, I am here DHARMENDRA VORA, HELLO,

Can U please share me the name of PMS provider, which can help small investor like me.

dharmendraji

you can reach me on 9819861049 on djrish@gmail.com

I am also waiting and need your help Rishab Ji. Please mention their fee/charges also. If you can share your experience please do let me know. Thanks

renuji you can reach me on 9819861049 on djrish@gmail.com

Rishabh, your own PMS ?

jai i dont own a pms but i am a small investor like many other people in this market, just learning from others experience and ofcous my mistakes too.

i invest through pms and happy to discuss with other about more opportunities in this space.

Most of the Bank RMs etc are strongly recommending Birla PMS and they claim it has performed better than most & has a large corpus but the same is not even mentioned in the article? Any clue as to the exact status of that PMS?