LC ka sil sila shuru hua

“LC ka sil sila shuru hua ….. ab yeh non-stop gaadi banegi ……….. retail investors like us will be hit the maximum. Just two years in the market and it has closed its gates of growth and opened gates of hell,” an investor at MMB whined, tears welling in his eyes.

“its pure fraud and cooked books..before deloitte has quit they have even reported to ministry of corporate affairs..its just a matter of time now..another treehouse and vakarngee in making…i really doubt if retailers will get chance to exit,” a distinguished silver member stated.

The other investors/ punters stood around, shuffling their feet, silently trying to come to grips with the fact that a part of their life savings had evaporated into thin air.

Some newbies were wondering if they could dive into the stock and rake in a few bucks.

“bhai sahib- Isko thoka kyon aur kisne thoka? isme paisa daal sakte hain kya? return dega kya?” a youngster asked, his eyes wide with innocence.

The elders glared at him.

“Stay away from Manpasand till any clarification from the management for resignation of auditors. Board Meeting also postponed. Will hit 1-2 more lower circuit. So stay away from the stock,” a wizened punter warned in a stern tone.

“There is another two time 10% LC and then two time 5% LC…..so totally 4 LC on the way…..,” another veteran added.

From “genuine long term investment opportunity” to “suspected fraud”

Till yesterday, life was coasting well for Manpasand Beverages and its illustrious investors.

Sanjoy Bhattacharyya, the doyen amongst value investors, has the onerous responsibility of picking stocks for the Ocean Dial Gateway to India Fund.

He has discharged his responsibility in an admirable manner as is shown by the stellar quality of stocks in the portfolio and the out-performance of the fund in relation to its peers.

The logic for awarding Manpasand Beverages a position in the portfolio of Ocean Dial Gateway to India Fund was explained in crystal clear terms.

“The size of the beverage industry in India is US$10bn of which packaged juice is US$1.2bn1. The segment is growing at more than 30% per annum in the last few years … The per capita soft drinks consumption is 1/20th of the USA and 1/8th of Thailand and the Philippines,” it was stated, implying that Manpasand, with its dominant brands like ‘Mango Sip’, “Fruits Up”, “Coco-Sip”, “Pure Sip” etc, is a no-brainer.

At the end, Manpasand was described as a “genuine long term investment opportunity”.

This theory was supported by Motilal Oswal which predicted a whopping target price of Rs. 841 (pre bonus).

The logic appeared quite sound:

“Valuation and view: We believe strong summer, along with the focus on advertisement, will drive superior performance at MANB. Demand continues to be strong in the fruit drinks category. However, on account of capacity delay of the fourth plant, we cut earnings estimates by 19% for FY19. The company’s presence in low-ASP/SKU products, addition of new capacities and foray into newer geographies provide comfort. Also, the planned advertisement campaign for Fruits Up should complement its recent Fruits Up capacity addition at Ambala. Thus, we expect a robust revenue and PAT CAGR of 45% and 52%, respectively, over FY16-19E. We value the stock at a P/E of 27x FY19E EPS, with a target price of INR841 (20% upside). Reiterate Buy”.

Ventura went a step further and predicted a target price of Rs. 1,067 (pre bonus) for Manpasand.

Can of worms opened? Auditors’ resignation sparks fears of accounting malpractice

Deloitte Haskins & Sells, a distinguished firm of auditors, rocked the boat by suddenly resigning from their post of statutory auditors.

Manpasand Letter from Auditors Read More : https://t.co/s5NOMpuh1l @sajeetkm pic.twitter.com/N7Ig453RkV

— Yatin Mota (@YatinMota) May 28, 2018

It was claimed that the resignation was because the management did not share “significant information”.

The auditor of Manpasand Beverages resigned because they didn’t share “significant information” for auditing its financial statements. https://t.co/DE4qwJAJFK pic.twitter.com/f0ekjsmlZ0

— BloombergQuint (@BloombergQuint) May 28, 2018

However, Deloitte did not reveal what the alleged “significant information” was on the ground that it is “confidential information” which cannot be divulged to the public.

The auditors were being unreasonable?

On its part, the management stayed defiant. They implied that Deloitte acted unreasonably because all the required information was provided.

“If more info was required, it could have been provided,” it was stated, implying that there was no provocation for the statutory auditors to resign in a huff.

#CNBCTV18Exclusive | Manpasand Beverages speaks first to CNBC-TV18 after Deloitte resigns as co's auditor, says co had provided all information to auditors, more info was required by auditors which could have been provided, the co says pic.twitter.com/r82Lz4MINS

— CNBC-TV18 (@CNBCTV18Live) May 29, 2018

'Distribution related information was pending from our side. Was surprised with the resignation of Deloitte as an auditor', says Abhishek Singh, Director of Manpasand Beverages in a #CNBCTV18Exclusive conversation with @CNBCTV18Live’s @_prashantnair @SumairaAbidi @blitzkreigm pic.twitter.com/jXs99eRBO4

— CNBC-TV18 News (@CNBCTV18News) May 29, 2018

They also dashed off a letter where they claimed that Deloitte’s resignation is “in the best interests of our shareholders” and a “minor hiccup”.

MANPASAND TO BSE

It is very unfortunate that we had to part ways with our long-term associate.

Decision has been taken by the management after due consultations and it is in This is just a minor hiccup and doesn't represent any long term business impact. https://t.co/MZ3ziJRxrI— Mangalam Maloo (@blitzkreigm) May 28, 2018

Shankar Sharma not impressed

Shankar Sharma has a lot of experience in dealing with alleged ‘Ghotala’ companies.

In fact, at the Sohn India Conference, he recommended investment in a company which was caught red-handed with its hands in the till.

He also has substantial investment in Himachal Futuristic (HFCL), which, according to the intelligentsia, is/ was a “ghotala” company.

Shankar was not impressed by Deloitte’s sudden resignation as statutory auditors.

I wonder what's worse: having a low quality Auditor OR having a so- called high quality Auditor, who resigns one day pic.twitter.com/MGiIsMr8xJ

— Shankar Sharma (@1shankarsharma) May 28, 2018

However, some of Shankar’s followers expressed a contrary view.

Their decision may b right in environment where more strict action & penalty is imposed by institute & government..

— Deepak Bhansali (@markettweeet) May 28, 2018

Kadak kaanon under Modi regime had been responsible for this.

Sharmaji toka samaj Naa aayi.??— Vinay Sarda (@vinaysarda) May 28, 2018

While #Manpasand debacle is doing the rounds, one must appreciate @DeloitteIndia's stance in upholding their independence & integrity and being true 'watchdogs'. Something where when peers like PwC (Vakrangee), EY (Kitex), GT (PCJ), etc have failed.#Deloitte @theicai pic.twitter.com/PU0LGswIEy

— Abhishek Murarka ?? (@abhymurarka) May 28, 2018

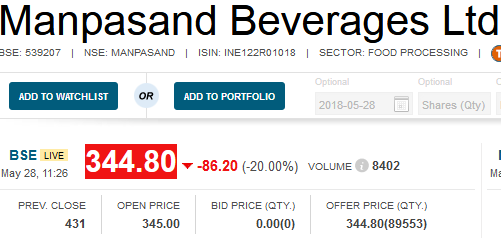

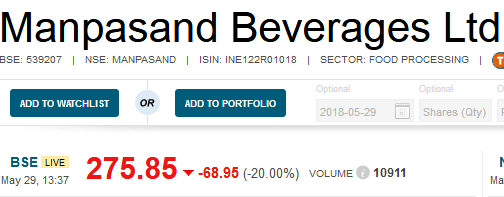

Investors lose fortune of Rs. 1700 crore in crash

Naturally, the hullabaloo relating to the auditors’ resignation sparked panic amongst investors that the financials may be fudged.

Everyone hit the sell button at the same time, leading to the stock being locked in back-to-back lower circuits.

.@ManpasandLtd has lost about Rs 1,700 cr in market cap over the last two days! @blitzkreigm pic.twitter.com/CrxOSAeMy1

— CNBC-TV18 News (@CNBCTV18News) May 29, 2018

The list of investors who are invested in Manpasand reads like a who’s who.

Manpasand Trades 20% lower today. Key Shareholders

Reported Holdings: Source: Bloomberg

SAIF Partners 17.6% (2 crore shares)

Motilal AMC5.6% (64 lk shares)

Baron Cap5.2% (58.8 lk shares)

SBI MF4.4% (51 lk shares) pic.twitter.com/POgJhPB9FR

— Yatin Mota (@YatinMota) May 28, 2018

Interestingly, Motilal Oswal Mutual Fund is also a victim of the fiasco.

According to Bloomberg, Motilal Oswal Most Focused Multicap 35 Fund owns 58 lakh shares of Manpasand.

However, Aashish Sommaiyaa, the CEO of the Mutual Fund, clarified that the damage is minimal.

Yes it’s a concern I agree. It’s 2% of multicap and 1.3% of Long Term (ELSS). NAV is up today by the way. FYI.

— Aashish P Sommaiyaa (@AashishPS) May 28, 2018

The Worst-Hit Mutual Fund Schemes After Manpasand Beverages Tumbleshttps://t.co/3Ma7SNo5Da

— Darshan Mehta (@darshanvmehta1) May 29, 2018

Mutual fund investments are subject to #manpasand risk☹

— Astik ?? (@bhaveshastik) May 29, 2018

Kotak Drops coverage on Manpasand Beverages. Cites Lack of transparency and disclosures by Management. They will take a call once annual results are published.

— Yatin Mota (@YatinMota) May 28, 2018

Manpasand Bev, no longer investors’ मन पसंद . Stock down from 450 to 275 in two trading sessions. #stocks_that_rock

— Anand Radhakrishnan (@Anand_1969) May 29, 2018

“Curious case” had alleged irregularities in Manpasand Beverages

A research firm named 2point2 capital had alleged that there are “curious irregularities” in the Company.

However, knowledgeable investors had discounted the fears at that time.

In fact, the stock surged to an all-time-high of Rs. 484 (post 1:1 bonus) on 8th January 2018 implying that the concerns were overdone.

Manpasand Beverages-Hits 52week high to hit 813 today

I Remember many ppl sold in loss when a malicious report was floated in market!— Rakesh Laroia (@r_laroia) May 18, 2017

And I am bullish on healthy business prospects of #ManpasandBeverages – @r_laroia https://t.co/T9smZ7KFIZ

— Pankaj Singhal (@AnyBodyCanFly) May 18, 2017

Whether there is any connection between the allegations made by 2point2 capital and the information demanded by/ denied to the auditors is not known.

My BloombergQuint interview on Manpasand Beverageshttps://t.co/khSrSwiNO4

— Amit Mantri (@amitmantri) May 28, 2018

Manpasand Beverages a favorite of many MF's raised

IPO Rs 400 Cr in 2015

QIP Rs 400 Cr in 2016"Showed" huge branded drink sales which could never be matched in any consumption surveys.

Now Auditor resigns before results.

Interesting.— sandip sabharwal (@sandipsabharwal) May 29, 2018

When I was looking at Manpasand Beverages stock idea, I decided to try its products. I bought its mango juice and my daughter after trying a few sips of it said "Papa, manne na pasand"

Phir kay tha, hum bhi bole theek hai betaji phir yeh stock bhi "Manne na pasand"???

— Passionate Investor (@Passion8Invstr) May 29, 2018

I have seen Manpasand's Mango sip selling in trains, Delhi-Gwalior route. Tasted it, didn't like it. Decided not to invest in Manpasand beverages.

— Khaane Bhi Do Yaaron (@AAPism) May 29, 2018

What if new auditors give clean chit to Manpasand Beverages?

The moot question is as to what will happen if M/s. Mehra Goel & Co, the new statutory auditors of the Company, give a clean chit and sign the accounts without any qualification.

Will the present sordid episode be forgotten and will the stock revive its glorious days?

We will have to wait and watch the scenario as it unfolds!

Ventutra need to made to buy the stocks they recommend. They recommended sintex plastics to go to 195 🙂

don’t forget arvind remedies from ventura

Manpasand is bad. Delloite is good. Pundits are good. A parade is going on in twitter claiming how smart investors were in disowning the stock however no one said that before the fiasco. competition is going on who looks cuter/smarter.

Let this be the opportunity for all smart folks to step out and let us know all they already know about other bad stocks. Speak now or keep you moth shut for ever..

In the Hind sight everything is 20/20. Not sure when people will stop stroking their own egos !!

Disclaimer: Don’t own the stock. Once upon a time I had it in my PF but sold for different reason , was not smart enough to predict future like others

Big issues with Manpasand. Poor quality products and way over valued. One should have just looked at the financials and deciphered it was not investment worthy. Yet Shankar Sharma, Ramdeeo have been very greedy in luring young investors into their trap. Shankar is a known Rahul Ghandi sympathizer and ramdeeo is very cunning and sly. They both will recommend stocks after getting handsome under the table rewards. I am very well aware of their methods of operation. I have been privy to information.

jason What Rahul Gandhi has to do with this discussion. Please spell out for the benefit of all !

Next in the line is KITEX . I think

Manpasand was covered as one of the best emerging companies in Business Today and is also strongly recommended by Karvy who are very careful about their recommendations.

Auditor’s resignation does not mean the the business is in trouble or that all these years figures were fudged.

Unless we are told what information was not provided, it is not possible to judge the seriousness. If it is a business secret or black money or something illegl, auditors will not be provided that info. We have to appreciate the auditors, who for the first time in India has decided to resign.

jason What Rahul Gandhi has to do with this discussion. Please spell out for the benefit of all !

If the likes of Motilal Oswal and Sanjoy Bhattacharya who are ethical and who have at their disposal brilliant CAs can not figure out creative accounting from their balance sheets and do not imagine anything wrong when the company “Showed” huge branded drink sales which could never be matched in any consumption surveys, how is SEBI and the layman investor going to figure out. Similar is the case with Vakrangee and PC Jewellers, not to talk about Gitanjali Jewels. Is pro-actively identifying fraud not the job of the regulator when such indications were there?

what was Delloite for past many years if the company was fraudulant. they had signed the results 3 months ago also. If something was cooking in Manpasand, Delloite was a part of it for past years. Suddenly resigning doesn’t make them good and paksaf. Sebi should take action against Delloite for approving and signing false results in the past and eroding investors wealth. Or Delloite should issue a certificate that all was well with Manpasand 3 months ago and what was the information company is not providing.

Sarda plywood falling knife..today again 5%down…on its way to 10rs

I saw this last year and knew something was not right in this stock.

http://alphaideas.in/2017/11/24/missing-manpasand/

Time these analysts are taken to court for misguiding the public.