Midcap stocks are at 20% discount

Axis Capital has expressed the view that the mid-cap stocks are now quoting at a steep discount compared to their large-cap counterparts.

It is pointed out that on a P/E metric, midcap discount to largecap is now at a 7-year high.

It is further stated that on a P/B metric, midcap discount to large-cap is now at its 10-year mean (~20% discount to largecap).

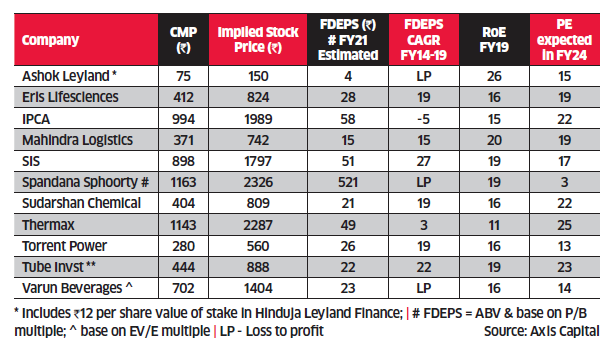

11 top-quality mid-cap stocks

Axis Capital has cherry-picked 11 of the best mid-cap stocks.

A stringent quality control process has been adopted to screen the stocks.

The stocks are chosen based on the opportunity size, industry dominance, management quality, RoCE etc.

It is confidently stated that the 11 stocks have the potential to give 100% gains by 2024.

NOW is the time to buy #Midcaps says Axis Capital.

FIIs, DIIs have room to add midcaps as small/midcap ownership within institutional portfolios has fallen to 14% from peak of ~20% in FY12.

Top Picks ?? pic.twitter.com/pbVvNONLDq

— Geetu Moza (@Geetu_Moza) November 7, 2019

Details of the 11 multibagger midcap stocks

The said 11 stocks are the following:

| Company | CMP (Rs) | Target Price (Rs) | RoE FY19 |

| Ashok Leyland | 75 | 150 | 26 |

| Eris Lifesciences | 412 | 824 | 16 |

| IPCA | 994 | 1989 | 15 |

| Mahindra Logistics | 371 | 742 | 20 |

| SIS | 898 | 1797 | 19 |

| Spandana Sphoorty | 1163 | 2326 | 19 |

| Sudarshan Chemical | 404 | 809 | 16 |

| Thermax | 1143 | 2287 | 11 |

| Torrent Power | 280 | 560 | 16 |

| Tube Invst | 444 | 888 | 19 |

| Varun Beverages | 702 | 1404 | 16 |

(i) Ashok Leyland

Domestic is going through a cyclical downturn, which,

Axis Capital expects the cyclical downturn in the MHCV industry to bottom out in FY21.

With economic growth recovery, pick-up in private capex cycle and higher freight demand, there will be a strong uptick in MHCV industry volumes over FY21-24E (17% volume CAGR).

Further, implementation of the scrappage policy could lead to upside risks as the population of over 15-year MHCVs would be around 900 k units, which is >3x FY21E industry volumes.

(ii) Eris Lifesciences

Eris Lifesciences is uniquely positioned as 100% sales are from domestic formulations, with a focus on high-margin Chronic therapies and metro cities.

Growth/margin visibility on multiple levels:

(1) focus on chronic/ lifestyle therapies, coupled with growth recovery in the acquired Strides’ portfolio leading to improved MR productivity and

(2) new launches.

The domestic business trades at 22x-25x on superior return ratios and FCF generation ability. Sales growth has been muted. Growth recovery (execution) can lead to PE rerating from current 19x to 22x with around 15% PAT CAGR over FY19-24E leading to more than doubling of the value of the share.

(iii) Ipca Laboratories Ltd

Axis Capital expects IPCA’s EBITDA margin to expand 150-340 bps and PAT to grow 2.5x over FY19-24E, coupled with improvement in fixed asset turnover from 1.9x in FY19 to 2.9x in FY24E on multiple operating leverage drivers from widespread growth led by domestic formulation business, UK business, and higher API sales among others.

(iv) Mahindra Logistics

Mahindra Logistics is a leading player in Indian 3PL/ supply chain management.

Unlike most of its peers, who dominate in the automotive sector, it has a diversified pan-India presence across high-growth non-automotive verticals like e-commerce, FMCG, pharma and engineering.

Axis expects Mahindra Logistics to more than double over FY20-24E as (a) SCM growth revives FY21 onwards – to be led by 26 percent CAGR in non-M&M SCM (16% overall) and (b) gradual margin expansion on better business mix and warehousing/ distribution logistics focus, aiding 25 percent earnings CAGR.

(v) Security and Intelligence Services India Ltd

SIS has achieved its first milestone of being the number 1 security player in India. It now aims to be the number 1 player in facility management and cash logistics.

Plugging portfolio gaps in key geographies, it has made five acquisitions— Rare Hospitality (FM), SLV (India sec-north), UNIQ (India security– Bengaluru ) Henderson (Singapore security) and P4G (New Zealand security). It maintains the guidance of 18-20 percent organic revenue growth (India security + facility).

SIS is expected to post 30 percent CAGR earnings over FY19-24, cash conversion of more than 50 percent and RoCE improving to 23 percent by FY24 (17% in FY19).

(vi) Spandana

Sharply focused on rural opportunity, Spandana is one of the most profitable (7.2% RoA, 19% RoE) and only MFI to get a rating upgrade after the recent liquidity crisis (A- from ICRA).

Spandana is expected to post over 32 percent AUM CAGR over FY19-23E, with improved RoA of over 8 percent and RoE of 20 percent by FY23 without raising any fresh capital (CAR high at around 37%).

At the CMP, the stock trades at 2.8x FY20 P/ABV and 18x PE.

Based on estimates, the EPS will show 28 percent CAGR over FY19-23E and the stock has the potential to double over the same period without any need for fresh capital infusion.

(vii) Sudarshan Chemical

Sudarshan Chemicals is India’s largest (around 35% market share) and world’s fourth-largest pigment manufacturer, with more than 400 products across organic, inorganic and effect pigments.

It addresses requirements across high-growth segments like coatings, plastics and cosmetics apart from relatively matured inks.

The company plans for 40-50 percent capacity expansion (led by HPP and Azo) over the next three to four years (current utilization at around 72%), which will help it scale-up new product launches and few other high-potential molecules, aiding growth.

Planned capex (Rs ~5 bn over FY20-22E) can double its revenue over the next three to five years.

(viii) Thermax

Thermax plans to double its turnover to Rs 110 billion by 2023 (Axis estimate: Rs 100 billion by FY24).

It has consciously shifted its focus on international business (targets 50% of revenue) since the domestic market share of 25-30% has been captured in key product areas (except water where the market share is around 5%).

Focus on exports and international geographies has de-risked Thermax from cyclical risks. The share of exports has increased to 28 percent and international revenue has doubled to 35 percent.

(ix) Torrent Power

A turnaround in stranded gas plants will double PAT by FY23E. Cheaper gas prices—near six-year low—and increasing share of renewables warrant grid balancing by gas power projects, with the possibility of government incentives /pooling schemes to re-start some of these projects will aid upside.

Free cash flows are likely to turn positive by FY21E. Major incremental capex incurred by the company, and RE and discom are key areas of growth that investors should watch out for.

(x) Varun Beverages

Varun Beverages (VBL) is a proxy play on the long-term growth story of the complete soft-drinks category in India, with end-to-end execution capabilities and presence across the entire beverage value chain.

The overall opportunity size for VBL stands at Rs 1.2 trillion and is likely to grow at 9.4 percent CAGR over FY19-24. VBL is PepsiCo’s second-largest CSD/NCB franchisee (outside the US) and operates around 80 percent of the Indian market and several international markets.

(xi) Tube Investments (TI)

Tube Investments aims to achieve revenue growth at 15-17%, which implies a revenue of Rs 100 billion over the next four years. Increase PBT margin to 10 percent (4.7% /7% in FY18/19), with further improvement possibly up to 12 percent will be positive.

Over the years, TI had invested around Rs 10 billion to incubate financial services business and Rs 5 billion to acquire Shanti Gears, increasing its debt level to around Rs 13 billion .

The management unlocked value from TI’s general insurance business by selling 14 percent stake of its 74 percent holding in the business to its JV partner, Mitsui Sumitomo, for Rs 9 billion. The proceeds (Rs 6-7 billion) were used to pay down debt.

all stocks will loots your money for another 2 years .It will start moving before next elections