My bet on specialty chemical stocks has done phenomenally well

Shankar Sharma was one of the first to identify the Billion dollar opportunity that specialty chemical companies in India have owing to the crackdown on pollution in China.

He recommended specialty chemicals stocks to us as far back as in April 2016.

“As we have spoken also, the specialty chemicals space we have liked a lot …. We have seen it coming over the last two years that China because of the huge pollution problems has no option but to clamp down on chemicals,” he said.

Shankar explained that globally, all chemical companies have problems on pollution and are shutting down industries to improve the air quality so that people from across the world do not see China as a polluting country.

“It is a huge trade on a secular basis because India will be the beneficiary of production moving from China in the chemical space and that is a big macro shift which is happening already,” he added, giving a glimpse of his visionary abilities.

@commentvadi because China is clamping down big time on chemical sector. Production will move to India

— Shankar Sharma (@1shankarsharma) March 2, 2016

Shankar’s hypothesis was aided by the trade war between the USA and China.

The anti-dumping duty imposed by the US on Chinese imports has made Indian products irresistible to consumers in foreign countries.

Presently, the situation is that all specialty chemical stocks are surging like rockets with gains of up to 80% YoY as can be seen from the table below.

| Stock | CMP (Rs) | YoY Gain |

| Fine Organic Industries Ltd. | 1941.00 | 83.71% |

| Black Rose Industries Ltd. | 84.00 | 69.70% |

| Deep Polymers Ltd. | 64.00 | 58.81% |

| Alkyl Amines Chemicals Ltd. | 867.90 | 44.86% |

| Pidilite Industries Ltd. | 1351.50 | 39.24% |

| Fairchem Specialty Ltd. | 491.45 | 34.42% |

| Kemistar Corporation Ltd. | 41.90 | 31.76% |

| Aarti Industries Ltd. | 804.55 | 29.19% |

| Yash Chemex Ltd. | 95.50 | 27.16% |

| Narmada Gelatines Ltd. | 146.50 | 25.11% |

| Camlin Fine Sciences Ltd. | 57.95 | 21.74% |

| Crestchem Ltd. | 14.00 | 21.74% |

| Galaxy Surfactants Ltd. | 1505.15 | 21.47% |

Naturally, Shankar is pleased as punch.

“You go and look at the list of 7-8 stocks in that space. They have done phenomenally well,” he said.

“My portfolio never took a big hit despite the tribulations of the stock market,” he added with justified pride in his voice.

Take inspiration from Sachin & Virat: An average success rate of 50% is very good

Shankar counselled novices not to feel despondent about their failures in the stock market.

Instead, they should be inspired by the achievements of sportsmen like Sachin Tendulkar and Virat Kohli, he said.

“If you look at Virat Kohli or Sachin Tendulkar. Are they going to get hundred every innings? It is not possible. Their average is 50.”

Shankar explained that even highly talented players will have innings in which they play poorly and make zero runs.

“That is the nature of the beast,” he exclaimed, emphasizing that the sooner we get used to losses, the better it is.

Look at losses as “entry fees” and not as a “penalty”

Shankar also advised that we have to condition our mentality so that we do not attach a stigma to stock market losses.

“Think about it as an entry price, if I take you to an amusement park and the guy tells you Rs 500 entry fee, you will happily pay but the guy at the ticket counter tells you, it is a Rs 500 penalty, you will never go there,” he said, displaying astute understanding of human psychology.

Avoid Banks and NBFC stocks – it is a bad business

Shankar has always been hostile to Bank and NBFC stocks.

As far back as in March 2013. he had sent the chilling warning that “Banking is the worst business in the world” (see Told You Losers To Sell Bank Stocks: Shankar Sharma).

It's beyond my understanding why anybody would consider investing in a bank, at book value valuation, when the book value itself is all up in the air

— Shankar Sharma (@1shankarsharma) July 17, 2019

That's why I always steer clear of financials like NBFCs and Banks. ( Some exceptions like HDFC Bank, IndusInd notwithstanding). Through financial itihaas, bazaar mien always saare Khuraafaat ki Jad are financials.

— Shankar Sharma (@1shankarsharma) September 24, 2018

I consider two sectors to have the worst accounting and business practices: Banking and Jewelry. The current scam is a marriage made in heaven

— Shankar Sharma (@1shankarsharma) February 22, 2018

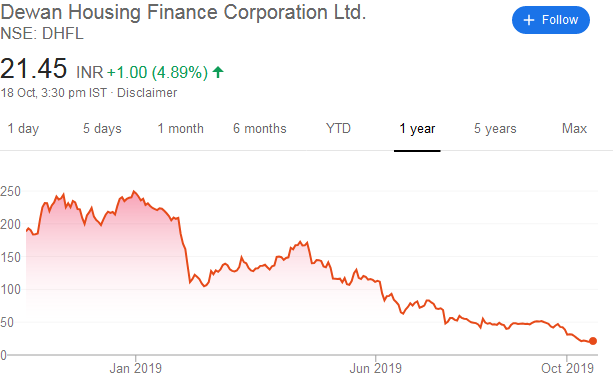

No doubt, Shankar’s words have proved to be prophetic if one looks at the colossal destruction of wealth caused by junk stocks like Yes Bank, DHFL, IndiaBulls Housing, PNB Housing etc.

Shankar repeated the same warning and pointed out that the business model of Banks and NBFCs is inherently wrong.

“As a category, banking or NBFC is a bad business, pure and simple, because the risk and the reward are never going to make sense,” he said.

“They also go through a huge amount of crisis because you are making a wafer-thin margin, a wafer-thin return on equity (RoE) and you are amplifying that with a use of large amounts of leverage.”

Shankar explained that it is a misconception to assume that leverage is essential to make high RoE.

He cited the example of Hindustan Unilever Ltd (HUL) to prove his point.

“HUL has no leverage and yet it makes 40-50 percent return on equity,” he said.

In contrast, Banks and NBFCs leverage themselves 10 times to make 30 percent, Shankar lamented.

Sale of PSU stocks means Govt is admitting failure

The issue of whether the Government should stay invested in random businesses like Tobacco, Hotels, Airlines, ticketing, etc is a sensitive topic.

Some intellectuals like Rahul Gandhi are opposed to it.

RaGa contemptuously referred to NAMO as “Bechandra Modi“.

#BechendraModi देश के PSUs को सूट-बूट वाले मित्रों के साथ बंदर बाँट कर रहा है, जिसे देश ने वर्षों की मेहनत से खड़ा किया है।

ये लाखों PSU कर्मचारियों के लिए अनिश्चितता और भय का समय है ।मै इस लूट के विरोध में उन सभी कर्मचारियों के साथ कंधे से कंधा मिलाकर खड़ा हू। pic.twitter.com/701zJQJnsZ

— Rahul Gandhi (@RahulGandhi) October 17, 2019

However, others have opined that it is the need of the day.

Arvind Panagariya, the former Chairman of Niti Aayog, has argued that all commercial enterprises must be run by the private sector and that the Country should not squander its scarce resources on the PSUs.

Prof @nandinigupta201 & I explain why india must sell PSUs to those who can run them the best. The picture below is worth a thousand words. With this performance of even listed PSUs should public money be spent on PSUs? Full article at https://t.co/5nr6YcHOv0 pic.twitter.com/kDVZS8rXqT

— Arvind Panagariya (@APanagariya) October 19, 2019

#BHEL had a peak Market Capitalization of Rs 125000 Cr

Today it is just around Rs 15000 Cr

In a strategic sale it can easily get sold at a price much, much higher than current market prices.

— sandip sabharwal (@sandipsabharwal) October 18, 2019

Dear @PMOIndia – look at psu stocks today – investors will run to buy some great cos if ETFs are abolished and only strategic divestment is announced. Kindly save PSUs and announce big policy reforms. https://t.co/br7kZWjWdq

— Varinder Bansal ?? (@varinder_bansal) September 5, 2019

Govt has tasted blood with success of IRCTC and market reaction on divestments in few cos. They will not stop & will want the best buck out of PSUs. @SecyDIPAM @nsitharaman pic.twitter.com/tkXsnzX0gq

— Varinder Bansal ?? (@varinder_bansal) October 19, 2019

Shankar, as expected, supported Rahul Gandhi and opposed NAMO.

“My view is that you cannot sell or you should not sell these assets. It is an admission of failure as a manager if I sell my company. Who is the manager of public sector undertakings (PSUs)? The government. It is a clear admission of failure,” he thundered.

“Are you saying you have failed in the endeavour to manage PSUs with better governance, with better transparency, less corruption?” he asked in a rhetorical tone.

“Every country is built on the platform of their strategic assets. Is China selling strategic assets? Why can we not manage them better? That is where your question – selling is the easy part. Get the world-class managers. If the same businesses by private sector can be run well, what suddenly changes if it is a public sector?” Shankar opined.

When dis Rahul Gandhi became an intellectual………….simply stinking

What Rahul Gandhi says makes political sense as the same people like namo an d late jaitley were shouting Swadeshi Swadeshi in the 1970-1990 period.

Now status is such that they will be sold at junk rates.

Govt should not sell BPCL which is a very good PSU spread all over india doing a great service to the country. Rather it can merge with_IOC. Or disinvest all PSUs keeping 51 per cent controlling stake. Some PSUs govt can try keeping 50 per cent stake.

Let us not compare with other countries.Chinese politicians are not interfering with govt companies for their own personal profits. BSNL and Air India were driven to bankruptcy by greedy politicians. China wont allow unions the way our govt PSUs do and protest. Privatization is need of the day.

Government is custodian of countries asset and do no have right to sell PSUs as its an asset of all Indians which is built post Independance. We have to take action against corrupt salaried managers and chairmans who get salary from govt. and work for private players or companies competing in those sectors. Politicians are public servants not owner of all these assets who have right to sell assets without sharing intentions where this money will go for sale proceeds. How many schools, hospitals and universities they give free to this country where all indians are getting benefitted and not exploited by private players with all black money they earn systematically.