Billionaire Ajay Piramal tilts scale in favour of Bulls

Today, the Bulls Army of Dalal Street (BADS) deployed heavy weaponry in the form of Billionaire Ajay Piramal in its war against the Bears.

Ajay Piramal is revered as the ‘Warren Buffett of India’ by the intellectuals and the novices.

His word is equivalent to law.

“NBFCs are critical for the growth of the country as they lend to MSMEs which are the backbone of the country,” the Billionaire roared.

“Things have started to settle down in the NBFC space w/ capital flowing much easier than few days back,” he added, implying that the days of gloom are now over.

#EXCLUSIVE | Things have started to settle down in the NBFC space w/ capital flowing much easier than few days back. Ajay Piramal of @PiramalGroup says NBFCs are critical for the growth of the country as they lend to MSMEs which are the backbone of the country. @Ajaya_buddy pic.twitter.com/YvPwR6r7ne

— ET NOW (@ETNOWlive) October 9, 2018

Billionaire Nirmal Jain of IIFL provided backup support.

He slammed the unscrupulous Bears for indulging in “rumour mongering” and spreading “panic” amongst hapless investors.

“We must listen at data, facts and not hearsay,” he thundered, implying that the data is irrefutable that NBFC stocks are safe and sound.

No NBFC, other than IL&FS has actually defaulted or shown any sign of distress or liquidity issue till now. Yet so much of rumour mongering and panic. In fact mutual fund, CP squeeze Sept rollover have been acid test for the sector. We must listen at data, facts and not hearsay

— Nirmal Jain (@JainNirmal) October 9, 2018

However, the final cut for the Bears came when the Government announced that SBI, the blue-chip PSU behemoth, would provide liquidity to NBFCs.

SBI today stepped up substantially a facility for purchasing portfolio of assets from NBFCs to provide liquidity to NBFCs. SBI would buy such portfolios up to a total amount of Rs. 45000 cr. This measure should alleviate liquidity concerns to a great extent.

— Subhash Chandra Garg (@SecretaryDEA) October 9, 2018

This sent the Bears scampering for cover with no place to hide.

In the aftermath of the concerted attack by the Bulls, the Midcap Index surged a colossal 663 points, which is historically the biggest daily gain ever seen by mankind.

#MarketAtClose | Midcap Index closes 663 points higher, biggest 1-day gain ever. Nifty bank posts biggest 1-day gain in absolute terms since Oct 2017, #Sensex & #Nifty post best trading session in last 6 months pic.twitter.com/t6YF2yPA2l

— CNBC-TV18 (@CNBCTV18Live) October 10, 2018

NBFC stocks surged like rockets bringing cheer to the faces of the beleaguered Bulls.

| Stock | Today’s Gain (%) | One Month Gain (%) |

| Bajaj Finance | 10 | (13) |

| DHFL | 16 | (55) |

| Shriram Transport | 13 | (9) |

| L&T Finance | 8 | (17) |

| Muthoot Capital | 8 | (17) |

| Chola | 10 | (16) |

| M&M Financial | 10 | (10) |

| Muthoot Finance | 9 | (11) |

Basant Maheshwari’s PMS Fund bears brunt of crash of NBFC stocks

It is no secret that Basant has a fascination for private banks and NBFC stocks.

In fact, he has formulated the famous theory that private banks and NBFC stocks will snatch market share from PSU Banks and grow at an eye-popping 27% CAGR.

Reading between the lines from this @udaykotak interview. A 30:70 ratio between private and public moving to a 50:50 ratio in 5 years assuming a 15% industry credit growth means a 27% CAGR for private financiers. Smaller companies in niche segments can grow faster ! https://t.co/CgZQNlSM6x

— Basant Maheshwari (@BMTheEquityDesk) March 21, 2018

Basant has also candidly revealed that his PMS portfolio comprises of consumer financier stocks, HFC stocks and private banks.

Have said this before also. Consumer, Consumer financiers, HFC and fast growing banks. https://t.co/TdwOm8RXCg

— Basant Maheshwari (@BMTheEquityDesk) June 26, 2018

Basant has also revealed that his favourite NBFC stocks include blue-chips like Bajaj Finance and PNB Housing Finance.

In fact, Basant’s heavy concentration of NBFC stocks enabled his PMS Fund to snatch the top-performer award in Q1FY19 with a hefty return of 17.55% as against the return of 5.59% given by the Nifty.

Sharing the Portfolio Management Service returns of Basant Maheshwari Wealth Advisers LLP to avoid the confusion of the various numbers floating around. Nifty comparison has been done for regulatory compliance. pic.twitter.com/qZJ5MYuDaG

— Basant Maheshwari (@BMTheEquityDesk) July 14, 2018

Tables are turned

However, now the tables have regrettably turned.

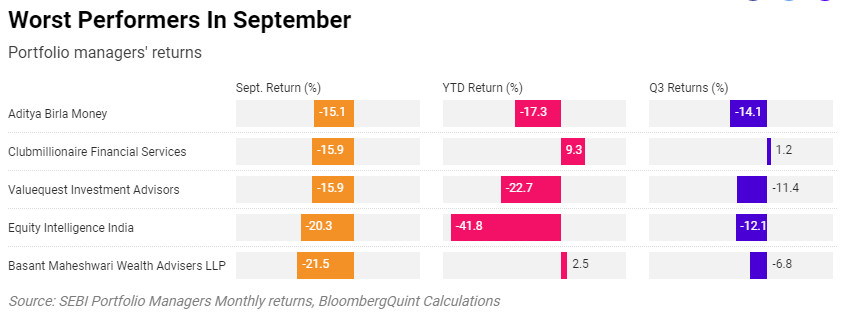

The sleuths of Bloomberg conducted top-secret research with SEBI sources and revealed that Basant’s PMS is now the “worst performing” PMS.

Basant Maheshwari Wealth Advisers (@BMTheEquityDesk) was the worst performing portfolio management firm in September.

Read more: https://t.co/h5xVCt9DX3 pic.twitter.com/uopKgiA6Mq

— BloombergQuint (@BloombergQuint) October 10, 2018

A careful study of the data flashed by Bloomberg reveals that Basant’s PMS has an AUM of Rs. 174.2 crore. The loss in the month of September 2018 is 21.5%.

However, Basant fared reasonably well with a YTD gain of 2.5% and a Q3 loss of only 6.8%.

| Basant Maheshwari PMS Fund | ||

| Sept. Return (%) | YTD Return (%) | Q3 Returns (%) |

| (21.5) | 2.5 | (6.8) |

Predictably, Basant was not cowed down by the crash in NBFC stocks and the poor show by his PMS.

Instead, he reacted in a belligerent and aggressive manner.

“So NBFC isn’t quite the new dirty four letter word? Let’s see what the commentators have to say on this now?” he asked, his eyes flashing in defiance.

He also hauled up some unnamed persons and alleged that “Neeche mein lene nahi diya kisi ko“.

So NBFC isn’t quite the new dirty four letter word ? Let’s see what the commentators have to say on this now? Neeche mein lene nahi diya kisi ko ?

— Basant Maheshwari (@BMTheEquityDesk) October 10, 2018

Please short it 🙂

— Basant Maheshwari (@BMTheEquityDesk) October 10, 2018

Basant has also categorically advised us to take advantage of the crash to tuck into high-quality NBFC stocks.

Basant Maheshwari #OnCNBCTV18 says don't think Govt can let NBFC sector fail. Think earnings will support market going forward, should go & buy high quality names right now, think it’s a good time to invest in quality names pic.twitter.com/fanh6Hp7Mh

— CNBC-TV18 (@CNBCTV18Live) September 24, 2018

He warned that if we dilly-dally too much, we will miss the bus and lose out on multibagger gains.

The bottom will be formed but only after you miss it. #TheathoightfulInvestor

— Basant Maheshwari (@BMTheEquityDesk) October 9, 2018

Porinju Veliyath’s PMS continues to bleed

In Q1FY19, Porinju had himself revealed that his PMS Fund has under-performed the Benchmarks and reported a loss.

No strategy is evergreen, equity investors have to go through good and bad times to create long-term wealth. Sharing EQ performance on popular demand? pic.twitter.com/RhNaMlciKx

— Porinju Veliyath (@porinju) July 4, 2018

Porinju also candidly admitted that the poor show was because his bet on “chor” stocks had backfired.

I have bet big on improving corporate governance in a structurally changing Indian economy; the strategy looks backfired as of now. Too early to write off India; I am still optimistic on #ChangingIndia

— Porinju Veliyath (@porinju) June 28, 2018

He also ruefully conceded that he had underestimated the ingeniousness of chor promoters to find loopholes to siphon off funds.

A Rule-Based Economy cannot be built overnight! Change is a painful and time-consuming process. It is true that many chor promoters still find loopholes during the transition period.

— Porinju Veliyath (@porinju) June 28, 2018

Sadly, the chor promoters are still running amok and defrauding minority shareholders.

In September 2018, Porinju’s Equity Intelligence PMS reported a loss of 20.3%.

The YTD loss is a colossal 41.8%.

Thankfully, the AUM is still standing strong at Rs. 1246 crore, implying that the subscribers are keeping the faith.

| Equity Intelligence PMS Fund | ||

| Sept. Return (%) | YTD Return (%) | Q3 Returns (%) |

| (20.3) | (41.8) | (12.1) |

Worst is over, tide is turning

Like Basant, Porinju is also not intimidated by the heavy losses caused by the savage Bear attack.

Instead, he soothingly advised that the “correction in small and mid-cap stocks is overdone” and that the “worst is over for the equity market”.

He also confidently asserted that the returns from small and mid-cap stocks will be “significantly higher” in the foreseeable future.

#OnCNBCTV18 | @porinju, Equity Intelligence India says returns in small & midcap stocks will be significantly higher; Bullish on the markets now @_anujsinghal @SurabhiUpadhyay pic.twitter.com/kWuraiEAL5

— CNBC-TV18 News (@CNBCTV18News) October 10, 2018

#CNBCTV18Exclusive | Porinju Veliyath says bullish on the markets now; returns in small & midcap stocks will be significantly higher@porinju pic.twitter.com/WqUwXjm8ZR

— CNBC-TV18 (@CNBCTV18Live) October 10, 2018

Time to keep an eye on buy-backs and creeping acquisition. After the price correction, panic & extreme pessimism, what remains is the recovery. This is not the end of equities. Many companies are expected to report impressive numbers, as per AGM reports & ground level facts.

— Porinju Veliyath (@porinju) October 9, 2018

Conclusion

It is obvious that Basant Maheshwari and Porinju Veliyath are, despite their differing ideologies, ad idem that the savage correction is overdone and that happy days will return to Dalal Street soon. Their theories are supported by the theories of Billionaires Ajay Piramal and Nirmal Jain. In the circumstances, there is no reason why we should not deploy our last remaining resources, if any, into buying more stocks!

The article does not say anything of worth except what Maheshwari is upto! who cares ?A PMS cannot be so heavy on NBFC’s and Banks. Most NBFC’s and Banks have opaque balance sheets and assets which cannot be vouched for.

To AL Mendonca,

You probably don’t have a good idea how “concentrated” Maheshwari really is most of the time. He is an aggressive gambler. Anyone giving him money to manage should be prepared for a huge draw down in falling markets.

Pvt banks looks better placed as compare to NBFC, in addition to low cost CASA funding available to banking sector , corporate Governess is better in Banking sector due RBI. Although NBFC with strong parents like L&T finance may not be having much issues.

Basant Maheshwari is a very aggressive stock picker. His concentrated portfolios may be good from a personal perspective but when managing other people’s money it could be a disadvantage if there is a drawdown during bear markets. One good thing is he is very detached from his stock picks. He sells out the first sign of underperformance.

Accumulate Blue chips across sectors in this Carnage (Mar Kat), and keep on averaging diwn in them as majority of Blue chips keep on making life time high every few years. No need to panic just enjoy buying of Solid Blue chips being thrown out by Gora Firangis (FII), they will definitely come back to buy all these from you at higher levels.

i am buying midcaps and also some small caps, let the carnage unfold…love the panic, much awaited :0)) by 2050 india will be a super power after china, third would be US…so buy and hold the ones.Remember, the market ALWAYS recovers and eventually, always goes on to greater highs. It’s been doing this for the last 140 years, and I see no reason why it should be any different now.

are you leaving some sectors or covering all sector’s bluechip?

Just don’t understand why people go for PMS when you have such a diversified and large MFs.

correct, its pathetic when educated people give their hard earned cash to be managed by an incompetent person…I agree mutual funds are far better..but better than all this is to go for a diversified portfolio with 20 stocks, I mean there are plenty of books available, if you are educated enough to read a book then you can definitely invest!!!

If one choose right PMS you will get tremendous returns.

High risk high gain. Porinju last 7 year record is good.

Even Buffet failed in rising market

Small Cap MFs offers the same option (HR & HG). Some of the small cap MFs (DSP) got +100 % return and am sure handsomely beaten PV’s return. Last 7 years, it was rising tide for everyone. Buffet underperformed S&P in rising market few times but never incurred -40% loss in one year. Someone is seriously kidding to compare Chor stock picker like PV with Buffet.

Warrant Buffet has mentioned in his annual report is that thrice Berkshire was down by more than 50%.

Everyone was praising PV for 7 years and complaining now. Same happened with PM, for last 4 years everyone was worshipping him and now saying this god is also having legs from soil.

HDFC MFs were also star for 20 years but not performing in last 2 years. Clearly if small and mid caps are falling then one shouldn’t blame PV or BM.

Some of small cap MFs (DSP) are performing better now but 7 years records these are laggards to PV.

People still don’t get it right. Most of the Berkshire downward periods came at times when the overall market was done poorly as well. Everyone’s portfolio went up in last 7 years due to bull market and nothing special with PV. But when the market lost 10%, these PMS guys suffered much more than market losses. Also PMS portfolios will be different for each customers and am sure many would have got brutal side. The one that we see in the public domain and in this article may be the best of the worst. PMS is the sure route to destroy the wealth. By the way Buffett himself said million times to go with the Indexing for normal guys and last annual report gave a detailed account of how handsomely beaten all hedge fund and other masters.