On 26th May, Porinju earnestly recommended Kalyani Steels as a “defense play”. “The stock is quoting at only 6 PE …. It is part of the Baba Kalyani group … Investors should have a look at it” Porinju advised.

This is @porinju’s defense play. https://t.co/r6epuDc3eW

— CNBC-TV18 News (@CNBCTV18News) May 27, 2016

Everybody listened to Porinju attentively but few acted on it. Kalyani Steels looked like another run-of-the-mill mid-cap stock and appeared to lack the wherewithal to give mega gains.

On that day, Kalyani Steels was going a-begging at Rs. 170.

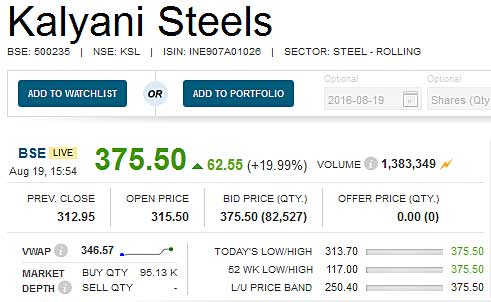

Today, to everyone’s disbelief, Kalyani Steels stands tall at Rs. 375. In fact, the stock stunned everyone today by surging a magnificent 20% and tripping the upper circuit.

This means that investors who paid heed to Porinju’s recommendation are richer by a spectacular 130% in less than three months.

Understandably, Porinju was mobbed by his fans who are delirious with joy at the massive gains that have enriched them.

Kalyani Steel has now doubled in just 2 months after the entry of @porinju .. Superb !!!

— Rahul Chhajed (@rahul6202) August 19, 2016

From 155 in May to 355 in Aug. One of many winners in @porinju 's stable explodes. Kalyani Steel +125% in 3 months. https://t.co/J5ZAunOECI

— Kush Katakia (@kushkatakia) August 19, 2016

Biocon is out of the portfolio

Porinju made the surprising revelation that he no longer holds Biocon, the mid-cap Pharma Company.

It may be recalled that Porinju had earlier defied the warnings issued by CLSA, Motilal Oswal, Daljeet Kohli, Nirmal Bang and the other brokerages that Biocon is floating on hope and that its stock price is not sustainable.

Porinju timed his entry into, and exit from, Biocon, perfectly. He recommended the stock on 24th December 2015 when it was quoting at Rs. 481. Today, just a few months later, the stock is Rs. 847.

This implies that Porinju has pocketed hefty gains from Biocon as well.

Jubilant Life Sciences is the successor to Biocon

Porinju has announced that Jubilant Life Sciences has been anointed the successor to Biocon in his portfolio.

The logic for selecting Jubilant Life Sciences fits in with Porinju’s template for selecting stocks. The stock is presently an underdog and is reeling under heavy debt.

Porinju gave three reasons to support his recommendation of Jubilant Life Sciences:

(i) 55 percent of its business is very high quality pharmaceutical business. It is very strong in the “nuclear medicines” which is a niche business and is becoming a global leader in some segments;

(ii) It is a large company with revenue close to USD 1 billion and market cap below USD 1 billion. It has debt of Rs 4,000 crore. So, at an enterprise value of Rs 9,000 crore, one can buy a company worth USD 1 Billion with the potential for strong growth;

(iii) The management is committed to reducing the debt levels. Every year, the debt is coming down by Rs 300-400 crore of debt.

Porinju added that one has to go beyond “number crunching” and mix it with a bit of “common sense”.

Porinju also declared that Jubilant Life Sciences is at an “inflection point”.

You are welcome!

The billion Dollar company is at an inflection point, I feel. Equity Intelligence holds. https://t.co/UmIXC75Lj5— Porinju Veliyath (@porinju) August 9, 2016

Porinju’s timing of the Jubilant Life Sciences recommendation is also perfect. The Company reported robust results and took off like a rocket.

| JUBILANT LIFE SCIENCES LTD Q1FY17 FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | JUN 2016 | JUN 2015 | % CHG |

| NET SALES | 1419.53 | 1445.7 | -1.81 |

| OTHER INCOME | 4.39 | 4.17 | 5.28 |

| TOTAL INCOME | 1423.92 | 1449.87 | -1.79 |

| TOTAL EXPENSES | 1051.37 | 1120.63 | -6.18 |

| OPERATING PROFIT | 372.55 | 329.24 | 13.15 |

| NET PROFIT | 164.02 | 130.33 | 25.85 |

| EQUITY CAPITAL | 15.93 | 15.93 | – |

The gains from Jubilant Life Sciences in just the last one month are a staggering 68%. The stock has notched up 30% in just the last week.

Gokaldas Exports disappoints

However, it is not entirely a bed of roses for Porinju. Gokaldas Exports, another of his favourite stocks reported disappointing results. The stock has lost 30% over the past month. The stock is presently resting at Rs. 80, still above Porinju’s purchase price of Rs. 68.

Other stocks

Of the other stocks recommended by Porinju, KNR Construction and Anant Raj have put up a spirited performance by notching up hefty gains of nearly 30% in a short period. The other stocks, namely, Indian Hotels, Tata Global Beverages and Orient Cement, have remained sluggish and close to their recommended prices.

Equity Intelligence PMS sees growth in clients and AUM

Equity Intelligence, Porinju’s PMS, is bursting at the seams as deep-pocketed investors are lining up to hand over their big bucks.

As per my last report, the PMS had 782 clients as of 31st March 2016 who had contributed an aggregate amount of Rs. 391.90 crore. As of the end of July 2016, the number of clients has swelled to 903 while the AUM has surged to Rs. 539.77 crore. The fund clocked in a return of 7.13% as at the month end.

So, it is clear that Porinju is making money hand over fist. Porinju is not only raking in big bucks from direct stock purchases, but the fees from the PMS are also adding hefty amounts to the kitty.

Fortunately, Porinju’s salutary habit of publicly sharing his tips gives novice investors like you and me also the opportunity to pocket a few bucks!

No wonder till luck is on his side.

I dont like his picks generally. But this was awesome. No doubt. Respect.

He has been a regular with hefty gains on his picks.

Another of his comments were on Sahyadri Industry.

The stock rocketed and now back to the recommendation point. Soon in triple digit?

Dear Arjun, why you have not posted anything on Stylam which you informed as Porinju pick in March last year around 100 levels? Porinju picked this stock much early, stock touched all time high of 649 recently giving whopping returns of more than 600% to Porinju followers.

Also, I saw IDBI Direct report on Stylam recently, it says company recently ongoing expansion will commence soon by early Sept and will contribute 30% to 40% in revenues from 3rd quarter, it will be really nice if you share your views on this multibagger stock, considering GST and anti dumping duty imposed by Govt for MDF for next 5 years, I think stock even after delivering 600% in last year can still give excellent returns going forward. Please enlighten us sharing your views! Thanks & Regards, Minu

I bought Kalyani Steels for 130 last year, I have to wait for full year to see upside. There is something special about his timing.