Yesterday, I reported that Kitex Garments, a stock that was so far lauded for its so-called “impenetrable moat”, high standards of corporate governance, brand image, etc, etc had collapsed like a ton of bricks over concerns of its growth prospects and valuations.

Today, Kitex lost another big chunk of its value, leading investors to question how some highly esteemed value investors had expressed unbridled optimism about its prospects despite so many tell-tale warning signs (which were highlighted in the valuepickr forum).

While the purists (investors who believe in investing only in “high quality” stocks no matter what the valuations) were wailing inconsolably over their huge loss, Porinju Veliyath was grinning from ear to ear, like a Cheshire cat.

Porinju has good reason to be pleased because his sustained campaign against the purists for advocating the purchase of so-called high-quality stocks without regard to their valuations is reaping rich dividends.

Porinju had once mocked investors in Page Industries (when it was quoting at an eye-popping P/E of 100x) by saying that the Government would have to make it compulsory for citizens to wear “two underwears” if Page Industries was to continue to thrive at its exorbitant valuations.

Page is over-priced unless govt makes it compulsory to wear 2 underwears, like superman 🙂 https://t.co/OVTovP99Lq

— Porinju Veliyath (@porinju) August 14, 2015

Some other high priced stocks that have been on Porinju’s hit list include Ashiana Housing, Symphony, Eicher Motors, Kaveri Seed, Bata India and Kitex Garments.

Sad that amateurs are chasing success stories at wrong prices; I have been warning about Page, Kitex, Ashiana, Atul Auto, Symphony, KSCL etc

— Porinju Veliyath (@porinju) August 17, 2015

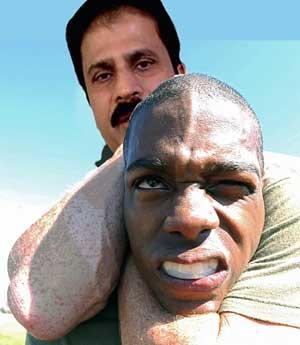

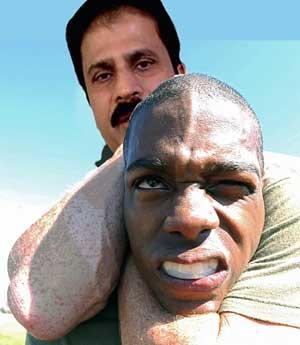

With the stocks steadily losing ground, Porinju was emboldened to launch personal attacks on the Gurus who dish out advice to buy high priced stocks. Porinju contemptuously called these Gurus “big people, fancied guys” and slammed them for leading naïve investors into the “biggest trap”. Porinju diplomatically did not name the Gurus.

Today, Porinju rubbed salt into the wounds of the purists by digging out an old interview in which he had cautioned investors from investing in Kitex Garments (then quoting at Rs. 800) and instead to invest in Vardhaman Textiles (then quoting at Rs. 600). Kitex is down 45% while Vardhaman is up 25% Porinju gleefully announced, much to the delight of his vast fan club.

Why Kitex@800 was bad (-45%) and Vardhaman @ 600 was good (+25%) – Fancy Vs Value!

https://t.co/frmJ8uYNYS via @YouTube

— Porinju Veliyath (@porinju) January 27, 2016

“Fancy vs. Value” Porinju proclaimed, plunging his sword deep into the bosom of the purists.

The purists got yet another jolt because Ambareesh Baliga has condemned Kitex Garments and recommended that investors dump the stock for whatever they can salvage. Ambareesh Baliga also revealed that even he had recommended that Kitex be sold when it was at Rs. 1,000 on the basis that the valuations were exorbitant and unsustainable.

GEPL also advised investors to dump the stock and head for the exit door on the ground that “management integrity is in question“. It set out its key concerns as follows:

(i) Despite Dollar at record high levels of Rs 68 company is not able to post a topline growth. Repeatedly they had said and stick to their guidance of 10 to 15% sales growth since last two con calls.

(ii) No repayment of Debt despite having cash balance of Rs 240 cr plus. Management had said in earlier con calls they will re deem their dollar denominated investments and clear debts since dollar was at record high levels.

(iii) No update on the Merger with the unlisted entity. Nor any update on the listing of the unlisted entity.

(iv) CFO resignation with immediate effect. Company said since he got better opportunity so he resigned immediately.

(v) No update on the con call for Q3FY16 results. MD is in USA and will be back on 6th Feb and no one else wants to comment on the results. No surety whether there will be con call after his arrival as well.

GEPL also pointed out that while Kitex has corrected from Rs. 1050 levels all the way to 450 levels, more downside is expected because some companies like Eros International, Kaveri Seeds, Tree House, Amtek group etc have corrected more than 60 to 90% when management integrity is in question. It warned that Kitex may correct another 30 % to 50% from current levels because of all the concerns.

Now, the ball is in the court of the purists to come up with an effective rejoinder to Porinju’s attack and salvage their reputation.

Yes, Porinju is right. We are not here to consume shares. We are in the business of buying low and selling high. Even if your buying gold it has to be cheaper relative to its fundamentals.

Blasphemy? His best pick, ironically, has been the same stock – Kitex! He’s said it at the 16 for 16 program by CNBC TV 18.

Also I’m wondering if there’s a plot twist to the story. Porinju is on the forum under some guise? Somebody who’s riding Vardhman Textiles in the Kitex debacle and has now targeted Page Inds.

Porinju’s picks in 16 for 16 were IHCL, Biocon, Tata Global & Anant Raj. Where did Kitex come into the picture?

not his pick in 16 for 16, to a question about his best pick ever – Kitex was the answer

Thats because he made money in Kitex in the past. That has nothing to do with the present.

High pe ratio shares works in bull phase at present it is the beginning of bear phase mkt. Will fall further by another 20 pc. After budget

He is targeting Sanjay Bakshi… Mr. Bakshi always post something about a stock after he made more than 400% personal return… And praise about the management and its business with so many fancy theories to tempt other investors… Finally he ends with a note “Stocks discussed are only for discussion, not buying”…

I had also my doubt about Kitex pl check in stock talk in thread of Kitex.Page is although a good company ,had been advised against investing in same thread and I realy like Porinju about his comment about wearing two undergarments.But he has equaly recommended third grade ,illiquid poor qulaity stocks.Now I doubt they may be equaly hit unless govt make compulsory to buy 100 stock each by all investers with. dmat accounts in next budget.

Where is value investors like Bakshi and where is Porinju? Porinju a dealer (more or less a data operatoer in back office) turned to a fund manager and we can not expect value investing from porinju

For sustainance frank Sinatra the god of the jazz can work as tea seller for better times so what is wrong with purinju as backodfice guy _he has one of the b3st brains to guide and and enrich us

Seems Porinju like a stock operator who is using insider info and playing opportunism

We may just keep on discussing failure of stocks recommended by all respectable great Gurus.I think all Gurus including Brave Porinju might have already shifted from failed stocks to Quality stocks or in cash to fight down trend .After all Gurus are Guru and Chelas ,small investers might be shivering by holdings those failed stocks.

kharb, porinju goes for low quality stocks, I guess you are right…also his stocks are extremely low in volume,pump and dump mentality

I am realy impressed and my respect to him increased many fold about Porinju explanation about Vardhman and Kitex comparison.Realy it seems he has good eyes to see deep.

porinju rules!!! we should give credit where it is due. he has single handedly decimated all big named investors. maarega jo sabko laath, veliyath, veliyath…

Completely agree with Porinju. Those who thinks he still holds Kitex are wrong. He sold it long back. Thats what a real investors mark…know when to sell out..

Porinjus stock pick has been exemplary.Offcourse there are some where he is steadfast like Selan Exploration despite going downards. Atleast,he appears genuine & generally advises or recommends when he buys something on same day not unlike others where they dump when they need to sell.Personally, i find convinction in his stock picks although i have observed he generally toes around the same picks as Ashish Chugh on some multibaggers.He is quite straightforward with his approach. Some of recent picks though like Selan,Swelect,Ajmera Reality,Ansal Builders,Sadbhav etc are not for faint hearted.

Picking stock in India is like black magic: one need to connect the devils….in this case, promoters, brokerage house, operators and media house which gives the first two some airtime. If you are in this circle, you can make the kill, otherwise, get killed. There are so many stocks which were pumped up and dumped on retail investors….in Kitex case also, HDFC securities gave a call in Dec end for buy for a target of 900+….what utter nonsense….same way the recommendation of Motilal Oswal, Karvy etc…..and to top it all we have this toothless monster called SEBI which does nothing to check the cartels…..retail investors hardly makes money in stock market in India….

Where is Mr. Porinju when Zicom has come down from 170 to 90 , Where is Mr. Porinju when Anant Raj came down from 60 to 35 , Where is Mr. Porinju when Tara Jewell came down from 60 to 40. Specially he will not comment on those stocks which have crack more than 100 % and some even on bigger level.

He will comment only when his picks appreciate otherwise his mouth zealed

Anand raj went down from 140 to 40 level due to 2G connection.. I personally lost my hard earned money.. this guy supports.. what a wonder..

kitex boss is enjoying in USA maybe his honeymoon….while he has left his shareholders in deep shit…sebi as usual will do nothing to promoters..maybe he has pocketed its officials..

SEBI is useless, Kitex falls no LC lock ? when casttextech was falling sebi sebi was enjoying

u la la la la la la la la la kitex ne mar dala

All the Gurus are same. How can a stock fall without selling by these biggies. They are in the market for their personal gains and not ours. So do your homework and take decisions. Do not follow them blindly.

Guys, tune in to ET Now at 1 PM today. Telecon with public live on ET Now. All your doubts will be clarified, hopefully.

All the gurus tell to buy not – when to sell…..