“Jai Veeru” storm Dalal Street

“Jai Veeru aaye hain,” Col. Mukeshbhai, the head of the intelligence wing of the RJ Fan Club, yelled in his typical excitable and high-pitched voice.

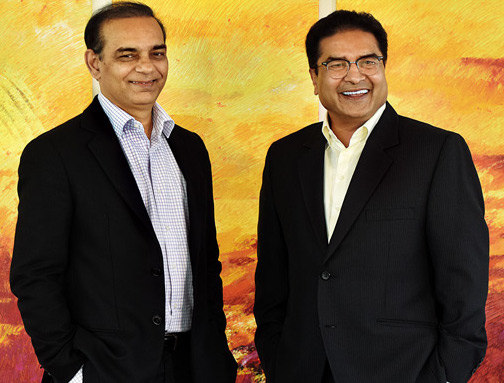

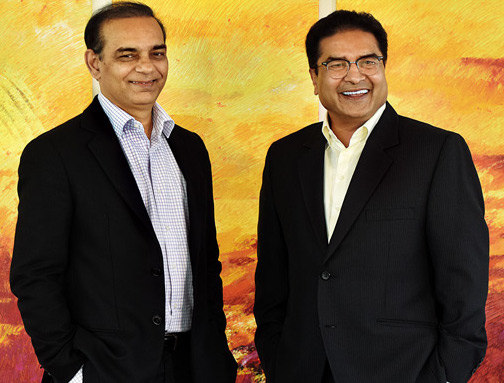

Everyone knew that the reference to “Jai Veeru” was a reference to Raamdeo Agrawal and Motilal Oswal, the dynamic duo who have raked in a massive fortune of Billions from Dalal Street through brilliant stock picking.

The duo has been conferred this prestigious moniker by Jash Kriplani of Outlook Business for their extremely profitable friendship and partnership.

“Just like how Jai and Veeru’s friendship remained resilient through life’s highs and lows in the movie, Agrawal and Oswal, too, have stuck by each other through various tumultuous phases of the market with sheer conviction and, of course, a little bit of luck,” the article has noted in a hushed tone of respect.

The duo had visited Dalal Street on a chilly winter morning to buy a truckload of stock of a micro-cap stock named “Bharat Wire Ropes“.

While Raamdeo helped himself to 9,42,109 shares, Motilal grabbed 9,42,108 shares.

The duo paid Rs. 26.25 for each share.

Naturally, there was great excitement at the counter and the stock surged effortlessly, breaching two back-to-back circuits of 20% each.

(The “Jai Veeru” of Dalal Street. Image Credit: Outlook Business)

Steel & Wire Manufacturing Industry is growing very fast

The interest of Raamdeo Agrawal and Motilal Oswal in Bharat Wire Ropes is easy to understand when one looks at the Directors’ report.

It is stated therein that the demand of wires is expected to increase by leaps and bounds in the years to come.

The Steel Wire Rope industry in India has prospered owing to growth in infrastructure activities and demand in industrial sector.

This growth was witnessed majorly due to government initiatives such as Pradhan Mantri Awas Yojana, Atal Mission for Rejuvenation and Urban Transformation (AMRUT), Smart Cities Mission, Delhi Mumbai Industrial Corridor (DMIC) and others.

It is also stated that the primary growth drivers for steel wire ropes in India have been infrastructure development, increased industrial activity, enhanced emphasis on shipping and port sector along with growth in the mining industry.

The resurgence in the Oil and Gas industry is expected to increase the number of oil rigs which will further add impetus to the growth of steel wire rope industry, it is added.

No doubt, the promise by NAMO to catapult India into a $5 Trillion economy as well as the assurance that Rs 102 lakh crore will be invested in infra projects augers well for the fortunes of Bharat Wire Ropes.

CNBC-TV18 newsbreak confirmed, FM Nirmala Sitharaman says the #TaskForce on infra investment has come up with recommendation for investing in Rs 102 lk cr worth of projects. In only 4 months, they held 70 stakeholder consultations. @ShereenBhan pic.twitter.com/BlErz9S0eW

— CNBC-TV18 (@CNBCTV18Live) December 31, 2019

| BHARAT WIRE ROPES LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 134 | |

| EPS – TTM | (Rs) | [*S] | – |

| P/E RATIO | (X) | [*S] | – |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | – | |

| LATEST DIVIDEND DATE | – | ||

| DIVIDEND YIELD | (%) | 0.00 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 14.89 |

| P/B RATIO | (Rs) | [*S] | 1.99 |

[*C] Consolidated [*S] Standalone

| BHARAT WIRE ROPES LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | DEC 2019 | DEC 2018 | % CHG |

| NET SALES | 58.48 | 55.01 | 6.31 |

| OTHER INCOME | 0.06 | 0.17 | -64.71 |

| TOTAL INCOME | 58.54 | 55.19 | 6.07 |

| TOTAL EXPENSES | 52.44 | 51.39 | 2.04 |

| OPERATING PROFIT | 6.1 | 3.8 | 60.53 |

| NET PROFIT | -16.12 | -12.11 | -33.11 |

| EQUITY CAPITAL | 44.95 | 44.95 | – |

(Source: Business Standard)

Is Bharat Wire Ropes the “next Maharashtra Scooters“?

Some astute punters on MMB pointed out that the seller of the 18,84,217 shares of Bharat Wire Ropes in the bulk deal is none other that “OSAG Enterprises LLP“.

OSAG Enterprises is in turn owned by Raamdeo Agrawal and Motilal Oswal.

According to one section of punters at MMB, the duo has indulged in a brilliant tax planning exercise and caused OSAG to book the losses it suffered from Bharat Wire Ropes since the days of its IPO.

However, another section pointed out that the duo had executed a similar maneuver earlier in the case of Maharashtra Scooters (see Raamdeo Agrawal’s “Golden Goose” Stock Turns Into “Mega Wealth Creator” Multibagger Stock).

On the eve of a crucial judgement of the Supreme Court, the duo had got Visu Associates, their investment arm, to transfer the shares of Maharashtra Scooters to their own personal names.

Needless to say, the Supreme Court ruled in favour of Maharashtra Scooters which has caused Raamdeo Agrawal and Motilal Oswal to bask in enormous riches.

@darshanetnow pic.twitter.com/XircLHgcuK

— Darshan Mehta (@darshanvmehta1) August 29, 2016

It is quite possible that Bharat Wire Ropes may be on the verge of a similar mega development which may have induced the duo to take custody of the stock in their own names from their LLP.