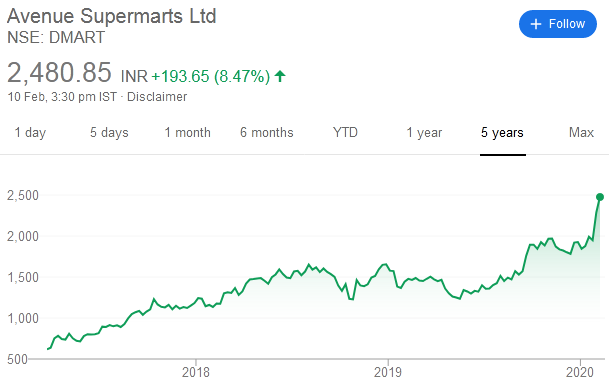

D’Mart gives 800% gain since IPO

Today, Basant Maheshwari had a big smile on his face.

This is because he was vindicated in his confidence in Avenues Supermart alias DMart.

The stock which is promoted by none other than Billionaire Radhakishan Damani, touched a stratospheric market capitalisation of Rs. 1.5 lakh crore.

Investors, who were lucky enough to be allotted shares in the IPO, are basking in massive gains of 800%.

Even investors who bought the stock on the day of listing are sitting on gains of 400%.

DMART

Stock at Another Record High

M-Cap Crosses 150000 Cr

At 2450, Stock has been 8 bagger from issue priceIn case, one wasn't lucky enough to get an allotment, still stock 4X since listing at 600.

Stellar Story! #FMCGisLife

Good Time to revisit – https://t.co/qvvWs2k8tW

— Mangalam Maloo (@blitzkreigm) February 10, 2020

Thank u Radhakishan Damani sir!!

You made dreams come true!!DMart +8x since IPO (Mar 2017)

In 3 yrs

a)Turned individuals into Lakhpati’s

*Invest Rs.15k

*Today=Rs.1.2lkhb)Turned "Extended" family of 8 into millionaires

*Fly of 8 invested 1.2 lkhs

*TODAY=Rs.10 lk(Rs.1 million) pic.twitter.com/a5mrHszbDf— Nigel D'Souza (@Nigel__DSouza) February 10, 2020

Basant has raked in mammoth gains because DMArt is his top holding across portfolios.

Basant Maheshwari, @BMTheEquityDesk , says Avenue Supermart is our top holding across portfolios

— CNBC-TV18 (@CNBCTV18Live) April 30, 2018

QUALITY helps you in bad times even as KACHRA sucks. The D-Mart stock is much like the D-Mart store. People who are in don't want to come out and the ones who are out can't get in. You can keep protesting but the stock is up 116% over listing price.

Disclaimer: We OWN it.

— Basant Maheshwari (@BMTheEquityDesk) February 23, 2018

Skeptics galore but Basant stayed resolute

It is notable that there were a number of skeptics who doubted the entrepreneurial capabilities of the wily Billionaire.

Samir Arora, for instance, was fortunate enough to go on a dancing session with Radhakishan Damani but forgot to ask for a preferential allotment.

Naturally, he has been sporting a glum face since then.

Timing is everything:

The precise moment when I should have asked for an allocation in Dmart. pic.twitter.com/ZXfjwpNPuW

— Samir Arora (@Iamsamirarora) March 12, 2017

Porinju Veliyath also left a lot of money on the table in the misconception that the stock is “overpriced“.

Not holding D-Mart now; looks over-priced! https://t.co/Pfxbg0FOyy

— Porinju Veliyath (@porinju) September 26, 2017

Some other experts condemned the stock for being caught up in “irrational exuberance“.

“The 115% appreciation in D-Mart share prices on listing day is taking things too far, notwithstanding the pedigree of the parent company Avenue Supermarts,” it was observed.

Some contemptuously called the listing “All Fools Day“.

Dalal Street advances #AllfoolsDay by 11 days. PE for Rent.

Celebrations begin shortly at the Ceremonial Bell. All are welcome? #DMart— Shyam Sekhar (@shyamsek) March 21, 2017

So the game being played in #DMart is this.

"If you dont buy today, you may not get quantity tomorrow. Float may be less." WoW.

— Shyam Sekhar (@shyamsek) March 21, 2017

50 shares of DMart allotted! Never going to sell them, will buy a 3BHK in Bandra with these 50 shares in 2037! ???

— Anupam Gupta (@b50) March 18, 2017

Some also claimed that the stock would plunge to its “fair value” of below Rs. 800.

To justify the PE Ratio of 80+ that #AvenueSupermart trades at it needs to grow earnings by 40% plus for the next 10 years.

Last quarter results were bad. This quarter disastrous with just 2% earnings growth. This is when they are not spending big on expansions

Value below Rs 800— sandip sabharwal (@sandipsabharwal) January 12, 2019

The skepticism continues to this day and the surge in the stock price was described as “madness“.

It is madness what is happening in #Dmart

Its not a business that can grow at a rate justifying a 100 P/E as its a linear growth business.

No valuation model can justify such prices.— sandip sabharwal (@sandipsabharwal) February 10, 2020

However, the stock does have supporters.

We have 3 D-marts near our place…people buy auto rickshaw loads of stuff everyday!

There is an unwritten rule which one shopkeeper told me:

"No retail store makes money in 3-kms radius of D-Mart"

— Aditya Shah,CFA (@AdityaD_Shah) February 10, 2020

People have been saying this since it's listing when Mcap was 20k around. So many videos are there.

5x hogaya since then. Puri rally miss karadi linear growth ke chakar pe. https://t.co/rN6OKNRKvz— Lalit (@lalitinvestor) February 10, 2020

Bajaj Finance, the “Ferrari without brakes“, also surges to life-time high

Bajaj Finance also thrilled Basant Maheshwari by effortlessly surging to its all-time high.

Over the past few years, the stock has surged in a spectacular manner from a market capitalisation of Rs. 2500 crore to Rs. 2.8 lakh crore and showered unbelievable gains of 16300% upon its lucky investors.

Bajaj Fin@life high

Crosses 4700 mark

Grt rtrn comes with grt cos

Spectacular move from 2500 cr mkt cap to 2.8 lakh cr & Journey still onNifty stock with highest return

1 Mth 13%

1 Yr 76%

3 yr 343%

5 yr 1072%

10 yr 16208%@SumitResearch @shail_bhatnagar— Deepali Rana (@deepaliranaa) February 10, 2020

Basant joyfully described Bajaj Finance as a “Ferrari without brakes in a road without speed bumps“.

Ferrari without brakes in a road without speed bumps. What’s that ?

— Basant Maheshwari (@BMTheEquityDesk) January 29, 2020

He has recommended the stock to us on a number of occasions in the past, including as one of the top 10 stocks for 2020.

Not just the results there’s something consistent about Bajaj Finance’s stock price also before and after the results. Own it no recommendations.? pic.twitter.com/nRGLTwPlFJ

— Basant Maheshwari (@BMTheEquityDesk) July 13, 2019

Value investors throw in the towel, concede defeat

When Saurabh Mukherjea had famously advised that we should buy high-quality stocks even if they are quoting at a nose-bleed valuations of 100x, orthodox value investors were up in arms and hotly contested Saurabh’s theory (see If You Buy Quality Stocks Even At 100 PE, You Will Still Make Money: Saurabh Mukherjea Stays Defiant & Rubbishes Fears Of Bubble In Valuations).

However, there is now a deafening silence amongst the value investors in the wake of the spectacular success of DMArt and Bajaj Finance.

This prompted Basant to ask the poignant question whether they had conceded defeat.

No one talking about expensive stocks today ? Why ??

— Basant Maheshwari (@BMTheEquityDesk) February 10, 2020

Raamdeo Agrawal confirmed that this is indeed the case.

“Value is out of fashion right now, deeply out of fashion. Even Warren Buffett is having a tough time,” the veteran stock picker stated, his shoulders slumped in resignation.

Why @MotilalOswalLtd's @Raamdeo Agrawal is not hunting for value anymore.

Read: https://t.co/uMw8fxMYHL pic.twitter.com/d7L1KoLmeu

— BloombergQuint (@BloombergQuint) February 10, 2020

Shankar Sharma expressed the same view.

“Avoid low P/E stocks, and go for high P/E plays if you want multibagger gains,” Shankar said in his deep baritone.

Avoid low P/E stocks, and go for high P/E plays: Shankar Sharma #ETMarkets #MarketsNews #BizNews #MarketsUpdate https://t.co/G2OmKrTSnW

— ETMarkets (@ETMarkets) February 7, 2020

Leave a Reply