Don’t kill the goose that lays golden eggs

When irate shareholders of Maharashtra Scooters Ltd gheraoed Sanjiv Bajaj, the promoter-director, he knew he was hopelessly outnumbered.

The shareholders had good reason to feel frustrated. The Company has stopped manufacturing activity a decade ago. Its only claim to fame is the fact that it holds a massive chunk of stock in blue-chip companies like Bajaj Auto, Bajaj Finance and Bajaj Finserv. However, while the underlying investments have spurted into multibaggers, Maharashtra Scooters has not kept pace. Instead, there is a whopping discount of 70% between the market value of the investments and the market value of the stock.

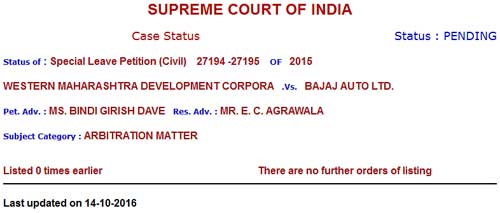

The reason for this sorry state of affairs is because the two promoters of Maharashtra Scooters, namely, WMDC (the State Government) and Bajaj Holdings/Auto are locked in litigation over control of the Company. The dispute revolves over whether the Bajaj group has a “right of first refusal” to buy WMDC’s stock and the price that it is obliged to pay. Bajaj offered a paltry sum of Rs. 75 per share while WMDC demanded Rs. 400 per share. The arbitrator took the middle path and fixed Rs. 151.63 as the fair price. The present status is that the Bombay High Court has upheld the arbitrator’s verdict though WMDC has challenged this by filing a SLP in the Supreme Court (click here to read the judgement).

“As the mandate for which the public gave money to Maharashtra Scooter has been defeated, the Company should be wound up and the proceeds distributed amongst the shareholders”, the shareholders demanded even as they pinned down Sanjiv Bajaj in a Heimlich maneuver.

Sanjiv Bajaj, a master at handling irate shareholders, was not cowed down. He stayed cool as a cucumber and pleaded with the shareholders not to “kill the goose that lays the golden eggs“.

Rs 1 lakh yields Rs. 2 crore in dividends and Rs. 15 crore in capital appreciation

When the shareholders calmed down a bit at the reference to Aesop’s fairy tale of the golden goose, Bajaj reminded them that they had earned enormous wealth from their investment in Maharashtra Scooters.

A paltry sum of Rs.1 lakh invested in Maharashtra Scooters has yielded Rs. 2 crore in dividend and has grown to nearly Rs. 15 crore, Bajaj said, even as the shareholders loosened their grip and patted him on the back for his stellar contribution to their well-being.

What happens if Bajaj Auto acquires control over Maharashtra Scooters?

At this stage, we have to do some crystal ball gazing and contemplate what will happen if the Supreme Court dismisses WMDC’s SLP and compels it to sell its 27% holding in Maharashtra Scooters to Bajaj Auto at the throwaway price of Rs. 151.63 per share.

Resumption of manufacturing operations not feasible

Sanjiv Bajaj has already ruled out the idea of Maharashtra Scooters resuming production. He explained that the cost of setting up a new plant is prohibitively expensive and not viable in view of the cut-throat competition amongst incumbent players.

Merger with Bajaj Auto/ Bajaj Finserv? – Full value of the stock will be realized by the shareholders!

As Maharashtra Scooters has nominal operating assets and no debt or liabilities, a viable option is that of merging it with the operating companies in the group such as Bajaj Auto or Bajaj Finserv or Bajaj Finance or Bajaj Holdings.

Each of these stocks is a blue-chip wealth creator in its own right. The best part is that in a merger, the shareholders of Maharashtra Scooters will receive the market value of the underlying investments. This will result in enormous “value unlocking” and the exiting steep holding company discount will disappear.

Obviously, if the market gets a whiff of the possibility of merger, the stock price will surge into the stratosphere.

Raamdeo Agrawal & Motilal Oswal appear to have anticipated this

Raamdeo Agrawal & Motilal Oswal, both stock wizards of exceptional caliber, appear to have anticipated this state of affairs.

In May 2016, they got Visu Associates, their investment arm, to transfer 279230 shares of Maharashtra Scooters equally to each of Raamdeo Agrawal and Motilal Oswal at the then prevailing price of Rs. 1,262.

At the CMP of Rs. 1863, the duo of Raamdeo and Motilal are already richer by 48% gains in just five months. The stock is up 88% on a YoY basis.

Maharashtra Scooters conferred status of “Mega Wealth Creator” owing to 30-bagger returns

Darshan Mehta of ET rightly conferred upon Maharashtra Scooters the exalted title of “mega wealth creator” for its stellar contribution towards enriching shareholders. He also helpfully provided a note which gives succinct information about the Company.

@darshanetnow pic.twitter.com/XircLHgcuK

— Darshan Mehta (@darshanetnow) August 29, 2016

PPFAS Mutual Fund explains why the stock is attractive

Rajiv Thakkar, the fund manger of PPFAS Mutual Fund, provided a concise explanation on why the Fund has invested in Maharashtra Scooters.

Supreme Court litigation is the stumbling block to riches

The Bombay High Court has ruled that the requirement in the Protocol Agreement between WMDC and Bajaj Auto that WMDC has to give Bajaj Auto “the right of first refusal” if it wants to sell the stock is valid and not in breach of section 111A of the Companies Act.

This has been challenged by WMDC in the Supreme Court. If the Supreme Court upholds the challenge and reverses the High Court, WMDC will be free to sell its holding to the highest bidder at the CMP and will not be constrained to sell to Bajaj Auto at the throwaway price of Rs. 151.63.

Obviously, such a verdict will upset the applecart of all hypotheses relating to a possible merger of Maharashtra Scooters with the Bajaj entities.

Unfortunately, the matter is still hanging fire at the admission stage in the Supreme Court. If the Court dismisses the SLP, that is fine. However, if the Court admits the SLP and decides to hear the litigation fully, several years could easily go by before a decision is arrived at.

Conclusion

Maharashtra Scooters may still be a “fail-safe” stock. Its blue-chip credentials coupled with the rock-bottom discounted valuations means that our money is safe and sound. Even if the Supreme Court verdict goes against the Bajaj group, we can be confident that we will get our money back in one piece. On the other hand, if the Supreme Court decides in favour of the Bajaj group, it is certain that we will have a magnificent mega wealth creator multibagger in our hands!

amazing Arjun saheb. Time to pick up some Maharashtra scooters. It is like heads I win, tails I win some.

Is it still a hidden gem?

Honestly Mah Scooters was attractive at 700, at these levels I don’t find it attractive.

Hi…Given that Now Maharashtra scooter has become subsidiary of Bajaj holdings what could be impact for shareholders of maharashtra scooters?