Rakesh Jhunjhunwala, the Badshah of Dalal Street, hates talking about stocks with journalists. However, he does have a soft spot for a few people and makes an exception for them. Menaka Doshi and Udayan Mukherjee have been accorded a special privilege and they are free to ask the Badshah any question they like.

Udayan Mukherjee has a special tact when talking to Rakesh Jhunjhunwala. He is careful to ask questions in an indirect manner and steer the Badshah to what he want him to talk about.

When Udayan asked the Badshah about his interest in aviation stocks, the latter pointed out that he is very gung ho about Indigo (Interglobe Aviation) because it is a low cost operator, has high ROC and is quoting at a reasonable P/E.

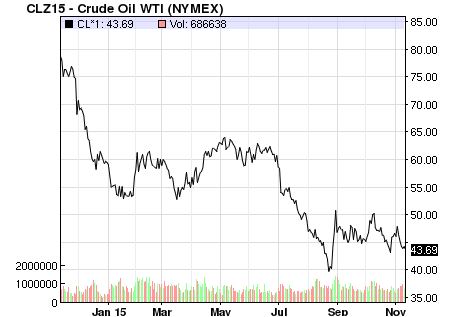

However, the Badshah also said something softly that was missed out in the ambient noise. He said he is “very bearish on oil prices”. He added that he does not see crude oil prices “going anywhere in 3-5 years”.

Now, this grim prediction should send alarm bells clanging in the camp of Porinju Veliyath and all other shareholders of Selan Exploration because Selan’s fortunes are directly dependent on crude oil prices remaining high.

Porinju’s PMS, Equity Intelligence, is the single largest shareholder of Selan Exploration with a massive holding of 831,758 shares comprising 5.07% of its equity. The investment is worth about Rs. 20 crore at the CMP of Rs. 248.

Porinju has earlier revealed that the PMS has a concentrated portfolio of only 8 to 10 stocks. This means that a crash in Selan Exploration’s stock price will weigh heavily on the PMS’ performance.

One can already see the evil effects of the falling crude oil prices on Selan Exploration. On a YOY basis, the stock is down 45%. On a two year basis, the stock is down 19%.

The Q2FY16 results are also miserable. The sales plunged 32% to Rs. 15.77 crore from Rs. 23.31 crore while the net profit plunged 68% to Rs. 3 crore from Rs. 9.57 crore.

| Selan Explorations Technology Ltd – Quarterly Results | |||

| Particulars (Rs cr) | Sep 2015 | Sep 2014 | % Chg |

| Net Sales | 15.77 | 23.31 | -32.35 |

| Other Income | 2.08 | 2.93 | -29.01 |

| Total Income | 17.85 | 26.24 | -31.97 |

| Total Expenses | 12.63 | 11.83 | 6.76 |

| Operating Profit | 5.22 | 14.41 | -63.78 |

| Net Profit | 3 | 9.57 | -68.65 |

| Equity Capital | 16.4 | 16.4 | – |

The worst part is that Asha Mahajan, one of the promoters, appears to have foreseen this doomsday scenario. She dumped a big chunk of her holding in March 2015. The overall promoter holding in Selan has dipped from 43.03% in December 2014 to 40.93% in September 2015.

Other whiz-kid investors like Dolly Khanna, Kenneth Andrade’s IDFC MF, Prem Nath Anand, Yohan Sachdev have already either sold their holdings or pared it to an insignificant amount.

Porinju Veliyath appears to be the last man standing on the sinking ship.

We must note that Porinju has so far been in a state of denial. On an earlier occasion when Goldman Sachs predicted that there was a risk of crude oil prices slumping to $20 a barrel, Porinju trashed the prediction and called it “shameful”.

Goldman Sachs predicts Crude @ $20, after the shameful forecast of $200 in 2008 at the peak around $140:

http://t.co/N3a1qK56Lt

— Porinju Veliyath (@porinju) September 11, 2015

However, whether Rakesh Jhunjhunwala’s latest prediction will impact Porinju’s thinking or not requires to be watched closely.

Please cover Ansal Buildwell. Porinju’s another pick which is not doing well. stock is almost down 40% in 2 days

Stay away from all stocks promoted on social media by Porinju. He buy on the PMS and then talks about it. I wonder why SEBI is not doing anything. ET and others have made these average ppl into stars

Yes, definitely Sebi need to look into Purinju habit of misleading the public and making money.. stay away from all his recommendation

PORENJU “s period is over as he regularly coming on media…

Veilyath’s another pick Sahyadri Industries is also doing very badly after a poor quarterly result, investors are getting carried away when he buys some thing but they do not monitor when he is selling and getting out, we cannot blame him for this , he is using the internet well for promoting his business however, we investors have to be careful as it is our money we are investing

Appreciate his confidence. Never he buying stocks for short term.

if Porinju bought selan, it is pure gambling and misleading to the public. Any third grader knows the oil prices are not going up marginally for next few years.. I agree with Sharath…and TheValueHunter… Sebi should handle this case. if it is PMS, he not supposed to talk on that …

He recommends 100 plus stocks. naturally few of them will do well but the loss in others will offset these gains. selan which forms major part of his pms is at life time low and not expected to do well any time soon.

Regarding Selan, i am not a follower of Mr veliyath , but i am directly related to oil industry, selan exploration has not much to do with international oil prices as of now, Indian government is spending a huge amount for exploration, and as u all know the Indian petrol or diesel prices doesn’t change with international oil price. selan is surely a good bet till next 2nd quarter result

I am positive on Selan for a great management team and more importantly its great oil wells in the West. I expect crude to bounce back and OPEC will one day cut production!!! Aban is trading at 2.6x earnings wtf.