Saurabh recommended three stocks, all of which are posting hefty gains

First, we have to compliment Saurabh Mukherjea for his brilliant advice during the depths of the CoronaVirus meltdown in the stock market that we should grab three stocks.

He rightly described them as “looking incredibly juicy and attractive“.

Saurabh Mukherjea says don's get caught up in the near term forecasts, focus on long term. Bajaj Finance, HDFC Bank, Kotak Bank look incredibly 'juicy', attractive at this level

Premium financials in NBFC space, auto look very attractive— avanne dubash (@avannedubash) May 11, 2020

Needless to say, the trio of Bajaj Finance, HDFC Bank and Kotak Bank have posted handsome gains over the past few weeks.

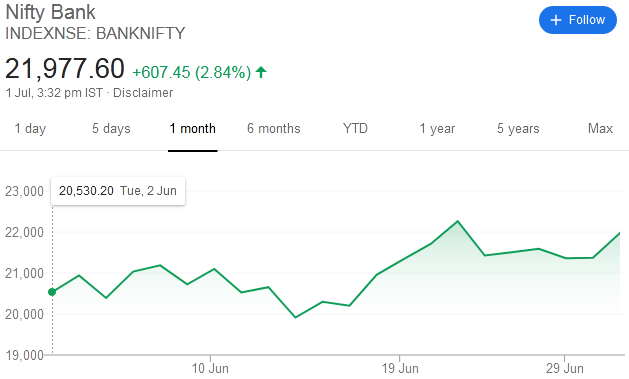

In fact, the entire Bank Nifty is looking like an unstoppable juggernaut and is effortlessly moving from strength to strength.

It is hard to believe that some Pundits had written the death sentence for Bajaj Finance and HDFC Bank during the depths of the meltdown.

Thankfully, their doomsday prophecies have not come true.

Ye shahar me naye hain, pehle ek sahab Canada wale the

— NEERAJ BAJPAI (@NeerajCNBC) March 27, 2020

Bernstein downgrades HDFC Bank to 'underperform' due to exposure to unsecured credit risk.

Read all market updates: https://t.co/HoprKnSYSx pic.twitter.com/GUe1ymb3yL

— BloombergQuint (@BloombergQuint) March 20, 2020

Normalcy is fast returning, economic news is not as adverse as was feared

Saurabh pointed out that latest Quarterly results of FMCG majors like Nestle and ITC is sending the clear signal that the sector is back to normal.

Even semi-essential items like undergarments, paints and adhesives are back to 70-80% of normal levels.

Even in the auto sector, two wheelers seem to be up 80% of normal demand and even tractor demand is roaring across the country. It is only in sectors like trucks and cars where normality is still some distance away, he said.

“So it is not clear to me if the pain is as acute as people felt it would be three months ago,” he added.

Saurabh also pointed out that the massive gush of liquidity by the Federal Reserve is helping matters and the markets will not slump.

“Central banks have printed the best part of $9 trillion in the last three months or so and they are promising to do more. It is very difficult to pull the market back regardless of how adverse the underlying economic news will be,” he said.

He also emphasized that the underlying economic news is not anything as adverse as people were fearing three months back.

Stay away from non AAA-rated lenders

Saurabh cautioned that the fact that the trio of Bajaj Finance, HDFC Bank and Kotak Bank are doing well does not mean that junkyard PSU Banks and NBFCs will also do well.

“There is a very sharp divergence in the cost of money between AAA-rated lenders and AA-rated lenders. I have not seen in my career this sort of gulf in the cost of money. So I think we will see a very sharp polarisation where the top lenders, whether they be banks or NBFCs, the top three to four banks and NBFCs will very sharply pull away from the rest. The rest will struggle to get access to funding and the top three or four will see NIM expansion and loan book expansion as we go towards the end of the current fiscal,” he said.

He also admitted that he is worried about the extent of the NPAs that the Banks and NBFCs will report.

“We do not know when we come out of these 180-day moratoriums, how big an NPA it will be. It is inevitable. What we are seeing in the country around us is that several companies who have taken moratorium, those businesses might never re-open. So restaurants, cinema halls; there will be big parts of the economy where the companies that have taken a moratorium might never re-open,” he said, his brow creased with worry lines.

“The weaker lenders will not be able to raise capital; whether it is equity capital or debt capital. The stronger lenders will be able to do so and thus consolidate the lending sector,” he added, implying that it will be a survival of the fittest and we have to put our money on the best.

Maruti, latest stock pick

Saurabh announced that his latest stock pick is Maruti Suzuki India Ltd, the blue-chip behemoth.

He also provided the investment rationale in a succinct manner.

(a) the car sector and the passenger vehicle sector will consolidate around Maruti, Toyota as one consortium and Hyundai and Kia as the other,

(b) All other players are is irrelevant. If there are only two strong players, there will be strong barriers to entry around these two players,

(c) Maruti caters to the lower end of the market; the cheaper segment of the car market, where there is insatiable demand.

“I think the industry starts to become very-very attractive. I do not see mad discounting in the passenger vehicle market and as rural comes through and as the interest rate cuts come through, Maruti should be in a good place and in some of our client portfolios, we have bought Maruti,” he said.

Nifty Auto up by 20% from March lows

High From March lows(usually 52 wk lows except escorts)

Motherson 54%

Amara raja 53%

Bajaj Auto 37%

Escorts 29%

Hero Moto 28%

Tamo 28%

TVS Mot 26%

M&M 25%

Maruti 16%

Exide 8%

Eicher 6%

Ashok Ley 4%— Deepali Rana (@deepaliranaa) May 21, 2020

What about two-wheeler and auto ancillary stocks?

It may be recalled that Saurabh had earlier advised us to aggressively tuck into blue-chip two-wheeler stocks like Bajaj Auto and Hero Motors.

Both stocks are doing well and notching up solid gains.

He has also advised us to consider ancillary stocks like Amara Raja and Exide Industries because both are beneficiaries of the OEM and replacement markets.

Auto stocks on fire

Best play probably will be battery stocks (Amara Raja and Exide)

– Majority cars are standstill due to lockdown

– Most cars will need new batteries as majority may be dead due to non use

– Auto companies have started so OEM demand will kick in— Darshan Mehta (@darshanvmehta1) May 11, 2020