Rajen Shah recommended Escorts – when it was Rs. 50

Rajen Shah of Angel Broking is/ was a master stock-picker.

During the depths of the stock market crash of April 2013, he had implored us to scoop up stocks which were then quoting at throwaway prices.

“Pain is the hammer of God, molding man to greatness” he said, implying that if we can bear the pain in our portfolios, we would achieve greatness.

“Why have the FIIs invested USD 12 Billion in the last three months” he asked in a poignant manner, suggesting that if the all-knowledgeable FIIs are aggressively buying stocks, we should join their illustrious footsteps.

Some of the stocks then recommended by Rajen Shah include the present day hot stocks like Reliance, Bajaj Finserv, etc.

Escorts Ltd came in for special mention.

“It is too cheap … You just need to buy and may be over the next two years probably you could be sitting at 100 per cent gains ..,” he said, his eyes sparkling.

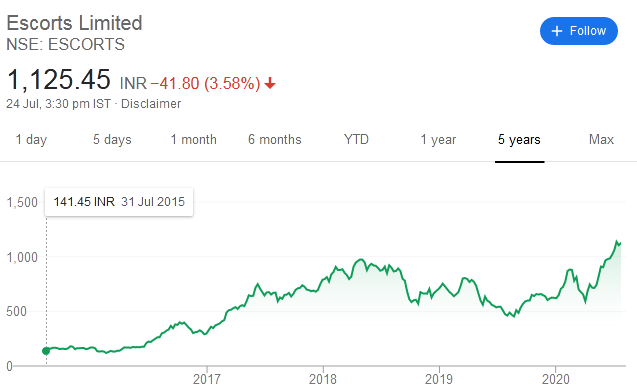

The advice was brilliant because Escorts is now standing tall at Rs. 1127, delivering mammoth 10-bagger gains of 1000%+.

Rakesh Jhunjhunwala bought Escorts at Rs. 70

Unlike us investors who get paralyzed with fear at the first sign of a correction in the stock markets, stalwarts like Rakesh Jhunjhunwala gird their loins and benefit from the opportunity.

The Badshah bought his first tranche of 6.21 lakh shares in August 2013 at about Rs. 70 per share.

His average price, after other purchase tranches, is about Rs. 125.

Thereafter, in February 2018, when Escorts was proven to be walking on the multibagger path, Rakesh Jhunjhunwala used it as an example of how we should be patient with our investments.

“A lot of investments test your patience and you doubt whether you have made a wrong investment,” he said in a soft tone.

“I bought Escorts at Rs 125 and today the price is Rs 850. But for two and a half agonizing years, I was the only buyer and everybody would say what are you buying, what are you buying”, he added.

Finding multibagger stocks is a matter of conviction, patience and luck he counselled.

As of date, Rakesh Jhunjhunwala is the single largest individual shareholder of Escorts with a holding of 91,97,600 shares, comprising 6.82% of the equity capital.

The investment is worth Rs. 1036 crore at the CMP of Rs. 1127.

This is after the Badshah encashed a small part of his gains from the stock.

In a regulatory filing on Friday, Jhunjhunwala said that he sold 2 lakh equity shares of Escorts on July 22. This takes his shareholding to 91,97,600 shares in the domestic tractor maker. https://t.co/FKt6RUqIUW

— ETMarkets (@ETMarkets) July 24, 2020

(Rakesh Jhunjhunwala with Devina Mehra, Shankar Sharma and other distinguished luminaries of Dalal Street)

Rural sector will thrive, Escorts will prosper

In his latest interview, Saurabh Mukherjea canvassed the theory that the rural sector has been relatively immune to the adverse effects of Covid-19 and will bounce back sharply.

“Given that the majority of our population lives in rural India I always used to feel that when rural comes back again, it will be a pretty sharp swing back to rural,” he opined.

He also pointed out that Rural India has experienced two good monsoons and the government has been proactive in doling out money to rural.

There are also elections coming up in Hindi speaking states in the near future which will put the rural sector in sharp focus.

“So whichever way I cut it, there’s a swing in the needle back from urban to rural both for FMCG and auto sectors seems to be on the cards,” he said.

Saurabh candidly disclosed that he is banking on Escorts to reap the benefits of the rural boom.

“Escorts is a recent addition to our portfolio,” he said.

He also explained the investment rationale in a succinct manner.

“When we were researching Escorts, the sort of feedback we were getting from rural Tamil Nadu and Punjab was tremendous. It was astonishing to hear that through June and early July, there is rural demand whether it is in south India or in the fields of Punjab“.

Focus on champions, buy the winners

Saurabh reiterated his pet theme that there is no need for us to forage in the bushes, looking for so-called undervalued stocks.

Instead, the better game plan is to cherry-pick from the champions, without getting our knickers in a twist about so-called exorbitant valuations.

“Every sector is consolidating into the hands of one or two champion players whilst hundreds of other companies get washed away,” he said.

“The well run, efficient, well capitalised companies will consolidate share and that in turn means difficulties for hundreds of companies,” he added.

“Our job is to focus on the winners and continue making money from them. Hence we try to a) stay positive and b) focus extensively on understanding why the winners are winning more,” he explained.

It is worth recalling that Saurabh has also, very generously, revealed the names of some multibagger stocks in his famous ‘Little Champs‘ portfolio of small and mid-cap stocks, so that we can also rake in a few bucks.

dont get carried away by names, asset allocation is very imp, maybe a very small portion into this.