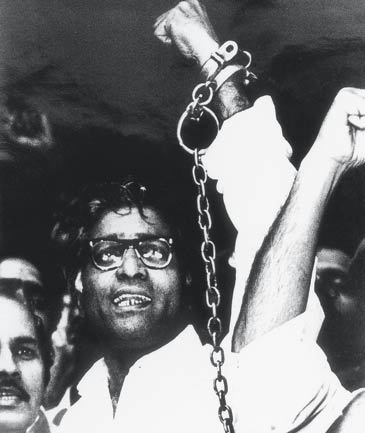

Young-timers may not be able to readily place George Fernandes. However, old-timers will remember him with a sense of dread. George Fernandes, a militant trade union leader, famous for his socialist policies, sparked terror in the hearts of industrialists and businessmen. In his heyday, Fernandes was feared for his ability to call for ‘strikes’ and ‘bandhs’ at the drop of a hat. His most notable agitation was the 1974 railway strike which paralyzed the entire Country and brought it to a grinding halt.

George Fernandes shot into fame/ notoriety when he insisted in 1974 that foreign companies operating in India should offer at least 40% of their equity to Indian shareholders. This requirement upset the foreign companies to such an extent that two blue-chip behemoths, IBM and Coca-Cola, packed their bags and walked away from the Country.

George Fernandes was severely criticized at that time for his anti foreign investors’ stance. It was feared that the exodus of foreign companies would leave the Indian economy in a shambles.

However, ironically, George’s move proved to be the biggest catalyst for the Indian stock markets. This is because blue-chip foreign companies like Nestle, Hindustan Lever, Colgate, Proctor Gamble, Glaxo etc were forced to offer their shares to the Indian public at a price determined by the Controller of Capital Issues (CCI) which usually was a pittance compared to the fair value of the stock.

The result was that George Fernandes’ leftist and socialist philosophies created humungous wealth for the Indian public who took to the path of capitalism.

Surprisingly, Shankar Sharma has echoed similar sentiments as that of George Fernandes.

Shankar has argued that India ought to have allowed “foreign portfolio investments” but not “foreign direct investments”. He claims that if the Country would have prohibited foreigners from starting their own businesses here, they would have been forced to invest in Indian companies, which would have led to far greater prosperity for Indians.

Shankar has cited the example of the Banking Industry to prove his point. He states that because foreigners are not permitted to set up banks directly, they are forced to invest in Indian banks and that this has created world-class behemoth Indian banks like HDFC Bank, ICICI Bank, Axis Bank etc.

“It boils down to a deeply-protected industry, both from domestic and international competition. As simple as that. So we have created massive local banks, which in turn have created huge investor wealth” Shankar said.

As a counter-example, Shankar has cited the example of the e-commerce sector which finds itself in a sorry state of affairs owing to the death match between Amazon and the Indian companies, Flipkart, Snapdeal etc.

“Why couldn’t we have walled off this sector to direct foreign competition, and allowed freedom to investor capital to come into our home-grown companies like Flipkart?” Shankar asked.

“Like private banks, we would have created huge domestic companies. Instead, we are seeing a behemoth called Amazon eating everybody’s lunch” he added.

Shankar cited the example of China as a “walled off” economy which has prospered thanks to the growth of local companies. “Their internet sector has grown into a trillion dollar market-cap sector, thanks to the walling off. They have created giant local tech/e-commerce companies which are now becoming global because they have the size, scale and capital to compete globally” he emphasized.

“We have failed miserably in putting a price to our massive domestic market, the way China has done” Shankar lamented.

Bull Markets are based on fraud:

Shankar has sent the chilling warning that we should not become “perma-bulls” but should always be cautious.

“Most bull markets are based on frauds” Shankar said. He warned that Bull markets are “engineered by central banks via manipulation of interest rates and exchange rates” and that they could collapse like a ton of bricks at short notice.

Zero Tolerance For Dissent:

Shankar has also sent the warning that he has zero tolerance for dissenting views. We saw on the earlier occasion of how Shankar had roughed up his followers by calling them “twitter jihadis” and “Gandi naali ka keeda”.

Shankar was at it again. When someone confronted him on his theory of bull markets being based on fraud, Shankar let loose a volley of abuse:

@dnshukla18 baahar aa gutter sey, cockroach. Tere liye to mere pair hi kaafi hain.

— Shankar Sharma (@1shankarsharma) July 14, 2016

@dhavalgandhi007 Teri 8::+:3:27:-::-::36-;;:-::+:+:;-::+::!!£!£:2637+;;=::+:-8;-:;+;-;:+:£;!-:-78-;-dafa ho, cockroach. Maza Aya

— Shankar Sharma (@1shankarsharma) July 14, 2016

When someone gently remained Shankar that it is not befitting his stature as a Guru to indulge in such gaali-galoch, he was unrepentant. Instead, he laughed it off and blamed his Dhanbad/ Punjab roots. “Isme maza aata hai” he added.

@1vipulsethi nahi bhai. Isme maza aata hai. After all, Dhanbad+Punjab roots hai?

— Shankar Sharma (@1shankarsharma) July 15, 2016

So, anyone planning to confront Shankar Sharma on his views should keep this in mind!