Aa gaya Shankar bhashan dene

“Aa gaya Shankar phir se bhashan dene,” Jigneshbhai snorted in disgust, making a face.

He struggled to speak with his mouth full of Gutka. A few drops of the Gutka juice dribbled down his chin.

“Shankar solid gyaan deta hai. Multibagger tips bhi,” Mukeshbhai retorted.

Shankar Sharma, like other luminaries, has his share of followers and detractors on Dalal Street.

Personally, I have a neutral stance.

I only listen to those interviews where my favourite interviewers are conducting the show.

Presently, Ayesha Faridi was grilling Shankar and I knew that it was only a matter of time before she would coax out a multibagger stock recommendation from him.

I was right because after meandering about Shankar’s childhood and days as a teenager in Dhanbad, Ayesha skillfully navigated her way to the most important aspect – stock recommendations.

“You do not go for largecaps, but if you had to buy one, what will it be?” she asked Shankar, in her usual professional style of interviewing.

(Ayesha Faridi with Shankar Sharma)

Maruti – beneficiary of hugely under-penetrated auto market

Shankar had obviously come prepared because he knows he is duty bound to offer novices at least one multibagger stock recommendation for 2019.

“Maruti,” Shankar replied, looking Ayesha straight in the eye.

“The auto market is hugely under-penetrated and there maybe about three crore cars and 10-12 crore two-wheeler for a 110-120 crore population. There is still a long, long way to go,” he said.

Shankar explained that it is inevitable that auto ownership in India will reach 10% of the population in 10 years and Maruti Suzuki will be a major beneficiary of this.

He further pointed out that Maruti has lost nearly 30% of its market capitalisation in the present crisis and that makes its valuation compelling as well.

“I have noticed is that in a bad bear market, good stocks without leverage typically fall between 30% and 40%. Maruti is down 30% from the top or so and it fits the bill,” he said.

(Shankar Sharma with the distinguished Devina Mehra)

Maruti Suzuki, 15-bagger in 10 years

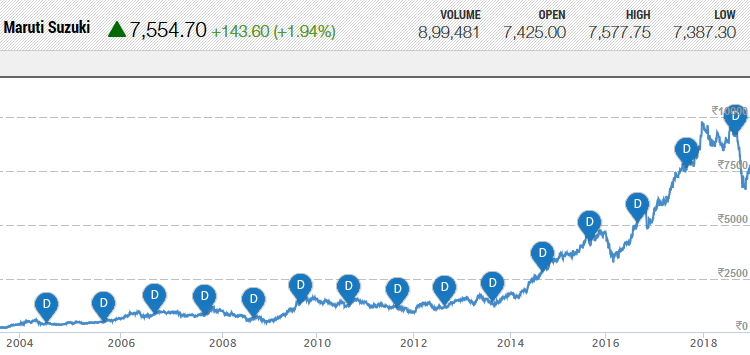

Prima facie, there is merit in Shankar’s hypothesis because Maruti has been a magnificent multibagger in the past.

Over the past 10 years, the stock has given a return of 1500%.

In the last 5 years, the stock has given 365% gain.

Over the past 24 months, the stock has returned 55%.

According to Shankar’s theory, only 3% of India’s population has four wheelers. If this number increases to 10% over the next 10 years, it is obvious that Maruti, owing to its dominant position in the marketplace, will sparkle and shower multibagger gains upon us.

In fact, Shankar had recommended Maruti in 2012 when it was available at the throwaway valuation of Rs. 900.

Shankar Sharma:India remains an under-penetrated auto market;Bullish on Tata Motors; Maruti attractive at Rs 900-950/share #Exclusive #ETNOW

— ET NOW (@ETNOWlive) January 17, 2012

(Maruti Suzuki’s multibagger journey)

What about small-cap & mid-cap auto ancillary stocks?

At this stage, we have to apply our minds and consider that if the ownership of two wheelers and four wheelers does surge over the next five to ten years, it is not only the OEMs but the ancillary companies which supply parts to them will also prosper.

In fact, leading experts have recommended two high-quality auto ancillary stocks with promises that they will deliver magnificent gains of 90% and 80% respectively.

JBM Auto – quoting at “tempting valuations”. Buy for 90% gain

HDFC Securities has recommended JBM Auto on the basis that it is quoting at “tempting valuations” and has the potential to deliver 90% gain.

The logic is as follows:

JBM Auto (JBMA) delivered decent numbers in 2Q amid challenging environment for PV segment. Consolidated Revenue (Standalone+JBMAS) rose 10% YoY to Rs. 4.5bn led by strong growth in tooling (+24%YoY) and bus division.

Despite slowdown in PV sales core sheet metal business grew by 3% YoY led by new business acquired from Tata Motors, M&M, Fiat and Toyota. EBITDA grew 8% YoY to Rs 547mn with margin at 12%(-30bps YoY). APAT came at Rs 209mn (+10% YoY)

We remain positive on JBMA, based on

1) Sustenance in Sheet metals business led by incremental wallet share from M&M, Ford, Tata Motors, VECV, RE and HMSI

2) Strong revenue potential in tooling business(high margin+30%), owing to increasing localization and outsourcing of tooling requirements by major global OEMs (cost-benefit of 25% in India)

3) Economies of scale coming in bus division, will foster margins and profitability going ahead. Moreover, the recent amalgamation of its subsidiary JBMAS and JV JBMMA (likely to be effective from next quarter) into a single entity will be synergetic and EPS accretive.

We cut EPS by 5% for FY19E factoring in 1H performance. Expect 27% EPS CAGR over FY18-21E; fuelled by improving operating leverage, richer product mix and acquisition of new clients At CMP stock available at 13/10x for FY19/20E EPS vs 5 Yr mean at 15x. We value stock at Rs. 560 (17x Sept-20E EPS) and maintain BUY.

Key highlights

❑ Sheet metal division: Delivered 3% YoY growth in 2Q in revenue and EBIT led by acquisition of new businesses for Mahindra Marrazo and Tata Nexon. Ramp up in CV segment also supported revenue growth led by higher revenue from Volvo-Eicher.

❑ Tooling division: Witnessed 78% jump in 1H to Rs 676mn backed by new launches and large orders secured in FY18. This segment enjoys 2.5-3x higher margins compared to sheet metal division.

❑ Bus division: The business, which was a drag (Rs 102/118 mn losses at EBIT level for FY17/18) on the JBMA’s financials, is gaining momentum with improving sales volume. The company sold 50 buses in 1H and to attain EBITDA breakeven, the company needs to sell 120 buses annually.

Jamna Auto – undisputed leader of suspensions. Buy for 80% gain

Stewart & Mackertich has recommended a buy of Jamna Auto on the logic that it has the potential to deliver gain of 80%.

The logic is as follows:

Jamna Auto Industries Limited (JAI) is the undisputed leader of the Indian automotive suspension space with a mammoth 72% share in the OEM segment. It is the India’s largest and world’s second largest manufacturer of tapered leaf springs & parabolic springs for Commercial Vehicles (CVs) in India with an annual production capacity of 240,000 MT and produces over 500 modes of springs for OEMs.

It has been a trusted and preferred supplier of Leaf and Parabolic Springs to all major CV manufacturers for over 50 years. The Company has 9 strategically located state-of-the art manufacturing facilities at Yamuna Nagar, Malanpur, Jamshedpur, Pune, Chennai, Pilliapakkam, Hosur, Pant Nagar and Lucknow.

It supplies to auto OEMs across the globe and boasts of a strong clientele consisting of Ashok Leyland, Tata Motors, General Motors, Kamaz Motors, SML ISUZU, Mahindra & Mahindra, Volvo and others.

Key Highlights

-Consolidated revenue for Q2FY19 reported at INR548.4 crore, up 42.4% YoY owing to the strong volume growth in the CV segment. It has managed to beat our estimate of INR521 crore.

Despite having a strong market share, rising raw material prices have dented its gross margin by 144 bps YoY to 36%.

-Absolute EBITDA for the quarter under review stood at INR68 crore, up ~35% YoY, which is marginally lower than our estimate of INR70 crore. Despite optimization in employee benefit expense and other expenses, EBITDA margin dipped 66bps YoY to 12.4%.

-Co. reported a PAT of INR35.5 crore, up ~21% YoY, which is marginally lower than our estimate of INR37 crore. However, PAT margin dropped by 117bps YoY to 6.5% due to higher higher financing cost and effective tax rate.

-The Board of Directors has declared an Interim dividend of INR0.50 per equity share of INR1 each amounting to ~INR20 crore on the paid-up equity capital.

Conclusion

Now the onus is on us to choose between either one or all of the three stocks listed above and prepare for the gains to gush into our portfolios!

Time to start worrying about Maruti

Aisa kya ?

Can’t agree with his logic for Maruthi..

He says 3 crores cars already there for 120 cr Indians.. India is not like USA where each family member has one car…. here things work like per family one car( except super rich)….so maximum requirment will be around 30 cr cares which it self 10% penetration…. come the days of Ola , Uber and shared mobility , parking issues …..you can’t expect everyone going to get car… its long long way to go…first 600 Millions Indians should come out of poverty…

And, lat but not least competition see the cars of TAMO.. and Hyndai and its Subsidiary Kiyo…. They are constructing huge plant in Anantapuram in Andhra Pradesh which is going to come start production from 2020 onwards…. and don’t forget about EV… with all these things under penetration 120 cr Indians going to have cars is most stupid explanation…

Now biggest dampner to maruti is 10 year life of diesel car and 15 year life of petrol cars.Earlier people were buying more than one car ,but as now cost of running a car has gone up substainaly and resale prices has gone down,family will avoid more than one car.I had personally 5 cars in my family of 5 ,now reduced it to two ,and take taxi for extra requirement..So people will now avoid buying a extra car if there is lower use…You may see Maruti sliding more in December itself.

In my view this gentleman is now badly trapped in small caps like porinju, this is no time to invest in small caps and still if one want to invest in these ,go through small cap mutual funds.For next one month Maruti may go more downwards than upwards as its growth has slow down which did not justice its very higj valuations and you may get better price although I am invested in Maruti.I am not an expert ,so my views are for discussion only.

Nice information. Focus on what we want to know that