Manish Chokhani of ENAM has opined that the market crash has created exciting opportunities...

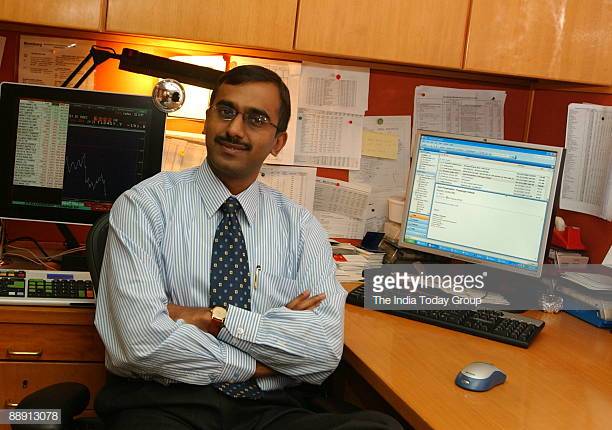

Enam

Billionaires Radhakishan Damani and Rakesh Jhunjhunwala, who share a Guru-Shishya relationship, are thinking alike...

Saurabh Mukherjea has homed in on a stock which has all the virtues of...

Sridhar Sivaram of Enam Holdings has described the present crisis in the stock markets...

A phalanx of ten top stock pickers has recommended ten top-quality stocks for us...

Porinju Veliyath has added a new high-quality stock to his portfolio. He has also...

Basant Maheshwari’s PMS Fund has put up a stellar show in February 2019 and...

The PMS Funds of Porinju Veliyath & Basant Maheshwari are hapless victims in the...

Bharat Shah of ASK Group has offered the soothing assurance that the economy is...

A consortium of ace investors has bought a massive chunk of a high-quality micro-cap...