Great minds think alike

It is well-known in Dalal Street that Radhakishan Damani uses aliases to buy stocks.

Some of his favourite aliases are ‘Derive Investments’, ‘Bright Star Investments’ and ‘Gopikishan Damani’.

Presumably, the reclusive Billionaire uses these aliases so as to fly under the radar and avoid alerting nosy-parkers.

Also, it is common for Radhakishan Damani to buy stocks which have been screened and approved by Rakesh Jhunjhunwala and other luminaries.

One example of this is Delta Corp, which is the favourite small-cap stock of Rakesh Jhunjhunwala and veteran value investor Kalpraj Dharmshi.

A few days ago, the Billionaire scooped up a big chunk of Delta Corp.

Yet another example is that of Camlin Fine Sciences, which according to leading experts has potential to give 130% gain. Radhakishan Damani bought a truckload of the stock without a moment’s hesitation.

Man Infraconstruction – latest stock pick

Radhakishan’s latest stock pick is a micro-cap stock named ‘Man Infraconstruction Ltd‘.

As of 31st March 2019, his alias Gopikishan S Damani, held 21,73,083 shares, comprising 0.87% of the equity.

As of 31st December 2019, the holding has swelled to 33,03,029 shares, comprising 1.33% of the equity capital.

Rakesh Jhunjhunwala, the Badshah of Dalal Street, is a long-standing shareholder of Man Infra.

He bought a consignment of 30 lakh shares (1.21%) in January 2015 and has held on tight since then.

Vallabh Bhansali, the veteran merchant banker and founder of ENAM, holds a big chunk of 60 lakh shares in his own name and the names of Suraj Bhansali and Saral Bhansali.

MAN INFRA +8%

Dec Shareholding

Gopikishan S Damani (RKD relative) in shareholding 1.33% stake.Name wasn't there in Sept. So may be new holding, or increase in stake above 1% in the last qtr.

— Mangalam Maloo (@blitzkreigm) January 14, 2020

| MAN INFRACONSTRUCTION LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 751 | |

| EPS – TTM | (Rs) | [*S] | 2.49 |

| P/E RATIO | (X) | [*S] | 12.19 |

| FACE VALUE | (Rs) | 2 | |

| LATEST DIVIDEND | (%) | 63.00 | |

| LATEST DIVIDEND DATE | 12 SEP 2018 | ||

| DIVIDEND YIELD | (%) | 4.15 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 33.73 |

| P/B RATIO | (Rs) | [*S] | 0.90 |

[*C] Consolidated [*S] Standalone

| MAN INFRACONSTRUCTION LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | SEP 2019 | SEP 2018 | % CHG |

| NET SALES | 43.36 | 58.36 | -25.7 |

| OTHER INCOME | 7.45 | 7.9 | -5.7 |

| TOTAL INCOME | 50.81 | 66.27 | -23.33 |

| TOTAL EXPENSES | 41.66 | 28.71 | 45.11 |

| OPERATING PROFIT | 9.15 | 37.55 | -75.63 |

| NET PROFIT | -0.83 | 12.84 | -106.46 |

| EQUITY CAPITAL | 49.5 | 49.5 | – |

(Source: Business Standard)

What is so alluring about Man Infra?

Man Infra, like other realty and infra companies, has been a hapless victim of the slowdown in the economy and the Bear market.

The stock price has been sluggish for a long time.

Therefore, the question arises as to what is so alluring about Man Infra that it has attracted eminent investors like Radhakishan Damani, Rakesh Jhunjhunwala and Vallabh Bhansali.

The answer is that the Rs. 102 lakh crore infra projects identified by the Govt is likely to galvanize the prospects of the Company.

CNBC-TV18 newsbreak confirmed, FM Nirmala Sitharaman says the #TaskForce on infra investment has come up with recommendation for investing in Rs 102 lk cr worth of projects. In only 4 months, they held 70 stakeholder consultations. @ShereenBhan pic.twitter.com/BlErz9S0eW

— CNBC-TV18 (@CNBCTV18Live) December 31, 2019

Also, the latest investors’ presentation reveals the latent strengths of the Company.

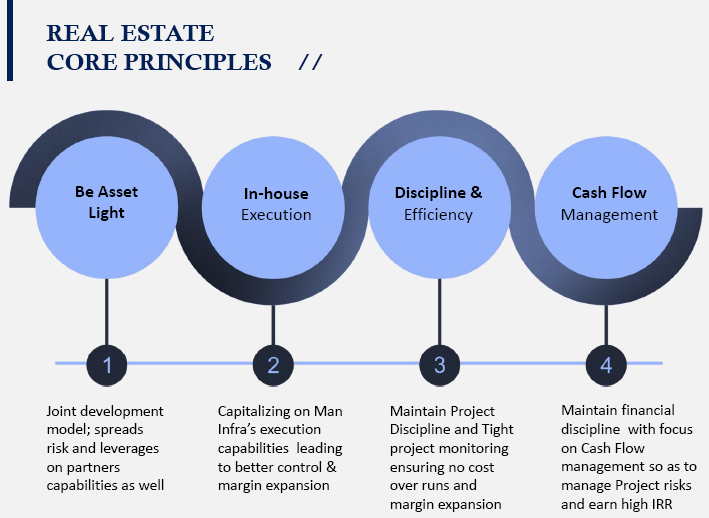

The company has adopted a “joint development model” which spreads risk and leverages on partners’ capabilities.

It also maintains Project Discipline and tight project monitoring to ensure that there are no cost over runs and margin expansion.

The company is also focused on ‘cash flow management’.

It ensures financial discipline with focus on Cash Flow management so as to manage Project risks and earn high IRR.

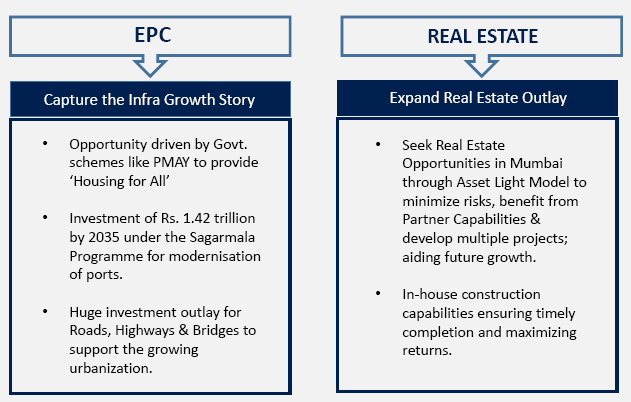

Yet another unique aspect about Man Infra is that it stands to profit from ‘EPC’ contracts apart from the traditional real estate projects.

The EPC sector is a gold-mine of opportunities driven by mega schemes of the Govt like ‘PMAY’, ‘Sagarmala’ etc.

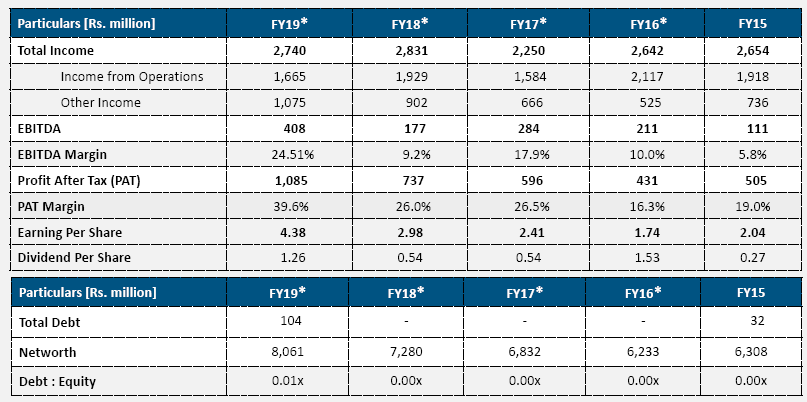

It is also notable that the financials of Man Infra are in ship-shape condition with literally a debt-free status.

As of FY 2019, the debt:equity ratio is a negligible 0.01x.

Stock has surged 45% in the last three months

Over the past three months, Man Infra has been surging like a rocket, posting massive gains of nearly 45%.

Obviously, if the realty sector comes back in demand, the aspirations of the trio of Radhakishan Damani, Rakesh Jhunjhunwala and Vallabh Bhansali of harvesting multibagger gains from the stock may be realized!

Leave a Reply