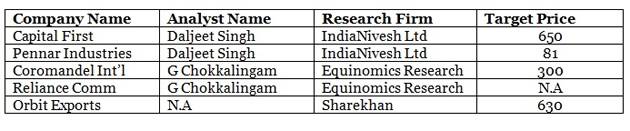

Kshitij Anand of ET has spoken to leading stock market experts such as Girish Pai of Nirmal Bang, Gurang Shah of Geojit, Daljeet Singh Kohli of IndiaNivesh, G Chokkalingam of Equinomics, Sharekhan etc and collated their ideas of five wealth-creating stocks with tremendous value:

(Image credit: ET)

Capital First: Target price Rs 650:

Capital First is a good idea to look at now. Though we have been recommending it for a very long time, now it is in the next phase of growth and numbers should also be very good, so we should expect some more appreciation.

Our near-term target right now is Rs 460 after the result, and I am sure it will be revised upwards. One should look at a target of Rs 650 or so in one to one-and-a-half years.

Pennar Industries Ltd: Target price Rs 81

Pennar Industries has a subsidiary called PEBS which has been seeking SEBI approval for an IPO. So, there is going to be a value unlocking for that.

To our understanding, the value unlocking will be almost equal to what is current market cap of the company is. So, there is a big potential in Pennar Industries also. In any case, we have a target for Pennar Industries at Rs 81 as of now.

Coromandel International Ltd: Target price Rs 300:

It is my top pick because it is a highly beaten-down stock. It is down by about 25 per cent from the recent peak. Coromandel International is a most efficient phosphoric fertiliser company. The capacity utilisation is just around 70 per cent. Hence, there is a lot of scope for improving the output even in non-subsidiary business like pesticide and insecticide.

The company has got access to phosphoric acid – a core raw material – from Africa. It has got two joint ventures. It is supposed to supply its produce at reasonable prices.

There has been a 6 per cent rainfall deficit at an all-India level so far this year, but the states to which this company caters have got reasonably good rainfall. Therefore, I firmly believe this stock can easily provide a target price of Rs 300 in a span of 6-12 months.

Reliance Communications Ltd:

I have picked up Reliance communications, which is also a beaten-down stock. Last year, the QIP was done at Rs 150; now it is down more than 50 per cent from that level.

Not only is the stock cheap, I also firmly believe that the group would monetise assets like tower, real estate, the global fibre optic business, etc. The value potential from these assets is slightly more than the total debt it has at a consolidated level. Even if 50 per cent of these assets are monetised, the earning per share can jump beyond Rs 10.

Secondly, this particular group is coming close to China and Russia in terms of business alliances. Recently, we saw its defence business also getting into alliance with Russian ventures.

Now, this group has proposed to take over Shyam Telecom in which Russian telecom giant Sistema has got stakes. In case they take over Shyam Telecom, it will be an opportunity for the company to forge stronger relationship with the Russian telecom giant.

Considering all these facts, I firmly believe that RCom can be a wealth-creating idea for the next 1-2 years.

Orbit Exports Ltd: Target price Rs 630:

Orbit is a leading manufacturer and exporter of novelty fabrics exporting its products to over 32 countries. The company is a recognised star export house and operates in the niche area of high-end fancy fabrics, which are mainly used by designers in women’s fashion apparels.

The brokerage firm expects its topline and bottomline to grow at a CAGR of 19.6 per cent and 22.8 per cent respectively over FY2015-18. Given the robust earnings potential and enviable return ratios, Orbit is expected to trade at higher multiples.

Thus, they expect the stock to get re-rated (in line with its peers like Kitex Garments). We initiate coverage on Orbit with a Buy rating and value the company at 22x its FY2017E earnings to arrive at a price target of Rs630.

Views regarding stocks are good.