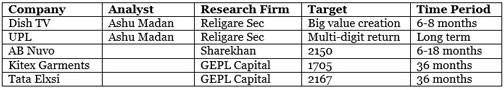

Kshitij Anand of ET has spoken to top-notch experts like Porinju Veliyath, Geoffrey Dennis, Harendra Kumar, Ashu Madan and Sharekhan and identified their best stock ideas:

Dish TV:

We have been recommending it for some time, but as far as wealth creation idea is concerned, for long term if somebody holds Dish TV, it could turn out to be a multi bagger story, because they are the dominant player in DTH market.

The way DTH market is growing, they are dominant player in this market. With the price hike imitative, increase in the market share of HD portfolio and the next level of digitalisation, this can go into a different level all together.

In the last few months the stock has been consolidating around Rs 80 and it has taken a big leap closer to 120. Now, it is again consolidating at 100 plus levels. One should get into the stock, do not see the market on daily basis and hold it for six to nine months and it can really create value for you.

UPL:

Worldwide agrochemical, very stable player, good synergy. The kind of strength what we have seen in the past shows that the stock is a clear outperformer. Investors should not think that they have missed the rally, despite 50 per cent up move in the last few months or a year, this is still one of the best placed companies as far as global footprint is concerned.

So one should not have any doubts and probably at this level also, this is one of the best stock. If somebody has to be in the market, one has to try and build a portfolio, not everybody can trade, so UPL is another stock which one should not trade and hold it for a medium to long term for multi-digit return.

Aditya Birla Nuvo: Target price Rs 2,150 (6-18 months)

Aditya Birla Nuvo (ABN), a conglomerate holding company, is present in different businesses ranging from lifestyle, telecom, fertilisers to financials, with each having either leadership or a strong competitive position in its market.

Sharekhan is of the view that owing to the holding company structure and composition, the underlying businesses are trading at a discount to their fair value. Over the last few years the company has made efforts to consolidate its position in each of the business verticals and gained market share in the respective businesses.

The brokerage firm sees scope for further re-rating of the stock as each of its businesses gets valued optimally, does not suffer holding structure and has a diversified business profile (no holding discount).

They, therefore, retain their positive stance on the stock and maintain our Buy rating with a revised price target of Rs2,150 (arrived at using the sum-of-the-parts approach, valuing each business vertical and adjusting the stand-alone debt).

Kitex Garments Ltd.: Target price Rs 1,705 (in next 3 years)

Kitex Garments Ltd. (KGL) is a Kochi based company which manufactures and exports infant garments. KGL is now eyeing for next phase of growth by acquiring licenses of few private labels in US and also through launching of its own brand in US.

Company is already negotiating with few private labels for acquiring its licenses and expects to finalise couple of private labels by this fiscal year. The sales from licenses of these private labels will start from FY16E onwards.

KGL has outlined minimal capital expenditures of Rs 100 mn to Rs 150 mn a year for next three years, as major capital expenditure of Rs 750 mn was undertaken in FY14 to replace the old machines with the new ones.

These will help in improving productivity and reducing wastage. KGL is trading at 16.1x its FY18E EPS of Rs 56.8 which is at an attractive valuation. With 25% sales and 40% PAT CAGR (FY15- FY18E), debt free status by FY18E, strong margin improvement, GEPL Capital expect stock to trade at 30x (0.75x PEG) its FY18E EPS of Rs. 56.8.

Tata Elxsi Ltd: Target price Rs 2,167 for next 3 years

Tata Elxsi is a design company that blends technology, creativity and engineering to help customers transform ideas into world class products and solutions. Tata Elxsi is a debt free company with return on equity more than 35% in FY15. With Sales expected to grow at 28% CAGR in next three years with strong margin improvements we expect return on equity to increase to 45% plus by FY18E.

Embedded product design which alone contributes 79% of the total cons revenues of FY15. It is growing at 19% CAGR in last three years from Rs 4.73 bn to Rs 6.73 bn. GEPL Capital expects this segment to grow at an 28% CAGR in next three years to Rs 14.2 bn seeing massive growth opportunity in the automotive and broadcast sub segments.

Tata Elxsi is trading at 12.9x its FY18E EPS of Rs 86.7. Given the niche business model, debt free status with strong growth drivers in next three years, we expect Sales to grow at 28% CAGR and PAT at 38% CAGR (FY15-FY18E) thereby commanding a premium PE multiple of 25x (0.7x PEG ) its FY18E EPS which gives a target price of 2,167 in the next three years.

Please guide me on ahmedmagar forging new name matalyst forging 513335 buy @317 quantity 110

heavy and unsustainable debt. avoid

Yes. Better to sell. There is a detailed article by Dr. Vijay Malik on the company.

http://www.drvijaymalik.com/2015/03/ahmednagar-forgings-limited.html

Hope it helps

Thanks

Please guide me on Hubtown. I had bought @ 142. Now it is trading at 85.

Sir

I have 1000 welspun India @ 137

Hold or sale . I am long term invester

What is your advice Sir.