Opportunity to pocket 165% gain from Dredging Corp squandered away

“Dredging Corporation is like monopoly today but when these kind of large opportunities emerge there could be many other companies also jumping into the bandwagon. Still, the leader with expertise and execution capabilities, actually even Dredging Corporation could be well placed,” Porinju said in his usual earnest style.

However, no one was interested in his stock recommendation.

Personally, I was not at all impressed.

“Who wants to mess around with a stupid PSU dredging the rivers,” I asked with a smirk on my face, thoroughly exposing my naivety.

Porinju was not dissuaded by the blank stares and smirks that his recommendation received.

“This is a sector which was ignored in the last 60 years in this country because the geographical position of this country with something like 7,000 km of shore, it is amazing. The transportation in this country feeding our 1.3 billion people, we would have done it decades ago. At least I am so glad, it is happening now. The recent past, there are very decisive moments in this regard to us our hundreds of rivers. Now, government has announced about 111 rivers converting into national waterways. It is a very important step,” he continued.

“Today, the cost of transportation, Nitin Gadkari was once showing it where per unit transportation cost of cargo by road comes to something like Rs 1.5 per unit, kilogram, whatever it is. And, by railway, it is Rs 1, whereas by water it is only Rs 0.25. So, it is a very important thing on a macro level. I think it is in the right way and there is something like Rs 70,000 crore kind of funding is arranged for the first phase of this development. Around Rs 50,000 km of waterways out of which Rs 35,000 km is inland waterways converting more than 100 rivers and something like 14,500 km of coastal waterways,” he added.

Porinju also made a desperate attempt to interest us by hinting in clear terms that Dredging Corp could blossom into a magnificent 5-bagger or even a 10-bagger.

“Dredging Corporation is priced at around Rs 900 crore today. It is a government company and it is a healthy balance sheet, some Rs 700 crore kind of debt and it is a very good company. It can grow fivefold or tenfold in the next 2-3 years time. That is the kind of potential is there”.

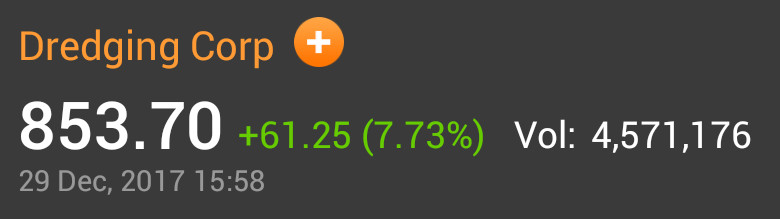

Needless to say, ignoring Porinju’s recommendation to buy Dredging Corp was an act of sheer buffoonery on our part because the stock is up a magnificent 165% since then.

In fact, the YoY gain is itself 120%.

Dredging doubled in 1yr; there are 50 such 'themes' to multiply your wealth in World's most diversified Economy!https://t.co/EO5RejJ3tX

— Porinju Veliyath (@porinju) April 23, 2017

Vijay Kedia buys Dredging Corp

Yesterday, Vijay Kedia stormed the counter of Dredging Corp and scooped up a massive chunk of 1,75,000 shares at Rs. 790.92.

His aggressive action sent shockwaves across the counter and sent the stock price surging up 17%.

Vijay Kedia: Dredging Corp: Kedia Securities bought 0.6% of equity stake i.e 1.75 lakh share. The stock closed ~17% higher in yesterday’s trade. #StocksToWatch #nifty #Market

— jayesh bhanushali (@jbhanushali9) December 29, 2017

Privatisation of Dredging Corp will lead to re-rating

On 1st November 2017, the Government formally decided to sell its 73.47% in Dredging Corp. The sale is expected to yield about Rs. 1500 crore.

According to experts, the privatisation of Dredging Corp will further enhance its competitive skills.

The Company is already a force to reckon with when it comes to bidding for the maintenance contracts awarded by Ports and is able to successfully outbid major global players like Mercator, Van Oord etc.

ICICI has pointed out that the privatisation talk has generated interest amongst investors though there is some reservation owing to the opposition by the unions.

If the privatisation does take place successfully and a major global player takes charge of the reins of the Company, it could take off in an upward trajectory.

Inland waterways will be game changer?

The Government has an ambitious plan to create an “inland waterways”.

Under the National Waterways Act, 2016, 111 inland waterways have been declared as National Waterways (NWs)in addition to the five existing NWs, across 24 States for utilizing them as an environment friendly and sustainable mode of transport.

??? Certainly a historic day for Inland Waterways today. Minister Gadkari & CM Assam flag off the maiden trip of 2 barges on National Waterway NW2 on the Brahmaputra river. Each 200 MT capacity barge will carry cement for 255 kms from Pandu to Dhubri.

— Vinayak Chatterjee (@Infra_VinayakCh) December 29, 2017

Bharatmala project will also provide impetus to Dredging Corp

The Bharatmala project envisages spending of incalculable sums of money for optimizing the efficiency of road traffic movement across the country by bridging critical infrastructure gaps.

It is described as “India’s biggest highway development plan”.

One of the components of expenditure in Phase I is the development of 2000 km of coastal and port connectivity roads at an expenditure of Rs. 20,000 crore.

It is obvious that a growth in the ports sector will automatically spell opportunities and prosperity for Dredging Corp.

?? 83,000 km Bharatmala program requires Rs 8 lac crs over 5 years = Rs 2 lac crs/annum. MoRTH expects Rs 78,000 crs frm Budget & plans to raise Rs 60,000 crs thru Bonds. That leaves 62,000 from all other sources – PPP/bi-multilateral etc.Should be enough to get going in Yr 1

— Vinayak Chatterjee (@Infra_VinayakCh) December 25, 2017

Second stock pick on the “trillion dollar opportunity” infra theme

In an earlier piece, I pointed out that Vijay Kedia had realized that his portfolio was incomplete because it did not have any infra stock in it.

“How can a visionary like Vijay Kedia not have an infra stock in his portfolio when the entire sector is expected to give 10x multibagger gains?” I had rightly wondered.

To make good the stark deficiency, Vijay Kedia loaded his portfolio with a big chunk of Everest Industries.

Incidentally, Everest Industries was also earlier recommended by Porinju Veliyath as part of his assurance that there is a “trillion dollar opportunity” in the infra sector.

Vijay Kedia later recommended as a “Diwali Gift” that we also buy Everest Industries. He also gave a masterful presentation on why Everest Industries is a great buy.

Not content with that, Vijay Kedia has also recommended Everest Industries as his “best stock pick for 2018”.

Dredging Corp is the second pick on the infra theme.

Conclusion

It is obvious that Vijay Kedia is also a strong believer in the proposition that the infra sector is indeed a “trillion dollar opportunity” and that it will generate several megabaggers. We have to take a cue from this and also load up on high-quality infra stocks when they are still available at reasonable valuations!