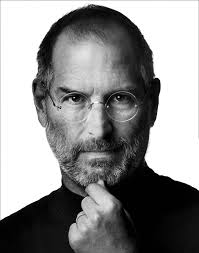

Steve Jobs, the great visionary who single-handed turned Apple into a powerhouse conglomerate with a market cap of Rs. 41 lakh crore, was a great believer in the theory that to be wildly successful, technology has to be “disruptive”.

The products that Apple made disrupted multiple industries such as Personal Computing (Apple II), Desktop Publishing (Macintosh), Music Management (iTunes), Portable Music (iPod), Mobile Phone (iPhone), Portable Computer (iPad), Retail (Apple Store) etc.

This business model of “disruption” enabled Apple to stay ahead of its competitors and create a deep and impenetrable “moat” for itself.

Vijay Kedia, our own visionary stock picker, appears to have been inspired by Steve Jobs. He tweeted a few days ago about the need for stock pickers to find “disruptive” theme stocks:

Next Big thing and theme is "Disruption". Anything which can be disrupted will be disrupted.

Let's find such story.

— Vijay Kedia (@VijayKedia1) December 8, 2015

Later, Vijay Kedia revealed that the big disruption stock that he has in mind is none other than Repro India, his all-time favourite stock.

@Mayank50feather yes. Rapples also but mainly one book factory is very big disruption from Repro.

— Vijay Kedia (@VijayKedia1) December 10, 2015

A slight investigation reveals that Vijay Kedia is, as usual, right in his analysis.

The presentation prepared by Repro for analysts points out that there will be a “revolution in the Indian publishing industry” and a “technology disruption”. It lays bare Repro’s ambitions to take advantage of the situation.

One can do no better than to quote from the presentation:

“The Revolution in the Indian Publishing Industry :

Repro – Ideally positioned to take advantage of the technology disruption in the publishing industry in India

– 12,000 crores; 16,000 Publishers; 4 million titles (estimated)

– Sales through Direct sales or channels

– Technology Disruption in the Publishing Industry

– Strong E-commerce channels accounting for majority of retail sales

– One-Book Production Technology in place to service demand immediately

– Acceptance of Digital Books in Education – thrust for lighter bags in schools

– Leveraging 2 decade old relationship with publishers to aggregate content

– Repro – Replicating Proven Global Production & Distribution model for physical and digital content in India

– Set up the One Book Factory to service immediate demand from e-retail channels

– Successfully Implemented Digital education in schools for all grades, all subjects, all curriculums”

The earnings conference call pursuant to the Q2FY16 results also gives several details of the business model of the Company. One point that was emphasized in the discussion is that the “opportunity size for e-Tail and Rapples is huge” because the volume of business in the Country from sale of business is nearly Rs. 3,000 to 4,000 crore. It was also pointed out that the Company has now reached a critical mass and that it can scale up very fast. It was also stated that because the Company is an aggregator of publications using technology, it is unaffected by competition.

Pramod Khera, Repro’s top-brass, also came on record to explain that the tie-up with Lightening Source means that the company will transition from a B2B business model to a B2C business model, which will result in an enhancement of its margins. Pramod Khera called this a “big transformation”.

At this stage, we must note that Vijay Kedia has put his money where his mouth is. His conviction in Repro is reflected by the huge investment that he has made in the Company.

As of 30.09.2015, Vijay Kedia held 5,57,209 shares constituting 5.11% of the equity. Not content with this, Vijay Kedia bought a further lot of 96,725 shares on 10.12.2015 at Rs. 425 per share. His total holding presently stands at 653,934 shares, worth Rs. 28.44 crore at the CMP of Rs. 435. Repro is possibly Vijay Kedia’s ‘highest conviction’ stock today.

Now what we have to see is whether Repro walks on the same illustrious path as Apple and whether Vijay Kedia proves to be as much of a visionary as the legendary Steve Jobs!

At CMP of Rs. 430, PE is 86. Is it sustainable – last 6 months have been extremely bad for the company. Is it still a good buy at 430 or there is some thing else which is not been seen as per the above commentary. “Disruptive” or “no disruptive”. You can’t pay through your nose for even the best company of the world.

The estimated market size will be 8000cr in 2020. Repro will have a monopoly on this. It costs them a small incremental cost of 4-6cr for major capacity expansion. Margins in this business are conservatively around 15%. This is a one of a kind company. Assuming Repro reach 1500 to 2000cr in next three years. Company bottom line should be around 200-350cr per annum. As you know only earnings growth governs a price of a stock in the long run. PE will revert to mean in the long run. Even taking a conservative PE mkt. cap could be anywhere between 4,000-10,000cr in 3 years. This is comfortable 7x from here on. You are buying a gem. Go big on Repro and remember this comment (as well as Vijay kedia haha)

MPS looks better on almost all the parameters .

Manugraph is much cheaper with less then 8 PE high Dividend Yield and BV

Its the oldest stock in the lot

I agree MPS is better placed to take advantage of technology evolution

U guys are made late entry. I entered already at 240 last year for me it is multi bagger.

Follow always leader then only you can get bottom picking. Once race started then only Ace investor will come join in the party.

http://fundamentalsharemarket.blogspot.ae/2014/10/repro-india-ltd-cmp-24605-buy-in-range.html

http://fundamentalsharemarket.blogspot.ae/2015/12/repro-india-ltd-update-from-246-to-609.html

Sir, if you entered at 240 how can it be a multi bagger? It is not even a single bagger for you. Sorry to break your glass dreams.

Jjanwar Ji after i recommended it is tested from 240 to 609 means 154%. One and half bag done. Multiple entry with same stock will generate multi bagger returns. Proper exit in right time and bottom picking will generate huge returns.