Edelweiss Securities has identified key sectors that are set to benefit from the long-term growth story and has recommended 5 stocks that investors can buy and forget for the next 10 years.

Coal India

Coal India (COAIND) is the world`s largest coal reserve holder and producer and also controls 80% of the Indian coal market. It is going to be the primary beneficiary of the structural deficit of coal in India. Moreover, it is one of the least cost producers of coal in the world.

Coal India, a Maharatna company, is one of the largest public sector companies in India in terms of turnover. Its product portfolio consists largely of thermal coal (90%) with the balance being coking coal. Coal India enjoys a near-monopoly position in the lucrative coal market and is more of a utility player due to assured volume off-take and minimal chance of a product price cut, as prices already remain at 50% discount to internal benchmark prices.

Coal India currently operates 471 mines in India and is also scouting for international mines to increase global presence and assure its resources. It sells 10% of its production based on the e-auction route and 3.5% beneficiated coal (2x realizations of raw coal). Beneficiated coal volumes are expected to rise significantly to 150 mtpa by FY17 (25% of total volumes).

Coal India produced 43.13 crore tons in FY10 and their reserve position (extractable reserves) stands at 2,175 crores tons as of April, 2010. This translates into 51 years of production capacity going by current production rates. Going by the reserve position, we believe that CIL is a great opportunity to own a critical resource. On the demand side, India being a power deficit country, there is significant power capacity being added with fuel resource being coal. Currently most private companies building power capacities have been signing up long term Fuel Supply Agreements (FSAs) with foreign players due to shortage of coal domestically. We believe there is enough demand for coal and further scale up of production by CIL would find more than enough takers.

The big trigger for Coal India comes due to the pricing differential between raw coal that CIL sells and washed coal that is imported from mines abroad. The average realization for CIL is 50% lower than import parity price of coal. The margin for CIL per ton is currently close to Rs 400/ton. The management of CIL has indicated that it is putting in place a system for producing more of washed coal to match the quality of imported coal. This would require capex of `350/ton but would improve realization and margins manifold. By FY17, COAIND would have a 25% share of washed coal.

At the CMP of Rs 386, the Coal India stock trades at a PE of 13.66x FY12E earnings and 12.64x FY13 earnings. We believe that Coal India Ltd is an excellent investment and would prove to be a multi-bagger in the long term.

Axis Bank

We believe that the current stage of economic growth in India, where savings and capital formation are at 34% of GDP, offers serious opportunities in financial intermediation. Core to our hypothesis is our belief that, over the next ten years nominal GDP (excluding agriculture) is expected to grow at 13%, and revenues from the financial services sector (which would lead this growth) are expected to grow at 22% to Rs 266.4 trillion by FY20E .

Axis Bank is the third-largest private sector bank in India in terms of asset size, with a balance sheet of Rs 1.5 trillion. It has a network of over 1000 branches and extension counters across the country. The bank earns substantial fee income from transaction and merchant banking activities.

Axis Bank has registered buoyant loan growth on a balanced portfolio skewed towards corporate advances than retail (as compared with its private peers). Retail advances contributed 20% to the total loan portfolio. Thus, it has better scope for aggressively expanding across segments where it has a low presence. It is also spreading across geographies and targeting presence in more than 75% of India`s districts inthe next five years. The bank`s loan book is expected to grow at a brisk pace of 25% plus in FY09-11E with SME, agri, housing, and personal loan segments likely to be the key growth engines.

Rapidly growing franchise and new product offerings (viz., credit cards) will further drive growth in retail fee income. The bank is also intensifying efforts to penetrate the remittance business by aggressively spreading its international operations. Other key contributors to fee income will be project advisory, debt syndication, and third party distribution of insurance.

Led by stable to improving margin coupled with benign asset quality we expect Axis Bank to deliver a healthy 25% earnings CAGR over FY11-13E. The bank’s strategy of moderating pace of loan growth will enable it to build a more formidable retail franchise and achieve consistently higher RoA. We believe, it can sustain higher RoA of 1.5-1.6% against 1.0-1.2% a few years ago, allowing RoE to move closer to 20% in a capital efficient manner. As Axis Bank delivers consistent earnings we expect the current valuation discount of 40% with HDFC Bank to come off to 25%.

Pantaloon Retail

Pantaloon Retail is a leading Indian retail company with presence across most sectors of organized retail. The company, entered modern retail in 1997 with the opening of its department store format Pantaloons. In 2001, PRIL launched Big Bazaar, a hypermarket chain, followed by Food Bazaar, a supermarket chain. A five format company, two years back, it now operates over 20 formats which include Central (seamless malls located in city centers), Collection I (home improvement products), Depot (books, music, gifts and stationeries), aLL (fashion apparel for plus-size individuals), Shoe Factory (footwear), and Blue Sky (fashion accessories). It has recently launched its e-tailing venture, futurebazaar.com.

The Indian retail landscape is evolving with interplay of several demographic and economic factors. The long term prospects backed by changing consumer behavior in favor of larger discretionary spend has set the stage for a healthy growth in the retail space over the next few years. The big opportunity lies in the growing share of organized retail with the growing trend among consumers to allocate a larger share of income to consumption and gradual improvement in lifestyle.

Media reports suggest that the Cabinet could clear the proposal to allow FDI in multi-brand retail in the near term, setting the stage for the entry of large chains by the FY12 end. Nod to the proposal seems likely post the backing of the Prime Minister Manmohan Singh and Finance Minister Pranab Mukherjee. By opening the retail sector for FDI, organized retail penetration can swell significantly, benefitting retail firms.We believe this will be a positive for Indian retail sector especially for larger players like Pantaloon Retail.

At the CMP of Rs 311, the stock trades at a PE of 32.6 FY12E and 24.0x FY13E earnings, (represented by the core retail business). We rate Pantaloon as a `Buy` for the long term.

Mahindra & Mahindra

Mahindra & Mahindra (M&M) operates in nine segments-automotive, farm equipment, financial services, infrastructure, hospitality, IT services, Systech, which consists of automotive components and other related products and services, and others, which consists of logistics, after-market, two wheelers and investment.

Mahindra & Mahindra dominates the domestic tractors market, commanding 41% market share. Three key structural factors-higher farm product prices, firmer labour wages (notably NREGA), and greater commercial usage of tractors-have significantly increased rural incomes and brought smaller farmers (owning <4 hectares of land) into the ``tractor purchasing`` ambit. These factors are likely to drive long-term tractor demand, which Mahindra & Mahindra (M&M) is well-positioned to capitalize on. M&M is the leader in the UV segment and has managed to keep its market share above 55% currently. M&M, as the leader in the utility vehicle (UV) segment, is well entrenched with strong brands. Further, incremental volumes could come from the LCV/ minivan segment, where we expect the company to regain lost market share with the launch of its sub tonne Maxximo and Gio. We believe, Ssangyong Motors acquisition is a strategic fit with M&M`s ambitions of being a global SUV player. Ssangyong`s current financial performance seems to suggest a turnaround. Apart from the M&HCV space (JV with Navistar), other new businesses (two wheelers, defense or logistics) require minimal investments. The returns over a three year period though could be substantial, particularly considering M&M`s impressive track record in unlocking value of subsidiaries. M&M is in a sweet spot as demand for tractors and utility vehicles are benefitting from rising rural incomes and government???s increased rural thrust. At the same time, with a dominant market share and low competition in the segment, the company enjoys pricing power. ITC

Favourable macroeconomic drivers such as GDP and population growth, coupled with rising income levels and lifestyle changes to drive the FMCG market growth in India. Low penetration and low per capita daily consumption offers room for further growth. Increasing rural penetration to urban penetration levels presents another growth opportunity; multiple usage of products offer further upside. IMF expects the Indian economy to be USD 2.0 trillion by FY15. Assuming FMCG spend/GDP trend to continue, we expect the FMCG market to cross the Rs 2 trillion mark by 2015, from Rs 1 trillion currently

ITC is one of the largest FMCG companies in India with businesses spanning cigarettes, hotels, paper and packaging, and agri-commodities. Recently, it has set up a branded foods division with products such as staples, confectionery, and biscuits. Though the cigarettes division is still the major source of revenue, other businesses have grown over the years, contributing 49% to net sales and 34% to gross sales in FY10.

ITC`s pricing power is strong due to relatively inelastic demand profile of cigarettes and the company`s 80% market share. This translates into increasing margins for ITC as compared to any other FMCG company. Cigarettes volume growth of 8% in Q1FY12 surprised positively against our expectation of 6%. We expect cigarettes volume growth to be 6-7% with upward bias for FY12.

The e-Choupal network established by ITC gives it a phenomenal sourcing edge, which can help it transform into a retailing giant. The demand-supply conditions are in favor of the paper businesses, as the new supply will just be sufficient to meet the additional demand. With the Indian economy slated to grow at about 8% for FY11E, we expect cigarettes volumes to continue to witness growth momentum. The FMCG division is expected to scale up and turn profitable in FY13, contributing positively to the bottom line, going forward.

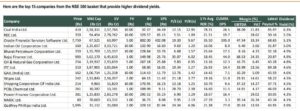

Edelweiss’ 5 stocks to buy for 10 years

[download id=””]