First, we have to compliment the wizards at Aditya Birla Money for their brilliant stock picking. The Diwali Model Portfolio for 2014 was packed with gems like Britannia Industries which has given a YOY return of 133%, ZF Steering which has given a YOY return of 119%, Alembic Pharma with a YOY return of 72% etc. Only one stock, Balkrishna Industries, was in the red. The average return of the portfolio is a magnificent 42.2% and it compares very favourably with the Nifty’s return, which was flat.

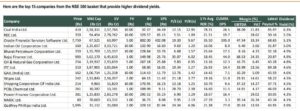

For SAMVAT 2072, Aditya Birla Money has recommended a portfolio of 15 quality businesses/ companies, which are mix of cyclicals (like auto, banking etc), new emerging sectors (like defense, media etc) and consumption with strong earnings growth momentum. AB Money expects these stocks to deliver returns in the range of 20-25% over next 6-12 months.

one can buy AB Money itself and this scrip is a multi bagger over the next few years, they are getting very good response to their initiatives