Huge value unlocking for investors of Aditya Birla Nuvo

Kumar Mangalam Birla, the illustrious Billionaire founder of the conglomerate group, had a big smile on his face as he rang the opening bell for Aditya Birla Capital at the hallowed premises of the BSE.

Aditya Birla Capital was listed yesterday after its demerger from Aditya Birla Nuvo.

“The whole idea is that we have been in the business for more than 10 years now… We need to unlock value for our shareholders, who have been invested for so long,” the Billionaire said even as shareholders cheered him.

“It gives us capital and gives us currency in the stock… Being a subsidiary of Grasim, we have access to cash flows from Grasim to the extent we require and as and when we require and gives us access to the market,” he added, making it clear that Aditya Birla Capital is a powerhouse that will take the financials sector by storm.

Aditya Birla Capital is a surrogate for the Indian economy: Ajay Srivastava

“It is a wonderful and a brilliant combination of businesses in that company. It is very focussed with decent growth rate and quality management. It is a kind of a stock which you must hold because this tells the story of India,” Ajay Srivastava of Dimensions Consulting said, his eyes sparkling with excitement.

He explained that Aditya Birla Capital is a conglomerate of financial services such as the NBFC, Insurance, Mutual Fund etc.

Its’ footprint is bigger than that of its arch rivals Bajaj Finserv and Bajaj Finance put together.

Financial services will continue high growth

Srivastava pointed out that all the businesses in which Aditya Birla Capital has a pie are expected to witness high growth.

The insurance and mutual fund business are expected to grow at 20-25% while the banking/ NBFC business may grow at 15%.

Insurance is at the tip of the iceberg, will be bigger than Banking

Ajay Srivastava emphasized that the insurance sector has vast scope and that we have not even scratched the surface yet.

“We are not even at the starting point of this game called insurance and I think this is going to be something which is beyond and these companies will become bigger than banks.”

He explained that the sector is highly under-penetrated with only a few million people having insurance cover.

About 300-400 million more customers are expected to come on board in the next four-five years.

He also emphasized that the fact that the mortality situation of Indian population is improving a lot over the years augers well because the number of claims will reduce.

Insurance regulations create a moat with low competition

Srivastava emphasized that the high level of regulatory supervision that insurance companies are subject to augers well because it creates a monopoly situation for the existing players.

No insurance company is coming into India for the next 10 years which means that investors have no choice but to buy into the existing players.

He also explained that the insurance business is very expensive to set up. It costs nearly Rs. 1,000 crore just to enter the market. However, once penetration is there, the players become well entrenched and cannot be easily displaced by rivals.

“This will be like a monopoly kind of a setup of seven-eight companies which will dictate this market in India. If you keep that perspective, you will find a lot of the value,” he added.

Huge growth potential ahead: Ajay Srinivasan, CEO

Ajay Srivastava’s hypothesis with regard to the growth prospects of Aditya Birla Capital is corroborated by Ajay Srinivasan, the Company’s illustrious CEO.

“There is a long way to grow in the life insurance businesses… We have seen strong flows in the asset management business… There is huge opportunity in the NBFC (non-banking finance company) space given the credit-to-GDP (ratio) is low,” he said.

“From a macro perspective or industry perspective, there is headroom to grow. We will look to grow each vertical,” he added.

Valuations are expensive but are still worth it

Srivastava ruefully conceded that the valuations at which Aditya Birla Capital listed are expensive.

However, he advised investors to bite the bullet and buy the stock because one is getting a NBFC conglomerate with the insurance and mutual fund business built in.

“It is expensive but good things do come in expensive packages,” he added in a soothing tone.

Weakness in stock price expected for the short period

There are two reasons why the stock price of Aditya Birla Capital could be weak in the short term.

The first is that the shareholders have received the stock pursuant to demerger. Because of the hefty gains that are already on the table, some of them will be itching to book profits.

The second reason is that because the stock is not a part of the MSCI Index, the Index Funds have to perforce sell the stock.

This was revealed by A Balasubramanian, the chief of Birla Mutal Fund (which is now under the control of Aditya Birla Capital).

This is mainly because of MSCI index funds selling as #AdityaBirlaCapital is not in the index

— A Balasubramanian (@MFBALA) September 1, 2017

Great buy if market capitalisation slumps to Rs. 32,000 crore

If the sustained selling by institutional investors results in the stock slumping to a value of Rs. 32,000 crore, it becomes a no-brainer buy, Ajay Srivastava opined.

“If you get anything close to Rs 32000 to 35000 crore market cap, you have got a good deal for yourself,” he said.

It is a “Jabardast” Investment: DD Sharma

DD Sharma, the veteran stock picker, also advised investors to buy Aditya Birla Capital without any hesitation owing to its blue chip credentials. He described the company as a “jabardast investment”.

Ajay Srinivasan, the CEO, was described as a “Damdaar Aadmi” (very competent person) by the host.

Is Reliance Capital cheaper than Aditya Birla Capital and a better buy?

Varinder Bansal, the ace investigative journalist with CNBC TV18, produced data which showed that while Aditya Birla Capital is demanding an exorbitant valuation of Rs. 37,931 crore, its arch rival Reliance Capital, which has a similar business profile, is demanding only Rs. 29,000 crore.

AB Capital Vs Rel Capital – only for education. Rel cap SOTP of nearly 29000 cr with lower multiples assigned pic.twitter.com/v29mMHoXyp

— Varinder Bansal (@varinder_bansal) September 1, 2017

However, some astute investors rightly pointed out that the comparison is not apt because while Aditya Birla Capital enjoys the stature of a blue-chip stock, Reliance Capital has dubious credentials owing to the financial troubles of the ADAG group (see Investors Wail At Losses As Veritas’ Doomsday Prophecy Comes True).

It's not just about valuations. Whom should an investor choose? The reliable Kumarmangalam Birla or Anil Ambani, who also owns Rcom, RPower?

— Sunil Tinani (@TheBullBull) September 1, 2017

Varinder, one more thing. Please compare price charts of Rcap and AB Nuvo (ABCL original owner) from 2008-2017.

Which stock is better? pic.twitter.com/DwXXOwGk57

— Sunil Tinani (@TheBullBull) September 1, 2017

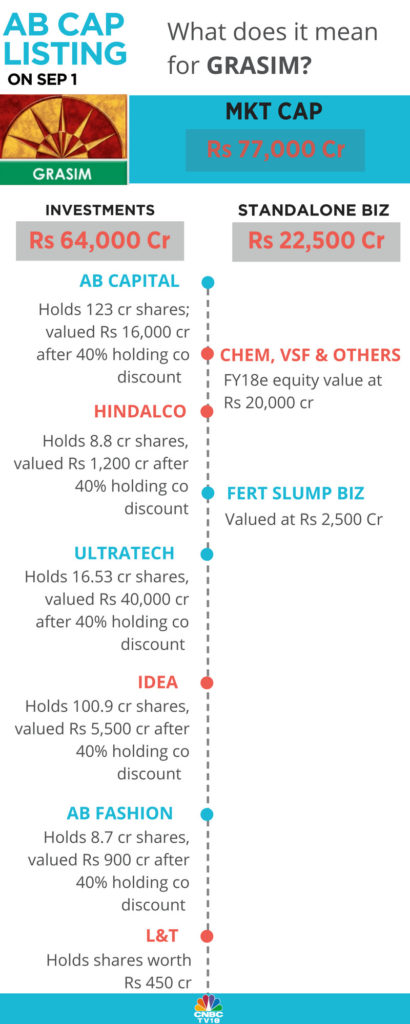

Is Grasim, the holding company, also a good buy?

Avinnash Gorakssakar, the leading stock market expert, opined that Grasim, the holding company which controls 55 percent of Aditya Birla Capital, also makes a good buy because its valuations will mirror that of the subsidiary.

Varinder Bansal further explained the nuances of Grasim’s SOTP valuation and the impact on that by AB Capital’s valuations.

As AB Capital is set to make a debut on D-street, catch @varinder_bansal on what this listing means for Grasim @CNBCTV18Live pic.twitter.com/EY6pYz9dKy

— CNBC-TV18 News (@CNBCTV18News) September 1, 2017

(Click for larger image – credit: CNBC-TV18)

JP Morgan also suggested that Grasim is grossly undervalued because assuming a 40% holding company discount, Aditya Birla Capital is being valued at only Rs. 130 per share.

Given that Aditya Birla Capital has actually listed at Rs. 237, Grasim’s stock price will have to move higher to keep pace.

JPM: Assuming a Hold Co discount of 40%, Grasim currently seems to be

pricing in Aditya Birla Capital listing price at Rs130/ share.— Darshan Mehta (@darshanvmehta1) August 31, 2017

Conclusion

Prima facie, the rationale advanced by the experts on why Aditya Birla Capital is a good buy is convincing. We will have to keep a hawk eye on the stock and systematically tuck into it at every opportunity!

Why are we chasing these expensive stocks? Stocks like these will double your money in 5 years or more. There are dime a dozen high quality stocks which can do 10x or 20x by that time. Do your research, dont expect free suggestions, in fact that is wrong. Dont even think of AB Capital.

Hi venky sir, please throw out some names of those 10x or 2ox multiplier stocks. We are eagerly waiting for your positive response.

A B Capital is good over priced stock ,can be accumulated at lower levels.Rel Capital is still under priced with strong businesses under its belt.Some invester Dinesh Tinani@ TheBullBull has raised issue of ADAG ,R Com which is in ICU ,but Idea is no better which also needs oxygen cylinder of merger with Vodafone.No doubt ADAG had issues ,so has with Birla group, Dinesh Tinani@TheBullBull needs to go through Coal Scam and mine cancelation by SC to upgrade his knowledge.L&T fin holding is also a good long term pick if some one want better credentials or if some one Realy concerned about past.Investers has choice.

Azim premji bought around 2 2% equity of A B Capital (4.8Crore shares) (my data is aprox on basis of my memory ,pl check its accuracy,)at just 145 two months back.Stock market and NBFC sector has not done great since then,so these lower circuits are on expected lines.

Added Aditya Birla Capital below 200 today.

I invested a lot in this shit and regret very much. Is there any remote chance of recovering my money or just forget about the damn thing? These folks have always landed me in loss in whatever they recommended.

I thought every shareholder of Grasim will get 7 of Adityabirla capital..I dont see Aditya birla capital in my demat..any thoughts?

Would be a good buy around 160 levels

So when do you see this stock touching 160/-?

For every 5 shares of Grasim held before 19th July, you were getting 7 shares of AB Capital.

I have subscribed to it and will accumulate as and when the opportunity arises.

What to do to invest in aditya Birla sun life growth plan investment.

How to start under this investment.

What to do with this stock, should we hold of sell