Real estate sector: From pariah to favourite

Saurabh Mukherjea was amongst the first of the luminaries to sense that the winds are changing for the realty sector.

“The area where we are getting very intrigued is real estate. We are hearing that in small town India, residential real estate demand is picking up, we are seeing some positive price action as well,” he had alerted a few weeks ago.

“There are early signs of green shoots in the residential real estate market, not in Mumbai but in other cities like say Ahmedabad,” he added.

Sanjiv Bhasin, the veteran investor, had expressed a similar viewpoint.

“I have been an advocate of real estate and I can tell you if gold is going to be Rs 58,000 and you are going to be smiling your way to the bank, then definitely hard assets like real estate will be the next trend setter. Mind my words, 2021 will belong to real estate and that is hard assets,” he had said with immense confidence in his tone.

2021 will belong to real estate, play this theme with 4 top picks: Sanjiv Bhasin https://t.co/zuLSE3WSGz via @economictimes

— sanjiv (@sanjiv_bhasin) August 28, 2020

Interest rates are rock-bottom, Govt is flooding incentives for the realty sector

Uday Kotak, the visionary Billionaire founder of Kotak Bank, pointed out that the interest rates are now rock-bottom at only 6.75% and that there is no excuse for us to not buy homes.

“Lower prices, lower stamp duty, low interest rates could support home values going forward, like old times!,” the visionary said, sending the unmistakable hint that the realty sector will regain its glorious days of the past.

Home Loan at 6.75%! Covid has made our home the centre of life. Lower prices, lower stamp duty, low interest rates could support home values going forward, like old times! https://t.co/oDx0qYk28I

— Uday Kotak (@udaykotak) November 2, 2020

Nirmala Sitharaman, the dynamic Finance Minister, has also risen to the occasion by granting much-needed stimulus incentives to the sector.

Welcome step by the Government and FM honorable Nirmala Sitharaman – for real estate sector and home buyers.

— CA Rajesh Mehta (@CARajeshMehta1) November 12, 2020

Knowledgeable experts have unanimously welcomed the move by the Finance Minister.

“Today’s announcements will undoubtedly uplift sentiments of all the stakeholders in the realty industry. In a bigger picture, these stimulus measures will go a long way towards job creation and infrastructure development in the country. Industry-wise, the increase in threshold limit for circle rate and transaction value will help developers, especially in the Mumbai market”, Ashish R Puravankara, Managing Director, Puravankara Limited, said.

Other experts pointed out that the stimulus package will help clear out about 5.45 lakh units, which will benefit the developers as well as the homebuyers.

Real Estate ancillary stocks are already flying like rockets

Saurabh had rightly alerted us that the building materials sub-space will be the first to react to the positive developments.

“This is the time to look at the building materials companies,” he said.

“We are taking a broader look at the building material space to see if they can benefit if the demand for building materials comes through especially as the data out there suggests that rural India is doing well. So the tiles, plywood, sanitary ware ecosystem can flourish again,” he added.

Saurabh was right as usual.

Cera Sanitaryware, which has a stranglehold over sanitaryware products, has taken off like a supersonic rocket in just the last few days.

It is worth recalling that Cera Sanitaryware is the favourite stock of noted value investors Vijay Kedia and Guy Spier, both of whom hold a big chunk of the powerhouse.

“Cera plays a dominant role not only in the sanitary sector but also in the housing sector as a whole. But it is only a midcap. So, the idea is to find a small cap which can transform into a midcap and a midcap which can transform into a large cap. It might take 10 years or 15 years. This is the job of an investor in the market,” Vijay Kedia had said.

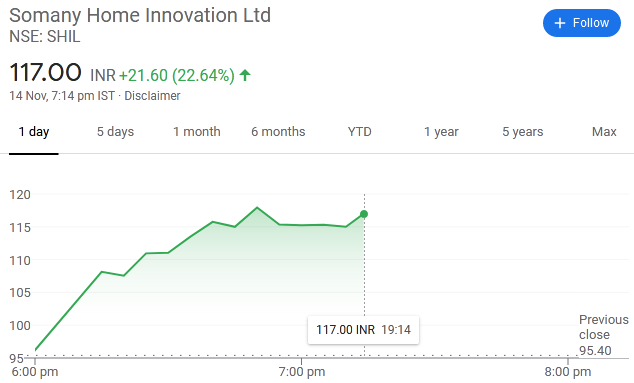

Yet another example is that of Somany Home Innovation Ltd (SHIL) which is also surging without any regard for the circuit limits.

SHIL is the favourite stock of Sunil Singhania, the distinguished fund manager of Abakkus Growth Fund PMS (see Sunil Singhania’s Buy Of Porinju Veliyath’s Fav Stock Hints Multibagger Gains May Be In Offing).

Abakkus holds a treasure trove of 19,87,520 shares of SHIL as of 30th September 2020, worth Rs. 23 crore at the CMP of Rs. 116.

EQ India Fund, which is Porinju Veliyath‘s PMS Fund, holds 10,00,000 shares as of the same date.

Godrej Properties is the best realty stock to buy: Atul Suri

Atul Suri also opined that the realty sector would sparkle in the foreseeable future.

“One sector which is beaten down, under-owned, unloved and at the same time, has a lot of focus from the government is Realty sector,” he rightly pointed out.

He recommended that we tuck into Godrej Properties without any delay.

“The top play in the realty sector is Godrej Properties. It is one of the best quality stocks in which leverage is not very high,” he said.

“This is one stock I could own and sleep well,” he added with a big smile on his face, implying that the stock is fail-safe and we have nothing to worry about.