Benjamin Graham, the father of value investing, was among the first to point out that institutional investors suffer a serious handicap in comparison to novice investors. In his classic treatise “The Intelligent Investor” Graham explained that large investors become “set” in their ways and become “risk averse”. They are not inclined to take any risk and are content to buy the same stocks that their peers are buying. This way, if something goes wrong, the stock takes the blame and not the stock picker.

The same theory was propounded by Peter Lynch in his treatises “One Up On Wall Street” and “Beating The Street“. The entire book explains the several ways in which individual investors are better than so-called whiz-kid investors.

One can see this play out in real life as several large mutual funds are under-performing even the Index. For instance, HDFC Mutual Fund, which is managed by star fund manager Prashant Jain, has been de-rated by Mint 50 for its consistent poor performance and inability to beat even the benchmarks.

Now, Bill Ackman’s poor performance gives us yet another example of how novice investors score over savvy investors.

Bill Ackman is a celebrity investor who founded Pershing Capital, a hedge fund with an AUM of $14 Billion (Rs. 91,000 crore). Ackman was in the news recently because his concentrated bet on Valeant Pharma has lost nearly $2 Billion (Rs. 13,000 crore) over allegations that Valeant Pharma is a “fraud” and the “next Enron”.

Stephen Gandel of Fortune has pointed out in his article “Why You Are a Better Investor Than Bill Ackman” that Bill Ackman has a consistently bad poor track record.

In 2015, the fund lost nearly 21% and was one of the worst performing of the largest hedge funds for the year. Till February 2016, the Fund has already lost 18.6% of its value.

What is worse is that Pershing Square has severely underperformed the S&P 500. In 2015, the S&P 500 gave a 1.4% return while Pershing Square lost 20.5% after fees. In the period from 31.12.2012 to 31.12.2015, Pershing Square has given a return of only 22.2% while the S&P 500 has given a return of 52.5%.

| 4th Quarter 2015 | Full Year 2015 January 1 – December 31 | Since Inception | |

| Pershing Square Holdings, Ltd. | 12/31/12 – 12/31/15 | ||

| Gross Return | -8.7% | -19.3% | 37.3% |

| Net of All Fees | -9.1% | -20.5% | 22.2% |

| Indexes (including dividend reinvestment) | 12/31/12 – 12/31/15 | ||

| S&P 500 Index | 7.0% | 1.4% | 52.5% |

| Russell 1000 Index | 6.5% | 0.9% | 52.1% |

| Dow Jones Industrial Average | 7.7% | 0.2% | 42.9% |

The high fees charged by the Fund are also adding insult to injury. As the chart shows, the fees have gobbled up 15.1% of the returns in the period of three years referenced above.

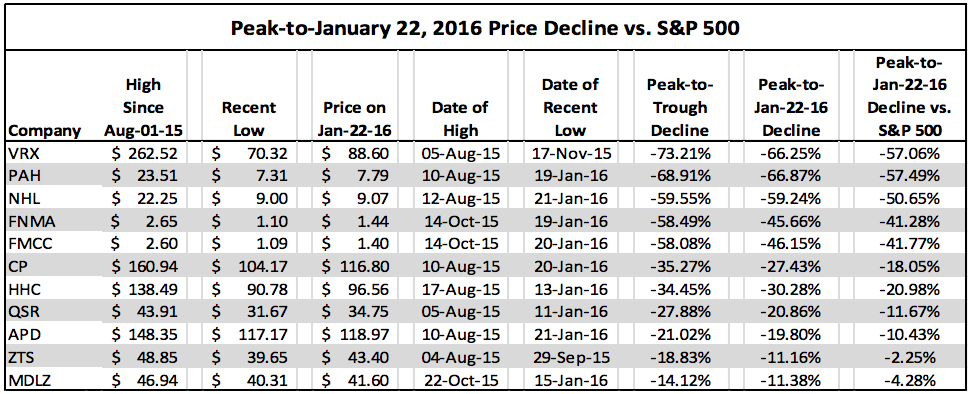

Stephen Gandel points out that there are two reasons for Bill Ackman’s failure. The first is the concentrated nature of the portfolio which means that there is no room to hide if the bet goes wrong.

All 11 stocks in Pershing’s portfolio are down in the red with one of them, Platform Specialties Products, having lost a whopping 76% in just the past six months. Valeant Pharma, in which Bill Ackman pumped in $4.3 billion (30% of the AUM), has lost 63%.

The second reason for Bill Ackman’s poor performance is his disregard for valuations. He bought Valeant Pharma without a care in the World even though it was quoting at exorbitant valuations. Even the fact that the stock had tripled in just the last two years did not bother Ackman.

Ironically, the two failings of Bill Ackman are the very reason why novice investors investing in an Index Fund are better. They get diversification owing to the large number of stocks and the average valuations across all the investments stay reasonable.

To his credit, Bill Ackman has recognized his pitfalls. In his letter to investors, Ackman admitted that the Fund had committed “important mistakes”. The first is “missing the opportunity” to sell positions that were overvalued. The second is committing the “biggest valuation error” in assigning too much value to certain stocks. In fact, Bill Ackman has devoted an entire paragraph to “Humility” in which he says:

“I have often stated that in order to be a great investor one needs to first have the confidence to invest without perfect information at a time when others are highly skeptical about the opportunity you are pursuing. This confidence, however, has to be carefully balanced by the humility to recognize when you are wrong. While no one here is enthusiastic about delivering our worst performance year in history in 2015, it certainly does a good job reinforcing the humility-side of the equation that is necessary for long-term investment performance. In 2016, we would like to generate results that reinforce the confidence side of the equation. Humility and skepticism will help get us there.”

The interesting part is that Bill Ackman is now very bullish about the prospect for equities. He says:

“Recent market conditions have created perhaps the richest universe of new opportunities for us to consider in recent years. During the last few months and weeks, companies that we have previously researched which met our standards for business quality, but whose valuations were not appealing, have dropped dramatically in price. We have multiple attractive new opportunities to consider, competing for internal human and capital resources”.

So, the time is ripe for us also to learn from the mistakes identified by Bill Ackman and to go shopping and pick up top-quality stocks at reasonable valuations!

Quite interesting post and analysis. However i believe retail investors must be ready with all the knowledge before getting into the battle field. Click on my image for such simplified investment gyan along with some chosen multibaggers.

Write a article on Dolly Khanna buying stylam or Ashish Kacholia buying Royal Orchid or Porinju apologising to Jim Rogers.

I dont think any of the ace investors including Bill Ackerman should be ashamed in any way. I do have an issue with companies that have no merit of investment being marketed as they are gold mines. No no. Dont ever do that. I am sure bill Ackerman will return to profits easily. Becuase he has enough money to make the mistakes. He can be wrong 5 times, but being right once will bring him back to prominence. People will forget the past losses. Novice investors don’t have that support.