Warren Buffett said he was not selling stocks ….

Warren Buffett is regarded as the gold standard amongst Billionaire investors.

He has been guiding us from time immemorial about the principles of value investing.

However, the fact is that even that he has fallen prey to the bad habit of saying one thing and doing another.

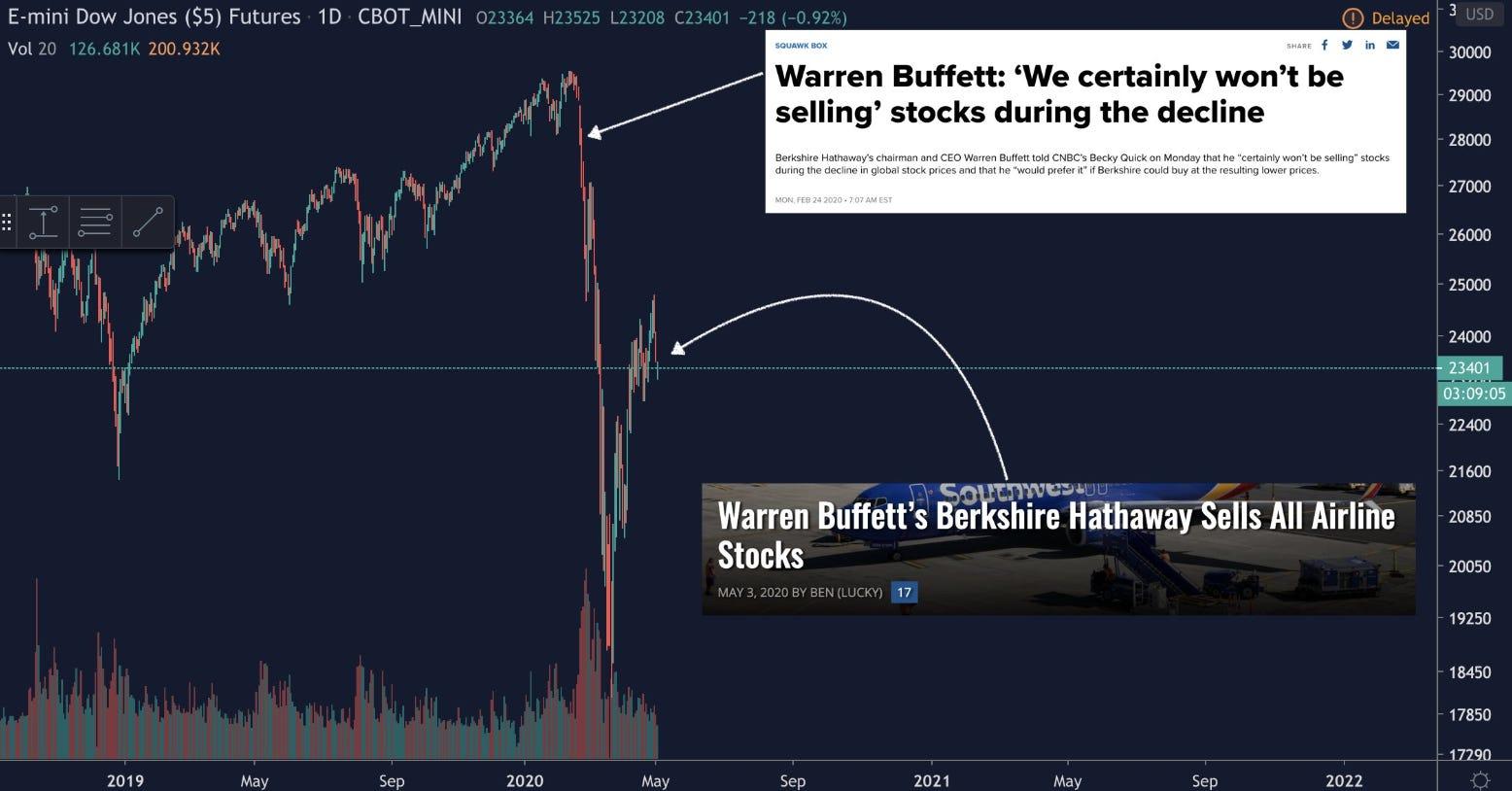

When Becky Quick, the charming anchor at CNBC, asked Warren in February 2020 whether he was dumping any stocks during the CoronaVirus pandemic crash, he denied it.

“We certainly won’t be selling stocks during the decline,” he said in a vehement manner.

“I would prefer it if Berkshire could buy at the resulting lower prices,” he added.

Yet, the Oracle of Omaha shocked everyone by announcing a few days later that Berkshire had dumped all of the airline stocks in its portfolio.

Airline stocks plunge at the open after Warren Buffett's Berkshire Hathaway sold out of its positions in American, Delta, Southwest, and United. https://t.co/bOtAgF7Jjq pic.twitter.com/iLoeKKtJio

— CNBC Now (@CNBCnow) May 4, 2020

Thereafter, he also sold stock in a Bank named ‘U.S. Bancorp’.

When everybody thought Buffett is neutral & sitting on the sidelines, the actual reality is – he is selling.

First all airlines and now a bank.

Berkshire Hathaway sold a total of 497,786 U.S. Bancorp shares (#USB) on May 11 and 12 for $16.3 millionhttps://t.co/Erh5LjbkEU

— Save Invest Repeat ??? (@InvestRepeat) May 14, 2020

Warren also changed his stance about wanting to buy stocks at lower prices.

He has now decided to hoard cash and postpone fresh investments.

Berkshire Hathaway has been selling stocks & stockpiling even more cash. “If Buffett himself isn’t seeing opportunities, even in his own stock, what are we to think about the recent market selloff? Is it not a buying opportunity for long-term investors?” https://t.co/RnXbC5ailW

— Lisa Abramowicz (@lisaabramowicz1) May 2, 2020

A wise value sage once quipped: ‘Sometimes Buffett says things that are in your interest; sometimes he says things that are not in your interest; but he ALWAYS says things that are in his interest.’

— Stephen W. Shipman (@swshipman) May 2, 2020

(Image Credit: Business Insider)

Billionaires cannot see the future. Their guess is as good as that of the Average Joe

Josh Brown, the CEO of Ritholtz Wealth Management, cautioned us not to implement the views of the celebrity investors but to act on our own wisdom.

He pointed out that Billionaires cannot see the future and have no idea what’s going to happen tomorrow or the next day.

Their guess as to what will happen in the stock market tomorrow is as good as anyone else’s.

He also explained that these investors have a sixth sense and usually trade off on their gut feeling.

They don’t usually use repeatable and systematic strategies.

He also warned that while the celebrity investors may reveal in the interview what stocks they sold or bought, they may have no inclination or opportunity to update viewers about whether they have changed their mind about the stock.

Tepper and Druckenmiller were bullish. Now they say stocks are overvalued

Josh Brown cited the examples of David Tepper and Stan Druckenmiller to prove his point that Billionaires can change their mind in an instant.

In January, both celebrity investors were bullish about stocks and were buying them aggressively.

However, when the markets crashed over the CoronaVirus pandemic, both changed their minds and opined that stocks are now “overvalued” and deserve to be dumped.

“The market is pretty high and the Fed has put a lot of money in here … The market is by anybody’s standard pretty full”, Tepper said.

Stan Druckenmiller added to the gloom by stating that the prospect of a V-shaped recovery in the U.S. is “a fantasy”.

He also alleged that the Risk-Reward in stocks is the worst that he has seen in his distinguished career on Wall Street.

Stocks hit session lows as David Tepper tells CNBC the market is the second most overvalued he's ever seen; Dow down more than 520 points, S&P 500 falls 2%https://t.co/yZQbZBAFL9 pic.twitter.com/uLBF6au73Z

— CNBC Now (@CNBCnow) May 13, 2020

The prospect of a V-shaped recovery in the U.S. is “a fantasy”, according to Druckenmiller https://t.co/vscB2HWoN6

— Bloomberg Markets (@markets) May 13, 2020

Are the Billionaires gaming the stock market?

The change in stance of Tepper and Druckenmiller from Bullish to Bearish did not go down well with some influential personalities like President Donald Trump.

Trump, who is famous for his outspoken views, alleged that the Billionaires may be indulging in the nefarious practice of spooking the markets so that they can rake in big bucks on their short positions.

When the so-called “rich guys” speak negatively about the market, you must always remember that some are betting big against it, and make a lot of money if it goes down. Then they go positive, get big publicity, and make it going up. They get you both ways. Barely legal?

— Donald J. Trump (@realDonaldTrump) May 13, 2020

Earlier, Billionaire Bill Ackman had created a controversy by causing the market to tank and then revealing that he had made $2.6 Billion from his shorts.

This guy should be locked up… market manipulators make me sick.https://t.co/nZLqKpFPll

— Justin Solomon (@mrjustinsolomon) May 11, 2020

CNBC should be ashamed he had positions that are short he said it!

— Jonathan Glaubach (@TraderYON) March 18, 2020

I agree that high-quality company stocks are a bargain of a lifetime right now. However, your interview on CNBC was the most irresponsible thing anyone has ever done. All you did was unnecessarily breathe fear into an already frightened public. You owe Americans a public apology.

— David W Ingle (@DavidWIngle1) March 18, 2020

Bill Ackman denied that there was any gaming by him. He claimed that he had already raked in a bulk of the profits from the shorts before coming on TV.

Anyway, the bottomline of the episode is that we will land up in a soup if we listen to the celebrities and do as they say.

“I don’t think that individual investors or the vast majority of professional investors … should be reacting at all to what they have to say,” Brown rightly said.

“Do not change your asset allocation based on Druckenmiller because Druckenmiller ain’t gonna call you when he has a different opinion a few days later,” he concluded.

“Do not change your asset allocation based on Druckenmiller because Druckenmiller ain’t gonna call you when he has a different opinion a few days later.”

This truly sums it up. We have no idea about the position-size, information flow, investment horizon, leverage or obligations of any big investor. So, should invest accordingly. In this way, even if we lose money we will gain knowledge which will be useful for our next investments.