Bears attack PC Jeweller

“Woo .. woo .. woo .. woo”.

My blood froze at the sound of the alarm bells in the RJ Fan Club. It signaled that somewhere in the labyrinths of Jeejeebhoy Towers a Bear attack was underway.

A quick check at the radars and sensors revealed that the victim was none other than PC Jeweller, a small-cap. The Bears were mauling the stock and tearing it to shreds.

I grabbed whatever weaponry I could and rushed to the scene.

Mukeshbhai and Jigneshbhai were already at the counter, fearlessly fighting the Bears in hand-to-hand combat.

Mouthing vile obscenities, I grabbed two slimy looking bears with my bare hands and ferociously slammed them to the ground.

I pinned a third one in the Heimlich manoeuvre. With my awesome strength, I could have effortlessly snapped his neck.

Thankfully, the Bears realized that they were overpowered and could not win. They beat a hasty retreat.

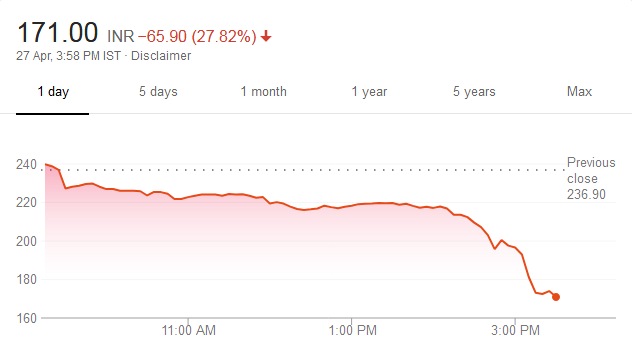

However, the attack took its toll on the stock. It slumped a mammoth 28% and shaved off a colossal fortune from investors’ portfolios.

PC Jeweller is an exceptional company experiencing a phenomenal growth rate: Brahmal Vasudevan & Motilal Oswal

As I stood amidst the ruins, my thoughts drifted to the balmy day in February 2015 when Brahmal Vasudevan, the illustrious founder of Creador & Idria, had personally handpicked PC Jeweller for his PMS portfolio.

“PC Jeweller, under the leadership of Balram Garg, is an exceptional company experiencing a phenomenal growth rate. As the organised share in jewellery retail increases, PC Jeweller is bound to benefit from this trend and we are delighted to have this opportunity to partner with Balram and his team in shaping its next phase of growth,” Anand Narayan, the honcho at Creador had gushed.

As of 31st March 2018, Idria held a treasure trove of 1,81,51,436 shares of PC Jeweller comprising 4.60% of its equity.

At the CMP of Rs. 172, Idria’s investment in PC Jeweller is worth a king’s ransom of Rs. 312 crore.

Brahmal and Anand were not alone in reposing trust in PC Jeweller.

The wizards at Motilal Oswal had also come out with all guns blazing in support of the stock.

“We have a BUY rating on the stock, with a target price of INR645, valuing the company at 29x December 2018E EPS, 40% discount to Titan. We believe that the valuation gap vis-à-vis Titan will shrink further, once PCJL demonstrates its ability to maintain its revenue and earnings trajectory,” the wizards had stated.

No doubt, the logic given by Motilal Oswal in support of the buy recommendation was based on facts and figures and was quite convincing.

PC Jeweller is a “Pump and Dump”?

In a desperate attempt to assuage nervous investors, the top brass of the Company clarified that all is well and that all that had happened was that Padam Chand Gupta had “gifted” some shares to a family member in a personal capacity.

PC Jeweller just clarified to us – main promoter Balram Garg hasn't sold any shares, his elder brother, 68 yr old Padam Chand Gupta gifted some of his shares to a family member in personal capacity. Co says NO I.T RAIDS, NO REDUCTION OF STAKE BY MAIN PROMOTER @CNBCTV18Live

— Surabhi Upadhyay (@SurabhiUpadhyay) April 26, 2018

However, the timing of the so-called “gift” by the promoter raised suspicions of astute investors.

Nigel D’Souza of Mid-cap Mania fame hinted that the family member may in turn have dumped the stock on the unsuspecting public.

PC JEWELLER continues to struggle

CO Told @CNBCTV18News yestrdy

'Padam Chand Gupta Has Decided To Gift Some Shares To His Family Member'Biggest Question??

*Who is this family member?

*More IMP is D family member holding the gift or has he gifted it to the public???— Nigel D'Souza (@Nigel__DSouza) April 27, 2018

PC JEWELLER at days low

Passing the parcel??#Pcjewellers https://t.co/OP1JdU13Ua— Nigel D'Souza (@Nigel__DSouza) April 27, 2018

Did this happen in PC jewellers??

*promoter gifts to some1

*has tat person kept the gift or has d ? been passed on??#Pcjewellers pic.twitter.com/dUhCODYs8B— Nigel D'Souza (@Nigel__DSouza) April 27, 2018

#CNBCTV18Exclusive | PC Jeweller's Sanjeev Bhatia says Padam Chand Gupta has gifted some shares of the company to his family members and despite that promoter stake holding remains comfortably above 51%. @latha_venkatesh @_soniashenoy @_anujsinghal pic.twitter.com/83Ch9lZiSm

— CNBC-TV18 News (@CNBCTV18News) April 26, 2018

Is this why pc jeweller stock wad down by 15% yesterday

Better to keep away guys

Management keeps on giving clarifications making investors jittery pic.twitter.com/erKioYSJku— Avinash Gorakshakar (@AvinashGoraksha) April 26, 2018

Rakesh Bansal of RK Global condemned PC Jeweller as a “pump and dump” stock.

“PC Jeweller is a pumping-and-dumping stock where operators push the prices higher, and dump those at higher levels, therefore I advise not holding it in your portfolio for long-term. If you were to trade in PC, do it with a strict stoploss,” he said in a fiery tone.

“Who really is buying jewellery from PC Jeweller? If you observe, people prefer Tanishq over PC,” he added, implying that all figures of sales and profits may be bogus.

This was corroborated by Sandeep Jain of Tradeswift Broking.

“Although jewellery business is nice, but most businessmen running it are not. Many investors have already lost fortunes on some of jewellery stocks. My advice would be to buy Titan on declines and exit PC Jeweller now,” he said.

Experts had earlier warned that PC Jeweller is a strict avoid

In March 2018, Darshan Mehta of Bloomberg had cornered three leading experts being Harihar, Savi Jain and Ashwin Agrawal and asked them point blank whether after the 40% correction (in the wake of the Gitanjali Gems and Vakrangee fraud cases), PC Jeweller was worthy of a buy.

The experts were unanimous that PC Jeweller should be avoided like the plague because it was beset with innumerable problems and was not investment worthy.

The warnings were prophetic and would have saved investors if they had paid heed to it.

Jewellery stocks are a “dark black box”: Shyam Sekhar

Shyam Sekhar has a penchant for making sweeping and generalized statements condemning stocks and sectors.

He has earlier condemned banking and NBFC stocks, chemical stocks and also realty stocks as not being worthy of investment.

Jewellery stocks are now in his cross hairs.

He described them as a “dark black box” and warned novices in a stern tone not to “throw hard earned money into jewellery market cap”.

Can’t you find even one decent, clean, simple, growth business to invest?

If not, take a clean break.

Don’t throw hard earned money into jewellery market cap. It’s a dark black box. Not a pot of gold.

— Shyam Sekhar (@shyamsek) February 16, 2018

What about Kenneth Andrade’s investment in Thangamayil Jewellery?

I reported in November 2017 that Kenneth Andrade has taken a fancy for Thangamayil Jewellery and had bought a chunk of 489,427 shares at Rs. 410 per share for his Old Bridge Capital PMS Fund.

The seller was none other than Balusamy Ramesh, one of the promoters.

The stock had surged to an all-time-high of Rs. 697 on 12th December 2017 and is presently resting at Rs. 552.

The present holding of Old Bridge Capital PMS Fund in Thangamayil Jewellery is not known.

According to the opinion of some MMB punters, there is a risk that the panic amongst investors with regard to jewellery stocks may extend to Thangamayil Jewellery as well and send it spiraling down like a ton of bricks.

It is better to err on the side of caution and be safe instead of sorry is the prevalent view amongst the punters.

Of course, if Kenneth Andrade comes to Dalal Street to dump his holding in Thangamayil Jewellery, that itself will be sufficient to plunge the stock to a point of no return!

Dear Arjun,

Please arrange an article for liquor stock, after a lot of problem the stock at near 52 w high & ace investor also hold. Please explain why stock make new 52w high ? Consumption up/raw material cost down or both or other reason ? How ace investor found this sector.

Thanks for summing up PC Jeweller.

Why should the price fall so much just because promotors sell the shares, if otherwise fundamentals are OK?

Obviously there is something wrong in the fundamental analysis.

Note that only Motilal, ICICI and Emkay had been recommending this stock.

HDFC, Kotak or Karvy were not giving any buy recommendation.

What is the learning point from this episode?

If reputed analysts are not able to find issues behind numbers and caution investors, there will be many similar stock and there will be many more losers in the stock market.

One major differentiator between PCJ and Vakrangee is promoter holding. In Vakrangee it is as low as 15% whereas in PCJ it is 59%. PCJ has confirmed that promoters shares r not pledged.

Perhaps the negative news flow is being used by bear cartel to brutally hammer the stock.

Why not promoters use creeping acquisition to increase their stake st this point?

Illustrious analysts give news of screaming buy.. At the same time have they no responsibility to share their wisdom under such situations?