Dolly Khanna Portfolio

According to the laws of Dalal Street, it is mandatory for all novices to periodically pay obeisance to Dolly Khanna and her portfolio of magnificent multibagger stocks.

This is necessary because Dolly and her portfolio have proved to be guiding light for novices since time immemorial.

We have not only been spared of penury but have pocketed multibagger gains by cloning her stock picks.

Some novices are still wary of following Dolly’s footsteps in the apprehension that the stock may already be overpriced.

However, it is established beyond doubt from real-life examples such as Avanti Feeds, Rain Industries, Sterling Tools, PPAP Automotive, NOCIL, Nilkamal, GNFC, Thirumalai Chemicals etc that even if we would have bought the stock much after the official announcement of Dolly Khanna’s investment in them, we could still have taken home massive riches.

Her latest portfolio as of 31st March 2018 is as follows:

| Stock Name | Nos of shares | Value of portfolio (Rs Cr) | % of Portfolio |

| Asian Granito | 3,72,229 | 18.05 | 2.12% |

| Associated Alcohol and Breweries | 1,87,279 | 7.33 | 0.86% |

| Butterfly Gandhimati | 2,53,415 | 13.78 | 1.62% |

| Dwarikesh Sugar | 21,81,896 | 5.23 | 0.61% |

| GNFC | 15,80,202 | 71.58 | 8.40% |

| IFB Agro Industries | 1,20,882 | 9.42 | 1.11% |

| LT Foods | 34,74,601 | 31.94 | 3.75% |

| Manappuram Finance | 98,74,485 | 12.,56 | 14.15% |

| Nitin Spinners | 5,87,408 | 6.16 | 0.72% |

| NOCIL | 32,10,573 | 69.41 | 8.14% |

| PPAP Automotive | 1,42,798 | 8.29 | 0.97% |

| Prakash Industries | 4,00,000 | 8.76 | 1.03% |

| Radico Khaitan | 14,05,336 | 59.79 | 7.02% |

| Rain Industries | 89,47,515 | 291.42 | 34.19% |

| RSWM | 4,20,911 | 14.10 | 1.65% |

| Ruchira Papers | 3,73,128 | 5.97 | 0.70% |

| Som Distilleries | 2,79,954 | 7.92 | 0.93% |

| Srikalahasthi Pipes | 6,93,546 | 25.87 | 3.04% |

| Sterling Tools | 4,42,196 | 17.90 | 2.10% |

| Tata Metaliks | 3,00,759 | 25.24 | 2.96% |

| Thirumalai Chemicals | 1,53,018 | 33.43 | 3.92% |

| TOTAL NET WORTH | 852.25 | 100.00% |

Why does Dolly Khanna buy multiple stocks from the same sector?

A careful study of the latest portfolio of Dolly Khanna reveals that there are three new stocks in it.

These are Associated Alcohols, Radico Khaitan and Som Distilleries.

All three companies are engaged in the business of distillation of alcohol and of supplying spirits to other manufacturers.

The first question which arises is why Dolly picked three stocks from the same sector when all three companies are engaged in the same or similar business and are competing with each other?

The answer is that though Dolly has visionary abilities, she is a highly conservative investor at heart.

Her modus operandi of buying the best stocks from the same sector ensures that her investments are properly diversified and virtually fail-safe.

There are several examples which prove this theory.

When Dolly realized (before anyone else could) that specialty chemical stocks would take off like rockets (due to the pollution crackdown in China) she packed her portfolio with not one but four stocks being Thirumalai Chemicals, Dai-Ichi Karkaria, NOCIL and Meghmani Organics.

Similarly, on the eve of the take-off of the textiles sector, Dolly gorged on stocks like RSWM, Nitin Spinners, Trident, Loyal Textiles and Nandan Denim.

The same trend is visible in Dolly’s bets on the automobile space (PPAP Automobile, Sterling Tools), Finance (Manappuram Finance, Muthoot Capital), commodities (Rain Industries, Prakash Industries, Tata Metaliks, Srikalahasthi) etc.

No doubt, Dolly’s modus operandi is very sensible and we should emulate it for our own portfolios.

What is so special about Distillery stocks?

For some reason, I was under the misconception that the alcohol and distillery sector is a sunset sector owing to the crackdown by the Government on liquor consumption, Supreme Court’s ban on bars on highway etc.

In fact, when Porinju Veliyath bought a truckload of Globus Spirits, I asked with my usual naivety whether he had committed a “tactical error”.

As usual, I was wrong because Globus Spirits has since surged and posted handsome gains.

Further, I was baffled to learn that the three stocks picked by Dolly Khanna have given mega multibagger gains over the past 12 and 24 months.

How come we were blissfully unaware of the ferocious rally in these stocks?

| Stock | Market cap (Rs Cr) | YoY Gain (%) | 24 month gain (%) |

| Associated Alcohol and Breweries | 708 | 248 | 403 |

| Som Distilleries and Breweries | 778 | 130 | 58 |

| Radico Khaitan | 5653 | 248 | 368 |

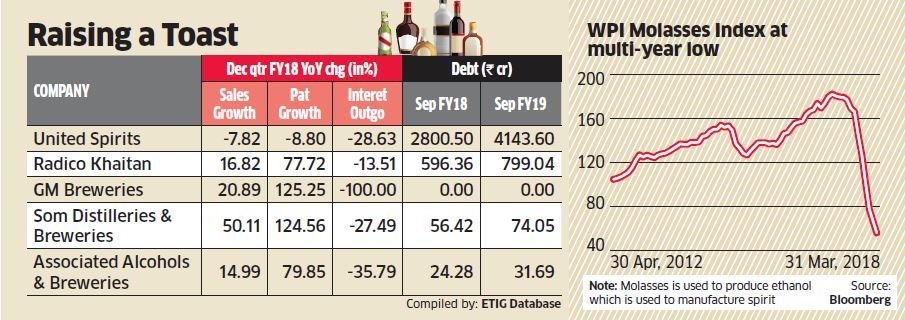

The reason for the spectacular performance of the alcohol and distillery stocks is explained by Jwalit Vyas of ETIG.

The first reason is that the price of molasses, a key raw material, has slumped with the consequence that profit margins have shot through the roof.

The second is that the companies are following the sensible strategy of ‘premiumisation’ and selling alcohol as branded products such as “8 PM”, “Royal Whytehall”, “After Dark Whisky”, “Contessa Rum” and other exotic products.

The third is that consumer lifestyles and rising incomes are creating a demand for alcoholic products.

In fact, such is the optimism about the prospects for the industry that Anand Kripalu, the CEO of United Spirits, stated that “We have never been more confident about the current health and the future of this business”.

(Image credit: ET, click for larger image)

Associated Alcohol and Breweries

The merits of Associated Alcohol and Breweries and why it enticed Dolly Khanna have been cogently explained by the experts at ET Markets in the following words:

(1) The company aims to double ENA (extra neutral alcohol) capacity in coming years, according to the annual report.

A mere 50 per cent investments in assets will double manufacturing capacity, strengthening its capital cost efficiency.

It has also emerged as one of the most competitive grain-based ENA manufacturers in India.

(2) Associated Alcohols has been a vendor to Diageo from the late Nineties, including consistent Smirnoff vendorship from 2002 onwards.

(3) The company also has plans to increase its distillery capacity to 7 crore litres per annum in coming years, from 3 crore litres.

It is set to use 10 acres out of its available land parcel of 125 acres for this Rs 80 crore expansion.

The project is expected to be fully go on stream starting 2020-21.

Following the scale-up, the Company expects to emerge as one of the largest ENA manufacturers in India with one of the lowest manufacturing costs, an effective volume-value play that will enhance the company’s competitiveness and profitability.

(4) Associated Alcohols is also trying to become a pan-India player.

In 2016-17, it was present in three states — Delhi, Madhya Pradesh and Rajasthan.

In 2017-18, the company intends to be present in five more such as Puducherry, Kerala, Goa, Maharashtra and Chhattisgarh.

(5) The company is readying plans to transform pricing model into premiumisation.

In the annual report, the company said, “In 2016-17, 20 per cent of the company’s revenues were derived from IMFL, of which 3 per cent of IMFL revenues were premium. By 2020, the company expects to increase the proportion of IMFL revenues to 50 per cent and 50 per cent of the company’s IMFL revenues are expected to be derived from premium varieties.”

Som Distilleries

When Porinju Veliyath pounced on Som Distilleries in January 2018 and bought a chunk of 1,50,000 shares at Rs. 197 each, we should have dropped everything and followed his footsteps.

The stock is up 40% since then.

Som Distilleries & Breweries- Interesting!

EQ India Fund bought 5lk shares (1.8%) at Rs 197 each for Rs 9.8 cr

Porinju Veliyath bought 1.50lk shares (0.5%) at Rs 197.95 each for Rs 2.96 cr— nickey (@OnlyNickey) January 11, 2018

The weekend starts in high spirits 🙂

Look for the next under-owned sector! pic.twitter.com/7iR757RZ7K— Porinju Veliyath (@porinju) October 27, 2017

The merits of Som Distilleries have been cogently explained by the sleuths of Bloomberg.

Apparently, their “Hunter Beer” is proving to be a favourite amongst tipplers and is sending the cash registers ringing.

The management stated that the present growth rate is a scorching 40% and that it expects to scale it up to a whopping 50-70% once the expansion plans come on stream.

The Company also revealed that its game plan is to avoid high-end products like scotch and instead target beer and semi-premium alcohol products. Almost 90% of the market is made up of the latter products, it was said.

Radico Khaitan

Compared to Associated Alcohol and Som Distellieries, Radico Khaitan is a behemoth with a market capitalisation of Rs. 5600 crore.

The stock is also a powerhouse and has won the confidence of veteran investors Kalpraj Dharamshi and Madhu Kela.

It appears that unlike its smaller peers Radico Khaitan is focusing on the premium/super premium space with its strong brand image.

Whisky Lovers: Came across a very interesting super premium pdt by Radico Khaitan. If it manages to garner a cult following, can change the game. Don't trust me cos I'm a teetotaler, but try it & give feedback for research. @varinder_bansal @Nigel__DSouza https://t.co/cKy1ug1LeZ

— Mangalam Maloo (@blitzkreigm) November 12, 2017

Radico Khaitan At Record High Today

Up 57% since Nov 12, 2017 https://t.co/fXRx6imPWs— Mangalam Maloo (@blitzkreigm) April 19, 2018

Liquor/ alcohol stocks are in early days of life cycle and have a long way to go: Nikhil Vora

Nikhil Vora of Sixth Sense Ventures is also gung ho about liquor and alcohol stocks.

He pointed out that while globally, liquor businesses are at a multiplier to cigarette business, In India, it is the reverse.

In India, the cigarette businesses are at a multiplier to liquor business.

However, this paradox may change in the near future because “liquor is a better vice than cigarettes”, he said.

He also explained that liquor stocks in the past were quoting at “ridiculously cheap valuations” which were not sustainable.

He opined that liquor stocks are “in extremely early days of their life cycle” and have a “long way to go”.

Huge scope for Distilleries/ Breweries in India

According to a report by Edelweiss, the spirits market size in India was 285mcs in FY16 and is expected to reach 337mcs by FY20.

The sales value of IMFL is expected to grow at a CAGR 6.3% and sales volume at 4%.

It is also stated that India’s liquor market tends to have a better consolidation in higher-end (value) space (top 10 players make up over 70% of market share in premium and super premium segments) while it’s more fragmented at the lower-end (value) (top 10 players only make up 17-18% of economy and low mid-range segments.

What about portfolio allocation by Dolly Khanna to her latest picks?

One aspect that is important to be borne in mind is that unlike novice investors, Dolly is a master of portfolio allocation.

Dolly allocates funds to her stocks depending on her level of conviction in the stock.

Stocks that are under probation are given small allocation till they prove themselves and win her confidence.

Looking at Dolly’s latest picks, it appears that Radico Khaitan is a relatively high conviction pick given that it has been allotted 7% of the net worth.

Associated Alcohol and Som Distilleries appear to be relatively low conviction picks given that they each have an allocation of less than a percent of Dolly’s net worth.

It is also possible that Dolly is feeling jittery at the fact that the stocks have run up quite a bit in the recent past. She may be waiting for a correction to add to them.

Conclusion

It is obvious that when all and sundry are buying alcohol/ distillery stocks in the expectation of raking in multibagger gains, we cannot remain mute spectators. However, given the ferocious rally that the stocks have seen in the recent past, we will have to bide our time and tuck into the best stocks if and when there is a meaningful correction!

Thanks Sir for covering liquor sector & also learn about portfolio allocation technic.

Sir, where are you found that dolly hold prakash Ind, I check Annual report last year & Share holding pattern, but not found her name, something mistake my me ?

It was announced on ETNow. The link is here.

Thank u sir.