NAMO’s surgical strike causes savage crash of NBFC stocks

Yesterday was a terrible day for the market in general and for NBFC stocks in particular. Several blue-chip NBFCs like Shriram City Union, Mannapuram Finance and others effortlessly lost big chunks of their value as panic-stricken investors fought pitched battles with each other to dump their holdings.

| COMPANY | LATEST | PREV CLOSE | LOSS (%) |

| SHRI.CITY UNION. | 1718.95 | 2060.40 | -16.57 |

| MANAPPURAM FIN. | 75.50 | 89.90 | -16.02 |

| BHARAT FINANCIAL | 594.55 | 690.65 | -13.91 |

| CAN FIN HOMES | 1372.00 | 1565.05 | -12.34 |

| GIC HOUSING FIN | 256.60 | 291.30 | -11.91 |

| REPCO HOME FIN | 525.00 | 594.45 | -11.68 |

| RELIGARE ENTERP. | 237.25 | 268.55 | -11.66 |

| CHOLAMAN.INV.&FN | 831.40 | 933.75 | -10.96 |

| CAPITAL FIRST | 532.00 | 595.35 | -10.64 |

| JM FINANCIAL | 63.55 | 71.00 | -10.49 |

| MUTHOOT FINANCE | 305.45 | 339.90 | -10.14 |

| L&T FIN.HOLDINGS | 85.85 | 94.90 | -9.54 |

| BAJAJ FIN. | 781.35 | 857.85 | -8.92 |

| M & M FIN. SERV. | 263.90 | 287.60 | -8.24 |

| EQUITAS HOLDINGS | 149.00 | 161.95 | -8.00 |

| GRUH FINANCE | 277.25 | 300.35 | -7.69 |

| LIC HOUSING FIN. | 481.10 | 520.05 | -7.49 |

| MOTIL.OSWAL.FIN. | 490.60 | 529.90 | -7.42 |

| MAGMA FINCORP | 91.70 | 99.05 | -7.42 |

| EDELWEISS.FIN. | 96.30 | 104.00 | -7.40 |

(Source: Business Standard)

Experts opined that NBFC stocks will face great challenges owing to NAMO’s move to demonetize currency notes of Rs. 500 and Rs. 1,000.

It was pointed out that cash-flows of the households, particularly the self-employed category, may be impacted for some time due to withdrawal of 86% of the currency from the system until normalcy is restored and business align themselves to the non-cash mode of payments including electronic payments.

The transition will take a couple of months, it was grimly stated.

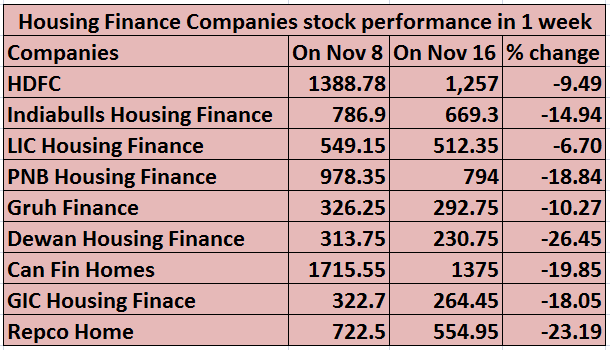

Not surprising, almost all NBFC stocks have lost significant chunks of their value since NAMO’s declaration.

(Source: Zeebiz.com)

Warning of clear and present danger by Shankar Sharma, Madhusudan Kela & Rahul Singh

It is notable that much before NAMO’s demonetisation move, several experts had warned that NBFC stocks are overvalued and deserve to be sold.

In August 2016, Madhusudan Kela warned that NBFC stocks have rallied ahead of fundamentals and that investors should book profit.

Shankar Sharma expressed the same opinion in October 2016. He warned that there is too much “euphoria” and “irresponsible lending” by the companies.

“NBFC profits are frontloaded and all the losses may come back to haunt later,” he said in a spine-chilling tone.

Rahul Singh of Ampersand Investment Advisors LLP was blunt in his criticism of the valuations at which NBFC stocks were then quoting.

“Last two or three months we have been saying that NBFC is a segment where we would be first taking the money off the table among our favoured sectors and that view continues,” he said.

NBFCs are an “expanding bubble”: Macquaire

In October 2016, Hamsini Karthik of BS collated the opinions of leading experts in his piece “Is it time to book profit in NBFC stocks?”.

He quoted the caution expressed by Macquarie that NBFC stocks are probably like an expanding bubble. “NBFCs have rallied sharply on strong earnings growth delivered at a time when growth is hard to come by. But at current valuations, the margin of safety is too low,” Macquarie said.

It was also pointed out that housing finance companies could be in for more troubles because delinquency in loan against property (LAP) portfolio could increase in the next four quarters. “Signs of early stress are visible in LAP business, including a sharp rise in 90 days past due delinquencies for some of the large players,” Ind-Ra was quoted as saying.

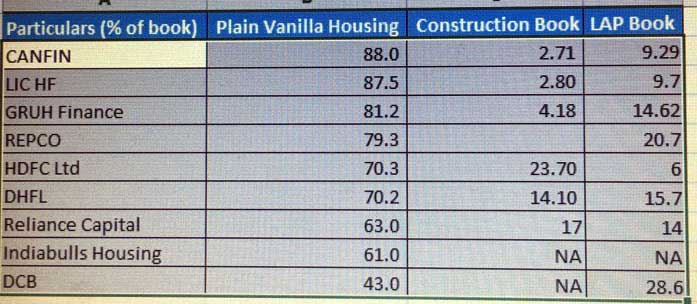

Details of LAP exposure and valuations of HFCs

Varinder Bansal, the ace investigative journal with CNBC, dug deep into the records of the NBFC’s and flushed out information relating to their “Loans Against Property (LAP)” exposure.

Housing finance cos valuation – loan book break up data. Hope it helps pic.twitter.com/PTYlRHeBlz

— Varinder Bansal (@varinder_bansal) November 16, 2016

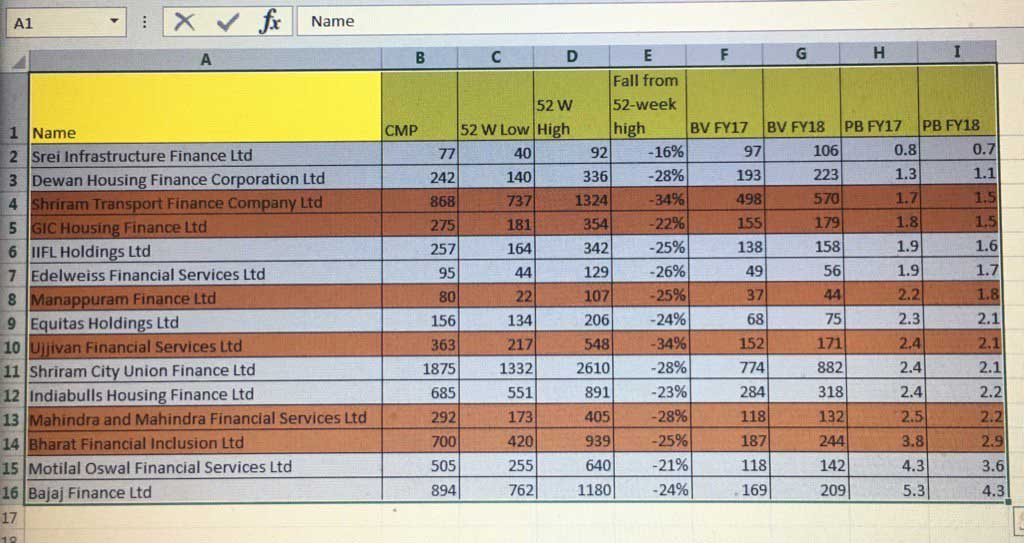

He also furnished up-to-date information relating to the present valuations of the NBFCs.

NBFCs valuations – hope it helps pic.twitter.com/qbKRV8sUcB

— Varinder Bansal (@varinder_bansal) November 16, 2016

Narayana Murthy’s Catamaran Capital Dumps Can Fin Homes

Billionaire Narayana Murthy looked his usual distinguished self even as he stood out in the crowd of panic-stricken investors at Dalal Street. Everyone expected him to do some bargain basement buying and to tuck into top-quality mid-cap stocks.

Instead, the Billionaire stunned everyone by placing a sell order for 153,041 shares of Can Fin Homes at Rs. 1290.32. This constitutes nearly 50% of the holding of the 344,183 shares in Can Fin Homes held by Catamaran.

Spooked by LAP exposure?

It is clear that something about Can Fin Homes has spooked Narayana Murthy. He is otherwise the quintessential buy-and-hold investor. He does not buy a stock unless he is thoroughly convinced about the fundamentals of the stock. Having bought the stock, the Billionaire remains unperturbed by short-term gyrations in the stock and is content to passively hold the stock for decades.

Prima facie, the exposure of Can Fin to LAP may have caused the veteran Billionaire some worry.

Caution advised by experts after demonetisation move

Shyam Sekhar, the noted value investor, sent the ominous warning that “Home finance will send a number of analysts/fund managers finally home.”

Home finance will send a number of analysts/fund managers finally home.

— Shyam Sekhar (@shyamsek) November 15, 2016

It may be recalled that Shyam Sekhar is a stiff opponent of the micro-finance segment. He has trashed the entire sector as being based on “organized usury”.

“I will not pay a P/E for usury“, Shyam Sekhar had then famously declared, sending a chill down the spine of novice investors who have invested their life savings in micro-finance stocks.

Suresh Ganapathy, an expert with Macquarie Capital Securities, also cautioned that unsecured loans and consumer durables are likely to see higher non-performing assets (NPAs) and that their earnings will be badly hit, in the short-term.

He was, however, gung ho about the prospects of housing finance/ mortgage lenders which he said are relatively safer.

Kotak Securities also sent a chilling warning: “The current round of demonetisation is likely to disrupt the small business ecosystem in the near term, as the segment operates largely in cash”. “We see challenging times for real estate, small businesses and CV finance,” it added in a grim tone.

Ill-timed, bargain-basement selling by Narayana Murthy?

Prima facie, it appears that Narayana Murthy’s abrupt selling of Can Fin Homes may not be justified. This is for four reasons:

(i) According to Varinder Bansal’s data, Can Fin Homes’ exposure to LAP and the construction sector is about 12% of its book value. This is the lowest amongst its peers;

(ii) Can Fin Homes has issued an official statement that the downward correction in property prices in the wake of demonetization augers well for the housing finance sector because demand will pick up.

(iii) SK Hota, MD of Can Fin Homes, called demonetization “the best thing that could have happened”. His precise words:

“For demonetisation, there is a lot of discussion happening in the media. As far as the ground realities are concerned for the genuine home buyers, this is the best thing that could have happened because somewhere the property prices are expected to discover the real values now. Some correction is expected. If at all, there is some 10-15-20 percent correction in the prices of homes then for genuine home buyers this is the right time because the houses will be much more affordable for them and along with that this year the Seventh Pay Commission is there, good monsoon is there, everything else is very positive. With that, demonetisation will have a positive impact as far as the real home buyers are concerned.”

(iv) Ventura recommends buy of Can Fin Homes with target price of Rs. 2,175.

As usual, Ventura’s logic is impeccable:

Can Fin Homes Ltd (CFHL) ticks all the boxes that investors expect from Housing Finance Companies. It has strong and rising NIMs, growing loan book with low risk, hungry management that sets challenging targets for self and growth without dilution. We believe Can Fin can sustain high P/BV multiple and reward patient investors as it chases target of loans of Rs. 350bn by FY20 from Rs.135bn at end FY16. We initiate coverage on CFHL with BUY with a target price of Rs.2,175, implying an upside of 29% from the CMP of Rs. 1,685.

Conclusion

The mystery as to why Narayana Murthy panicked and rushed to Dalal Street to dump Can Fin Homes requires to be probed dispassionately. Was it a knee-jerk reaction or a carefully thought out game plan? If it is the latter, does it spell the end-game for the sector? These are seminal questions for which we need answers ASAP because we will have to tailor our own investing strategy around that!

Looks like mr Murthy is in selling mood, or in panic….. today he sold swaraj engines

THE LAP share of CANFIN loan is just 6%. And half of that is to salaried class. Here are key take away from Canfin Concall yesterday.

Take away from Canfin homes (CFHL) Conference call today. Mr. Sarda Kumar Hota, MD and Mr. Atanu Bagchi, CFO CFHL participated.

Due to demonetization and Govt efforts to curb on black money, the real value of real estate will be discovered and chances are that prices may fall. CFHL hopes to benefit from this scenario as housing will become more affordable. Majority CFHL loan customers are first timer house buyers. Plus CFHL gives loan against the registered value of the property and not the AGREEMENT value.

Home buying(especially for first timers) will be easier as the property prices are expected to be more accessible.

Canfin homes is growing at a controlled pace. The key geography remains South India with cautious forays in Western and North India.

Expects some delays in loan repayments. 78% of loan book are housing.12% loans are non-housing. Sites (plot) purchase is categorized under non-housing.

Total LAP is mere 6% (50% salaried and 50% non-salaried). LAP average ticket size is 10 lacs. Canfin Homes not keen in LAP as there is no cash flow based repayment.

More money is coming into the system which will be good for Canfin Homes as the ‘cost of funds’ to lower further. Canfin hopes to pass over the lower fund cost benefits to the home buyer. Affordable housing and affordable interest rates is a sweet spot for Canfin Homes. CFHL expects a strong loan demand as more clarity comes through.

Builder loans will see some impact in short term. Though it constitutes just 0.19 % (23 crores) of CH loan book.

CFHL sticks to its guidance of a loan book of 13,500 Crore by March’17. CFHL plans to grow at 28-29% for next few quarters and hope a 30% growth rate thereafter.

CFHL does not expect a need for a fund raise in any near future.

No confirmation on Canara bank offloading its stake in CFHL.

Concerns that affordable housing (around 15-18 lacs) is not readily available. Hopeful that govt will encourage low-mid cost housing development.

14 LikesReply

Here are key take away from the Canfin Homes con call yesterday.

Take away from Canfin homes (CFHL) Conference call today. Mr. Sarda Kumar Hota, MD and Mr. Atanu Bagchi, CFO CFHL participated.

Due to demonetization and Govt efforts to curb on black money, the real value of real estate will be discovered and chances are that prices may fall. CFHL hopes to benefit from this scenario as housing will become more affordable. Majority CFHL loan customers are first timer house buyers. Plus CFHL gives loan against the registered value of the property and not the AGREEMENT value.

Home buying(especially for first timers) will be easier as the property prices are expected to be more accessible.

Canfin homes is growing at a controlled pace. The key geography remains South India with cautious forays in Western and North India.

Expects some delays in loan repayments. 78% of loan book are housing.12% loans are non-housing. Sites (plot) purchase is categorized under non-housing.

Total LAP is mere 6% (50% salaried and 50% non-salaried). LAP average ticket size is 10 lacs. Canfin Homes not keen in LAP as there is no cash flow based repayment.

More money is coming into the system which will be good for Canfin Homes as the ‘cost of funds’ to lower further. Canfin hopes to pass over the lower fund cost benefits to the home buyer. Affordable housing and affordable interest rates is a sweet spot for Canfin Homes. CFHL expects a strong loan demand as more clarity comes through.

Builder loans will see some impact in short term. Though it constitutes just 0.19 % (23 crores) of CH loan book.

CFHL sticks to its guidance of a loan book of 13,500 Crore by March’17. CFHL plans to grow at 28-29% for next few quarters and hope a 30% growth rate thereafter.

CFHL does not expect a need for a fund raise in any near future.

No confirmation on Canara bank offloading its stake in CFHL.

Concerns that affordable housing (around 15-18 lacs) is not readily available. Hopeful that govt will encourage low-mid cost housing development.

He must have some margin call on his USA poll positions.

Demonetization of the black money is one of the bold steps that is been taken by this govt, for this most of the black money will swipe out from the economy which adversely effect the real estate sector. But if we dig dipper into the nbfc space then we can see that there are two types of lenders are present in the market – one operates in the big-ticket financing another one deals with the small ticket financing. As the real estate prices are likely to be impacted, for which the big-ticket guys are likely to face the hit though if the property prices drop more than 15% then people will tend to buy the real estate which will help them to acquire new customers, which will help them to mitigate the threat of being adversely affected by the black money clean up process.

Now come to the small ticket nbfc players, this co.’s are used to lend money in 5-15 lac bracket, in this segment the prices of the property will not get impacted rather than the prices are likely to surge as the poor and the middle class people will earn more money, new jobs will be created and this will help the total small ticket segment to grow at much faster rate than the previous growth rate. Though for coming 1-2 months but after some time it will be fixed.

So, don’t worry. Start buying this shares from the current level.

Earlier I never belived in reincarnation , rebirth and words like history repeats,but now there is no reason left to disbelive .Indian Econmy will pay a heavy price .A Modi Made Big Recession has already set in and will result into large no of job losses and misery to poor and lower middle class specialy working in unorganised sector which are more than 85% of our workforceIt is severe body blow to Indian Economy.Any body predicting size of disaster will grossly fall short in that .First a confident PM assures that every thing will be right in two days,then Govt said 7 days,then FM said in two weeks and now PM already gone to 50 days. Already a confused Govt has revised its decisions in almost double digits in less no of days. .PM was Laughing just after taking the Decision in Japan, after returning to India start weeping on stage , may be due to his unpreparedness .Let hope he comes out of his confusion and finaly decides , it is matter of Joy (Laugh) or sorrow( cry ) to him.

Relax Kharb Ji. No recession in sight. And it’s the greatest positive thing for the Indian economy.

Wish you to be right.

Strange that Varinder got the LAP for CanFin wrong. It is 6% and not 12% and that too to the salaried class. Glad that Ramandeep pointed it out.

This is one of the best HF companies to be invested in. Those holding can continue to hold. There will be short-term pain but we’ve made some good money already. 🙂

Canfin Homes seems like a good bet with the recent price drop.

Narayana muthy ji will later realise when he will see the price of Can fin homes after 10 years. No doubt the price will multiply upto 10x from the current levels… Motilal oswal has huge stake in it..