Dolly Khanna takes Baby steps back into Dalal Street

Dolly Khanna, who was the inspiration of the Bulls in the previous Bull markets, is conspicuous by her absence in the present Bull market.

In July 2019, she had feared that the markets were overvalued and had aggressively pared her holdings.

“The current rally is irrational exuberance. I am a bit skeptical about it,” Rajiv Khanna, Dolly’s illustrious alter ego, had clearly warned.

This cautious strategy also enabled Dolly to escape the dreadful CoronaVirus meltdown that the markets witnessed in March 2020.

Chennai-based Rajiv Khanna, who invests in the name of his wife Dolly Khanna, pared his holding in at least 10 companies. @iYashUpadhyaya

Read more: https://t.co/sWMX9njymN pic.twitter.com/pUQLisBFXt

— BloombergQuint (@BloombergQuint) July 24, 2019

However, the cautious strategy has now backfired big-time because the markets have surged like a supersonic rocket.

Dolly missed out on all the mega multibagger gains that her previous holdings like Cera Sanitaryware, ADF Foods, Relaxo etc are effortlessly delivering (see Dolly Khanna lost colossal fortune of Rs. 100 crore by prematurely dumping Relaxo Footwear from portfolio).

In fact, her latest portfolio is a pale shadow of its previous glorious self.

| Latest Portfolio Of Dolly Khanna | |||

| Company | CMP (Rs) | Nos of shares | Value (Rs Cr) |

| Rain Industries | 136 | 53,53,625 | 73 |

| NOCIL | 161 | 16,84,410 | 27 |

| KCP | 76 | 31,55,543 | 24 |

| Nucleus Software | 547 | 358,251 | 20 |

| Butterfly Gandhimathi | 626 | 268,050 | 17 |

| NCL Industries | 166 | 483,580 | 8 |

| Talbros Automotive | 200 | 144,492 | 3 |

| Total | 172 | ||

Talbros Automotive is Dolly Khanna’s latest stock pick

Dolly has a good understanding of the automobiles sector and has earlier packed her portfolio with winners from it.

Some auto names that come readily to mind include Sterling Tools and PPAP Automotive, both of which blossomed into glorious multibaggers.

(Incidentally, Sterling Tools is one of the favourite stocks in Saurabh Mukherjea’s Little Champs portfolio)

Talbros Automotive is Dolly’s latest pick from the auto sector.

A study of the shareholding pattern reveals that she is the single largest individual shareholder with a holding of 144,492 shares (1.17%), worth about Rs. 3 Crore, at the CMP of Rs. 200.

Talbros Auto is a micro-cap with a market capitalisation of only Rs. 245 crore.

It was established in the year 1956 to manufacture Automotive & Industrial Gaskets in collaboration with Coopers Payen of UK.

It now manufactures Gaskets, Heat Shields, Forgings, Suspension Systems & Modules, Anti Vibration components and Hoses.

The Talbros Group has partnerships with global giants such as Nippon Leakless Corporation of Japan, Magneti Marelli of Italy, Marugo Rubber of Japan and technology partners such as Sanwa Packaging of Japan and Interface Solutions of USA.

The latest Investors’ Presentation of the Company throws considerable light on the proposed game plan and the financials.

| TALBROS AUTOMOTIVE COMPONENTS LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 246 | |

| EPS – TTM | (Rs) | [*S] | 8.46 |

| P/E RATIO | (X) | [*S] | 23.58 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 5.00 | |

| LATEST DIVIDEND DATE | 15 SEP 2020 | ||

| DIVIDEND YIELD | (%) | 0.25 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 147.78 |

| P/B RATIO | (Rs) | [*S] | 1.35 |

| TALBROS AUTOMOTIVE COMPONENTS LTD – FINANCIAL RESULTS | |||

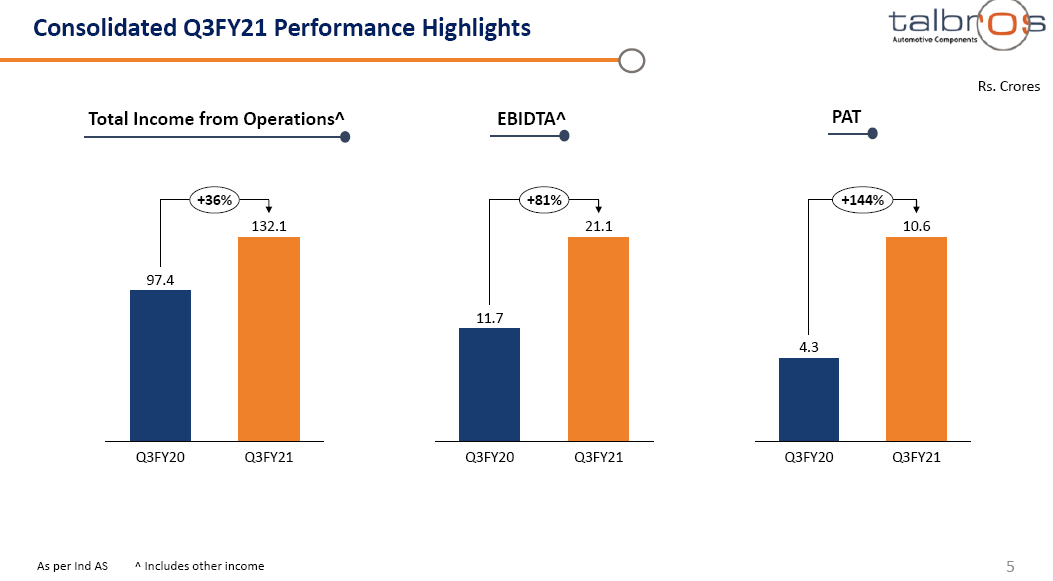

| Particulars (Rs Cr) | DEC 2020 | DEC 2019 | % CHG |

| Net Sales | 129.52 | 95.43 | 35.72 |

| Other Income | 5.25 | 4.12 | 27.43 |

| Total Income | 134.77 | 99.55 | 35.38 |

| Total Expenses | 110.93 | 85.7 | 29.44 |

| Operating Profit | 23.83 | 13.85 | 72.06 |

| Net Profit | 10.55 | 4.32 | 144.21 |

| Equity Capital | 12.35 | 12.35 | – |

(Source: Business Standard)

Why is Talbros a good buy? Expert explains

Sandeep Jain, a noted expert, has explained the merits of Talbros Auto in a succinct manner and recommended a buy.

He has opined that the stock has a target price of Rs. 250.

However, it appears that the target price is conservative given Dolly’s skill in picking multibaggers.

जैन सा'ब के GEMS

संदीप जैन से जानिए कौन से हैं वो ट्रिगर्स जिसके दम पर Talbros Automotive का शेयर पकड़ेगा रफ्तार?@AnilSinghvi_ @SandeepKrJainTS pic.twitter.com/Whq0DUt4pM

— Zee Business (@ZeeBusiness) February 12, 2021