Heritage Foods – sale of loss making retail division will boost profits

Dolly Khanna has to share the honour of discovering Heritage Foods with Vijay Kedia. Vijay Kedia had ceremoniously recommended the stock to us as his Diwali Gift of 2015.

It is a testament to Vijay Kedia’s stock picking skills that he recommended Heritage Foods on the basis that the stock is/was undervalued because of the retail division and that the same would either be turned profitable or jettisoned by the management in due course of time. In either event, there will be a re-rating of the stock, Kedia assured in his customary cheerful style.

The latter probability came true yesterday when Heritage Foods announced that the retail and allied business would be sold to Kishore Biyani’s Future group.

Future Retail to acquire retail and allied business of Heritage Foods https://t.co/rbKnMOWsMT

— Livemint (@livemint) November 7, 2016

(Nara Lokesh and Brahmini Nara with Kishore Biyani)

Heritage Foods to be re-rated and to catch up with valuations of arch rival Hatsun Agro

Vijay Kedia had meticulously explained at the time of his recommendation that while Heritage Foods was quoting at a rock bottom valuation of 1x sales, its arch rival Hatsun Agro was demanding a valuation of 1.5x.

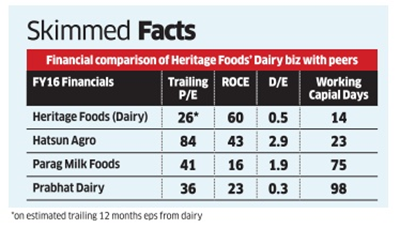

Jwalit Vyas of ET has conducted an in-depth analysis of the financials of Heritage Foods and its peers and confirmed the veracity of this proposition.

He has further explained that even in terms of P/E, Heritage Foods is at rock-bottom valuations. While Heritage Foods can be bought at 22x FY17 earnings, its peers like Parag Milk Foods, Prabhat Dairy and Hatsun Agro Products are quoting an astronomical P/E of 35-80x.

| COMPANY | CMP (In Rs) |

MKT CAP (Rs Cr) |

P/E (x) |

| Hatsun Agro | 344.65 | 5245.57 | 84.68 |

| Kwality | 135.70 | 3203.88 | 21.24 |

| Parag Milk Foods | 312.35 | 2627.18 | 51.37 |

| Heritage Foods | 876.35 | 2033.13 | 32.53 |

| DFM Foods | 1964.05 | 1964.05 | 76.93 |

| Prabhat Dairy | 114.45 | 1117.95 | 40.88 |

| Vadilal Inds. | 539.45 | 387.86 | 24.13 |

| ADF Foods | 171.65 | 363.90 | 43.79 |

It is obvious that Heritage Foods will now be re-rated and the valuation gap between it and its peers will narrow sooner or later.

Research reports expected from Ventura Securities and Religare

Heritage Foods is closely tracked by Ventura Securities and Religare.

Religare had recommended a buy of Heritage Foods in December 2015 on the basis that the stock has “tremendous potential”.

Ventura Securities recommended a buy in May 2016 on the basis that the stock is a “compelling opportunity” and that it has a magnificent upside of 81%.

Needless to say, both projections have come true and the respective target prices have been achieved.

It is important to bear in mind that these projections were made at a time when Heritage Foods was still burdened with the loss making retail division. How much upside is expected now that the Company is free as a bird to soar in the skies requires to be seen.

Dolly Khanna and Rajiv Khanna have their own dairy business

Few people are aware that Dolly Khanna and Rajiv Khanna have a milk distribution business of their own called ‘Kwality Milk’ which sells milk under the brand name ‘Sona’.

Rajiv Khanna revealed that after he and Dolly sold off the ice-cream business to Hindustan Lever (which now sells it under the ‘Walls’ brand name), he decided to start selling milk in Madras and neighbourhood areas.

In the course of his presentation, Rajiv Khanna reeled out impressive facts relating to the milk business and how there is an unending demand for the product.

It is a matter of pride that given the business acumen of Rajiv and Dolly Khanna, Kwality Milk is today a force to reckon with in the city of Madras and the neighbourhood areas.

Prospects for the dairy industry

We must also bear in mind the illuminating research report issued by Ambit as to the scope of the dairy industry in India.

Ambit has pointed out that the process of procuring raw milk from the villagers and converting it into branded value added products like paneer, cheese, butter, lassi etc results in hefty profit margins. Also, the changing dietary habits of the population and increased consumption of dairy products augers well for this business.

This proposition was also confirmed by Shyam Sekhar, the noted value investor.

Shyam Sekhar revealed that Hatsun Agro is his favourite dairy stock.

Ambit also stated that Hatsun Agro is its preferred stock pick from the dairy sector.

However, whether the recent development relating to Heritage Foods results in a change of preference amongst the savvy investors requires to be seen.

Conclusion

Prima facie, all the circumstances appear to be positive for Heritage Foods. However, we will have to await formal research reports from Ventura, Religare and the other experts for a proper appreciation of the stock’s potential to shower gains on the investors!

I don’t know about the quality of milk they are supplying to other parts of India but I can surely say that the quality of Heritage brand milk that I’ve used here in Bangalore for the last year is of below standard, especially the toned milk which is made out of buffalo milk. The quality of milk coming from DODLA DAIRY is much better than this. Heritage has other good products which might be boosting its revenue.

Best comment and information I have seen in a very long time in this forum. Though I no longer make any comments related to stocks and investing because I was not allowed to make honest and sincere comments I am glad that some people are still making genuine and helpful comments

@prasanna : mix both and drink. Heritage won’t taste so bad then.

Yeah, Thanks for the solution. You seem to have done a lot of mixing.

Dolly Khanna pruned her position in heritage below 1% as on Sep 30, 2016.

yes its an imp fact missed out, so question does arise if the valuation is right or sustainable

At 84 PE – will Hatsun deliver multibagger or just a top nearby for short-term. It has to come down to become a multibagger. It has to test patience level.