Porinju Veliyath buys 150,000 shares of Royal Orchid Hotels in bulk deal

Porinju was one of the first to recognize the potential of Royal Orchid Hotels, a micro-cap with a market capitalisation of only Rs. 327 crore.

On 31st December 2015, Porinju bought (in the name of Sunny) 150,000 shares at Rs. 66.25 per share.

He later explained the investment rationale behind his purchase of the stock:

“There could be companies like the Royal Orchid. It is in a very good expansion mode and a very clean company. It is mostly into management of the hotels, Oriental Hotels. That segment is to be looked at. The sentiment has been bad on the industry for last many years, so these companies are available at a very attractive valuations. That is why I would like to talk about these. And after many years in spite of the fact that too many hotels have come up, too many properties are happening, still there is like shortage of hotel rooms in the five star and four star segments, mostly during seasonal time. So, that is very positive for the profit margins for these companies can go up.”

Porinju has been well rewarded for his investment decision because the stock is up 81% since then.

His present holding in Royal Orchid is not known.

Ashish Kacholia holds 10,73,587 (3.94%) of Royal Orchid Hotels

Ashish Kacholia had to make multiple forays into Dalal Street before he could get the quantity that he was looking for.

He came on 4th and 5th January 2016 and also had to commute between the BSE and the NSE to persuade the shareholders to part with their holdings.

As of 30th June 2017, Ashish Kacholia holds a treasure trove of 10,73,587 shares of Royal Orchid Hotels comprising 3.94% of its equity capital.

Promoters and other illustrious shareholders control bulk of floating stock

The promoters, which are led by Chander Kamal Baljee and his family members, hold 70.80% of the equity.

Amongst the public shareholders, there are well known names like Rahul Kayan with a 1.48% stake.

The other shareholders include luminaries like Rajasthan Global Securities and Rahul Goenka.

The bottomline is that between the promoters and the illustrious investors, a major chunk of the equity is accounted for which means that there is very little floating stock for mom and pop investors to buy.

This obviously means that the stock enjoys the coveted “scarcity premium”.

Business model – asset light strategy

Chander K. Baljee, the MD and promoter, has summed up the business model of the Company in a succinct manner:

“Three years back we decided to adopt the asset-light strategy and we started aggressively for getting management contracts. Just to give an idea, in the last one year, we have added about 8 hotels having 374 rooms and this trend will continue over the next couple of years. Today we have about 43 hotels in our portfolio, out of which 10 are owned/leased hotels and 33 are managed hotels. We plan to go up to 45 managed hotels in the next one year. This strategy is working well and we are finding that, on a standalone basis, this subsidiary, which runs all of these managed hotels, has crossed the breakeven level and has turned profitable this year. So, I think going forward this is only going to grow.”

He explained the future outlook for the hospitality sector in the following words:

“We see a robust outlook for the hospitality industry and for Royal Orchid in the current financial year mainly due to limited supply of new properties and various initiatives undertaken by the government to promote tourism especially in tier-II and tier-III cities.

… With a consistently growing middle class and increasing disposable income, the tourism and hospitality sector is witnessing a healthy growth and accounts for 7.5 per cent of the country’s GDP. According to a report by KPMG, the hospitality sector in India is expected to grow at 16.1 per cent CAGR to reach Rs. 2,796.9 crores in 2022.”

| ROYAL ORCHID HOTELS LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 327 | |

| EPS – TTM | (Rs) | [*S] | 4.22 |

| P/E RATIO | (X) | [*S] | 28.44 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 10.00 | |

| LATEST DIVIDEND DATE | 02 MAR 2017 | ||

| DIVIDEND YIELD | (%) | 0.84 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 73.81 |

| P/B RATIO | (Rs) | [*S] | 1.63 |

[*C] Consolidated [*S] Standalone

| ROYAL ORCHID HOTELS LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | JUN 2017 | JUN 2016 | % CHG |

| NET SALES | 21.59 | 19.38 | 11.4 |

| OTHER INCOME | 2.06 | 1.09 | 88.99 |

| TOTAL INCOME | 23.66 | 20.47 | 15.58 |

| TOTAL EXPENSES | 19.48 | 18.41 | 5.81 |

| OPERATING PROFIT | 4.17 | 2.06 | 102.43 |

| NET PROFIT | 1.15 | -0.54 | 312.96 |

| EQUITY CAPITAL | 27.23 | 27.23 | – |

Royal Orchid Hotels is “on the cusp of graduation” and a “strong buy”: Stewart & Mackertich

Stewart & Mackertich has issued an initiating coverage research report in which it has recommended a buy on the following logic:

“We initiate coverage on Royal Orchid Hotels (ROHL) with a Strong Buy rating. Our rating underpins the company’s rapid expansion in the hospitality space, its rich property portfolio, new hotel launches and strong management bandwidth.

Investment highlights

Diversified portfolio across categories and locations:

The Company has 42 operational properties with a collective inventory of 3,159 rooms spread over 28 cities. The properties are spread across wide price categories ranging from 5-star to budget category rooms targeting leisure as well as business travelers. ROHL is all set to reach to 50 properties by the end of FY18.

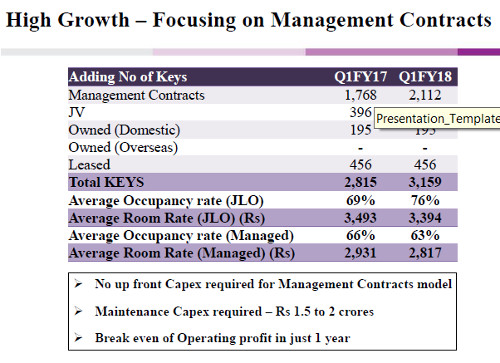

Clear focus on management contracts implying asset light strategy:

The Company started its operations through the ownership model by setting up two hotels in Bangalore. However, over the past 3-4 years, it is increasingly focusing on expanding operations through management contracts and leasing rather than owning the properties. Under management contract, the company charges 2-3% of the revenue as management fees and an incentive fee which varies from 6%-8% of the gross operating profit. ROHL bears no expenses and even the onus of renovation of the property is on the property owner. Out of the 3,159 room keys, 2,112 rooms are under management contracts.

Reduction in GST rate to positively impact the Company:

Royal Orchid Hotels used to pay 21% tax under the pre-GST regime. The GST council has reduced the GST rate on restaurants in five-star and luxury hotels (room rent up to INR7,500) from 28% to 18%, bringing it on par with standalone air-conditioned restaurants. This move is expected to benefit the Company as a majority of Royal Orchid’s rooms fall under this bracket.

The business is expected to perk up from FY18

– Asset Light Business Model (insignificant Capex): The Company started its operations through the ownership model by setting up two hotels in Bangalore. However, over the past 3-4 years, it is increasingly focusing on expanding operations through management contracts and leasing rather than owning the properties. Under management con-tract, the company charges 2-3% of the revenue as management fees and an incentive fee which varies from 6%-8% of the gross operating profit. Out of the 3,159 room keys 2,112 rooms are under manage-ment contracts. Under this model, ROHL bears no expenses and even the onus of renovation of the property is on the property owner. In FY17, its consolidated revenues stood at INR162 Crores, apart from this, its revenues from managed properties stood at INR128 Crore. This is expected to go up significantly in the near future as all the 12 properties which it plans to add this fiscal would be under manage-ment contracts.

– Improving Occupancy: Currently, ROHL is sitting at an occupancy of 69% across all of its hotels. However, some of its hotels such as Royal Orchid Central Pune and Royal Orchid Central Grazia, Navi Mumbai, the occupancy is close to 85%. Some of the new properties which have been added during the past two years haven’t achieved high occupan-cy which is averaging out the total group occupancies. This is poised to turnaround in the coming year when the occupancy goes up and reaches an optimum level. The company is planning to develop its land in Powai (Mumbai) under a joint development model (no upfront capex). Looking at the current occupancy rate of its property in Mum-bai, this seems to be a prudent decision, especially considering the fact that the hospitality industry is going through an up cycle.

– Lower Finance Costs: The management’s efforts to reorganize the Company’s debt are paying off. ROHL’s debt have gone from a five-year to 10-year repayment period. The interest rates have also come down from about 16% to 13.50%, as a result the interest expense has come down from INR14.92 Crore in 2015 to INR12.15 Crore in 2016.”

Royal Orchid is quoting at attractive valuations: ET

Rajesh Naidu of ET Bureau has conducted a thorough study of the affairs of Royal Orchid Hotels. He has opined that the asset light business model, low debt, diversified presence across various segments of accommodation, and lower taxes after GST has “burnished the allure” of the Hotel.

He has opined that mid-sized hotels, which have leaner balance sheets and no presence internationally, are expected to benefit more from the rising affordability quotient at home as well as the gush of foreign tourists into the Country.

He has also emphasized that Royal Orchid has reduced its debt to equity ratio to 0.5 in FY17 from 1.2 in FY13. Also, the fact that more than 60 per cent of its rooms are on management contract shows that the Company largely follows an asset-light business model.

The implementation of GST augers well because the Hotel will be paying 18 per cent tax compared with 21 per cent in the pre-GST regime. This is because most of the rooms are priced below Rs 7,500 a night.

As regards valuations, Rajesh Naidu explains that considering FY19 estimated EBITDA, the hotels’ enterprise value (EV) is 8.1 times EBITDA. This is quite attractive considering its past three year average EVEBITDA of 10.3.

Investors’ presentation

The latest Investors’ presentation throws considerable light on the size of the Indian Tourism Sector, the huge opportunity therefrom for branded hotels and the mismatch between supply and demand.

There is also information about the asset light model which generates free cash flows (FCF) together with details of the several properties held by the Company.

Information is also provided of the growth in rooms and members over the years.

Conclusion

Prima facie, the logic as to why Royal Orchid Hotels is investment worthy is quite convincing. The stock does look like a powerhouse with the wherewithal to fill our portfolios with hefty gains in the foreseeable future!

A very professional and focused Management with excellent business model. But for the downfall in hospitality sector Royal Orchid has a very high dividend payout history. Stock has not reached even it’s IPO price of Rs.165 of 2006. Company is likely to become debt-free in near future by selling it’s non-core assets (land at Tanzania and Misc parcel of lands). Stock poised for a very high trajectory. Best scrip in small cap segment of hospitality sector. Immediate trigger may be development/JV of 50,000 sq ft of Pawai (Mumbai) land which is valued around 80 to 100 crores.

Why a company which is basically a asset-light model company with most of the ‘keys’ on contract basis rather than self-owned basis should have a D/E ratio of even 0.55 at all.

Because it’s a hybrid model !! Company has adopted Asset Light Model since last four years. Before that it had owned assets which it is continuing. It has marquee assets at Bangalore a 100% Five Star Hotel with 195 keys, two four star Hotels which is more than 50% as Subsidiary, one five star hotel at Jaipur in JV on 50 : 50 basis and one four star hotel at Goa again a subsidiary. These units will have some debts and that is why debts are there but within very manageable limits.

Please note Ashish has sold his 3+% share this week. As usual we know only when porinju buys and not when he sells..(it could be after his tweet)….so blind following him is a death trap for retail investors.

I personally follow this site and like most of the articles…i have benefited in stocks like veto switch gear….thanks to this site.

And Ashish Kacholia’s entire holding in block deal has been purchased by Royal Bank of Scotland A/c Jupiter India Fund. Rather Fund has bought more.