Rain Industries, Apple of Mohnish Pabrai’s eyes

There is no doubt that Rain Industries is the apple of Mohnish Pabrai’s eyes.

He never tires talking about it. He has also made it a prop for illustrating esoteric investment theories.

When explaining the complex concept of “Margin of Safety”, Mohnish cited the example of Rain Industries.

“The price I was paying in 2015 was around Rs 30 or Rs 35 a share. It is approximately equal to the earnings per share of the company in around 2018 or 2019. So if I put in Rs 35,000, (about 1,000 shares) in four years, the company is going to make Rs 35,000 on those shares every year. So, it was a complete no-brainer. Anytime you can get to invest in a business at one times earnings, do not think about it too much”.

Rain Industries also figures prominently in Mohnish’s talks about his favourite “Heads I Win, Tails I Don’t Lose Much” theory.

Mohnish also took the aid of Rain Industries to drive home the point that investors should “water the flowers” and “cut the weeds”, meaning that they should hold on tight to the winning stocks whilst dumping the junkyard losers.

“We are not going to cut the flowers and water the weeds. It is a very stupid gardener who cuts flowers and waters weeds,” Mohnish said in reply to a query by a bright-eyed student on when he intends to encash the massive gains from Rain Industries.

Yet another theory propagated by Mohnish is that investors should not be in a hurry to book profits only because the stock price has surged like a rocket in a short time.

“30 months ago, we put less than $11 Million into it. Today, it is worth $90 Million. What am I supposed to do if the stock goes up 9x?” Mohnish asked, implying that inaction is the best course of action in these circumstances.

Rain Industries, also the Apple of Dolly Khanna’s eyes

Rain Industries dominates Dolly Khanna’s portfolio.

Dolly has allocated a mammoth 36% of her portfolio to Rain Industries. The investment is worth Rs. 311 crore.

Manappuram Finance comes second in the portfolio with an allocation of 12% aggregating Rs. 102 crore.

GNFC and NOCIL are tied for third place with an allocation of about 8% each.

A number of sundry stocks like IFB Industries, Nilkamal, Thirumalai Chemicals, Srikalahasthi Pipes etc make up the rear of the portfolio.

In a talk to investors at the Kotak Mid-cap conference, Rajiv Khanna, Dolly’s alter ego, stated that “India needs to move beyond value investing”.

India needs to move beyond value investing, says Rajiv Khanna. #LetsTalkMidCap

— Kotak Securities Ltd (@kotaksecurities) December 11, 2017

This implies that we have to focus on “growth” stocks and not on “value” stocks.

This also suggests that Rain Industries is a “growth” stock.

Rajiv Khanna also advised that the strategy should be “all about the next 5%”.

My strategy now-a-days is all about the next 5%. It helps me invest better and keep calm, says Mr. Rajiv Khanna. #LetsTalkMidCap

— Kotak Securities Ltd (@kotaksecurities) December 11, 2017

This implies that we have to focus on stocks which are safe and offer steady compounding returns.

This also implies that Rain Industries is expected to churn out fabulous compounding gains year after year.

(Three Musketeers: Rajiv Khanna, Mohnish Pabrai & Porinju Veliyath)

(Three Musketeers: Rajiv Khanna, Mohnish Pabrai & Porinju Veliyath)

Rain Industries has more upside but is not a “screaming buy”

In his last interview, Mohnish was asked point-blank by the interviewer whether Rain Industries is still a good buy.

Mohnish opined that Rain Industries does have a lot more steam to it.

However, he also dashed our hopes by declaring that he would not buy Rain Industries at the present valuations because it is not a “screaming buy”.

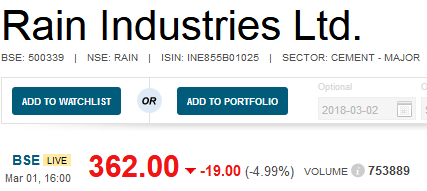

The warning by Mohnish was timely because Rain Industries has been quite soft and is sinking slowly and steadily.

The baffling aspect is that the softness has come about despite robust Q3FY18 results.

Of course, one must bear in mind that Rain Industries has given a mind-boggling gain of 1029% (10-bagger) over 24 months and 300% over 12 months and so we cannot grudge it the right to take a breather from time to time.

What made @MohnishPabrai buy Rain Industries? @_nirajshah https://t.co/3lTmaZmA6c pic.twitter.com/vItOJVDY8q

— BloombergQuint (@BloombergQuint) December 30, 2017

(Mohnish Pabrai with 11x Billionaire Uday Kotak. Mohnish complimented Uday Kotak for “amazing execution”)

Rain Industries has 37% upside: IDBI Capital

IDBI Capital was the first discoverer of Rain Industries’ multibagger potential.

They first recommended a buy of the stock in December 2016 when it was available at the throwaway valuation of Rs. 54.

Thereafter, the wizards at IDBI Capital have been diligently increasing the price target to keep pace with Rain Industries’ rapid ascension.

In the latest research report, IDBI Capital has projected a target price of Rs. 522 for the stock which is a whopping 37% upside from the CMP.

As always, the logic cannot be faulted:

“Carbon segment spreads on an uptrend

Summary

Rain Industries reported better than expected Carbon Product segment profitability during Q4CY17, despite weak volumes on delayed shipments; volumes should recover in Q1CY18 though.

Carbon Products EBITDA/tonne at Rs8,426 (+125.6% YoY, +11.8% QoQ) was ahead of our forecast. Segment EBTIDA grew to Rs6.4 bn (+104.1% YoY, +1.2% QoQ) despite fall in volumes to 0.7 mn tonne (-9.2% YoY, -10.0% QoQ).

In light of better than expected Carbon Products profitability and anticipated higher spreads for CPC/ CTP, we raise our CY18 margin estimates. We maintain BUY rating with a revised target price of Rs522 (earlier Rs418).”

(Ramesh Damani with Mohnish Pabrai)

Rain Industries has 29% upside: Motilal Oswal

Motilal Oswal came late to the party.

They first recommended the stock in November 2017 and assured a “normal” price target of Rs. 362 and a “Bull case” price target of Rs. 615.

To their credit, the target price of Rs. 362 has been achieved and investors are richer by 33% in just a few months.

In the latest research report, Motilal Oswal has revised the “normal” target price to Rs. 492, which offers a further upside potential of 29% from the CMP.

The logic is worth being reproduced verbatim.

“Temporary volume delay the only blip in an otherwise strong quarter

Maintain Buy

Rain Industries’ (RAIN) 4QCY17 EBITDA increased 4% QoQ (+58% YoY) to INR6.9b, as higher realization was offset by lower volumes due to timing issues with some dispatches. Adj. PAT increased 37% QoQ to INR3.3b, led by a lower effective tax rate (~21% v/s ~40% in 3QCY17). We note that the INR0.8b exceptional gain from the deferred tax reversal due to US and Belgium tax rate changes was offset by INR1.1b in charges on prepayment of debt.

Carbon division volumes were down ~10% QoQ to 744kt. CPC realization increased USD78 QoQ to USD415/t and CTP by USD107 QoQ to USD708/t. Division EBITDA/t increased USD15 QoQ to USD133. Management expects to maintain the current margin levels in 1QCY18.

Chemical division volumes were largely unchanged QoQ at 53kt. EBITDA/t increased by USD20 QoQ to USD58.

Cement division volumes were largely unchanged QoQ at 509kt. Realization was down 4% QoQ to INR4,173/t. EBITDA/t decreased 3% QoQ to INR515.

Net debt was unchanged YoY due to an increase in working capital, but should reduce 1QCY18 onward.

CPC market outlook remains positive, led by growing aluminum demand and limited supply addition. Debt repayment will result in annual interest cost saving of USD25-30m from CY18.

The stock trades at 8.9x P/E and 5.4x EV/EBITDA CY19E. We value RAIN at 6.5x EV/EBITDA CY19E to derive a TP of INR492/share. Maintain Buy“.

Conclusion

Mohnish Pabrai’s diktat that he would not buy Rain Industries at the present valuations has put us in a quandary. On the one hand, we cannot defy Mohnish. At the same time, leading experts have projected hefty targets for the stock. One way to resolve this is for us to look at Mohnish Pabrai’s latest stock pick. This stock is said to be a “hidden gem” by experts and may walk in the illustrious footsteps of Rain Industries. This way we can still rake in multibagger gains while staying in Mohnish’s good books!

What is members views about Mahindra Logistics as a compounder in long term.

Among Nifty or Sensex mega cap stocks,it looks L&t has clear runway for smooth take off even when market is going through troublance. No recommendation but just for discussion among members.

While L&T is a great compounder, ugly duckings L&T INFOTECH and L&T technologies are turning into swans. L&T infotech has doubled from 710 listing price to 1450 in 1.5 years quietly. Still lot of steam left as mutual funds have started buying.I had talked about this around 800 . New management is successful in changing portfolio from legacy to digital..

Currently fairly valued but could surprise with a breakout as it’s getting rerated.

I hold L&T infotech

Rain industries has generated massive upside, it might take a while to regain upward momentum.