What is ‘Margin Of Safety’?

There is nobody better than Mohnish Pabrai to tutor us on the concept of Margin of Safety.

In an interview to Tanvir Gill of ETNow, Mohnish provided a masterful definition of what ‘margin of safety’ is and how to ensure its presence in the stocks that we buy.

“Return of capital is way more important than return on capital and so the concept of ‘margin of safety’ was introduced by Warren Buffett”, Mohnish said in his trademark drawl.

He further explained that the concept of margin of safety is that there should be a heavy discount to the intrinsic value of the stock and the price paid for it.

One should only buy those stocks which are quoting at a “significant discount” to their underlying value, so that even in the worst case scenario, the investor can salvage all or some of his capital, Mohnish added.

Real-life examples of ‘margin of safety’ stocks

Tanvir Gill cleverly asked Mohnish to illustrate the concept of ‘margin of safety’ with real-life examples from his own portfolio.

Mohnish obliged by referring to Rain Industries as a textbook example of a steeply discounted stock when he bought it.

“The price I was paying in 2015 was around Rs 30 or Rs 35 a share. It is approximately equal to the earnings per share of the company in around 2018 or 2019. So if I put in Rs 35,000, (about 1,000 shares) in four years, the company is going to make Rs 35,000 on those shares every year. So, it was a complete no-brainer. Anytime you can get to invest in a business at one times earnings, do not think about it too much,” Mohnish said with a big smile on his face at the massive 10-bagger gains that have gushed into his portfolio from Rain Industries.

Tanvir looked expectant, forcing Mohnish to elaborate further.

He cited the example of realty stocks which had been crushed by demonetization.

“These businesses got down in some cases to one-fourth of liquidation value. If you are buying a business at a significant discount to what you can liquidate it to and on top of it has a great earnings engine and good management and other good things, how can you lose?” Mohnish asked in a rhetorical tone even as Tanvir gazed at him with admiration.

10-year-old must be able to understand that the stock is undervalued

Mohnish further made it clear that the undervaluation must be apparent on the face of the stock and not require any number crunching.

“It must be extremely obvious. One of the key tests I use before I make an investment is can I explain the thesis to a 10-year-old without the 10-year-old losing attention within a couple of minutes?”

(Mohnish Pabrai with Charlie Munger)

Does KRBL meet the test of an undervalued stock?

Now, we have to turn our attention to KRBL, Mohnish Pabrai’s latest stock pick.

On Monday, 12th February 2018, Mohnish turned up at the counter of KRBL and bought a massive consignment of 64 lakh shares for his Pabrai Investment Funds.

He pumped in a massive fortune of Rs. 381 crore into the stock.

BULK DEAL ALERT:

KRBL Ltd. Deal Price Rs. 594

Buyer: @MohnishPabrai

THE PABRAI INVESTMENT FUND II LP – 2,400,000 shares

THE PABRAI INVESTMENT FUND IV LP – 4,018,491 shares

Seller:

ABDULLAH ALI BALSHARAF – 3,250,000 shares

OMAR ALI OBAID BALSARAF – 3,250,000 shares— Rohan Gala (@RohanG90) February 12, 2018

| KRBL LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 14,210 | |

| EPS – TTM | (Rs) | [*S] | 20.21 |

| P/E RATIO | (X) | [*S] | 29.87 |

| FACE VALUE | (Rs) | 1 | |

| LATEST DIVIDEND | (%) | 210.00 | |

| LATEST DIVIDEND DATE | 08 SEP 2017 | ||

| DIVIDEND YIELD | (%) | 0.35 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 87.67 |

| P/B RATIO | (Rs) | [*S] | 6.89 |

[*C] Consolidated [*S] Standalone

| KRBL LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | DEC 2017 | DEC 2016 | % CHG |

| NET SALES | 783.51 | 798.04 | -1.82 |

| OTHER INCOME | 4.2 | 1.77 | 137.29 |

| TOTAL INCOME | 787.71 | 799.81 | -1.51 |

| TOTAL EXPENSES | 603.02 | 619.12 | -2.6 |

| OPERATING PROFIT | 184.69 | 180.69 | 2.21 |

| NET PROFIT | 122.99 | 110.92 | 10.88 |

| EQUITY CAPITAL | 23.54 | 23.54 | – |

(Source: Business Standard)

KRBL was recommended by Porinju Veliyath when it was a “penny stock”

It is unbelievable but true that Porinju recommended KRBL on 29th August 2013 when it was languishing at the throwaway price of Rs. 23.

Balaji Telefilms@31, Orient Paper@5, Orient Cement@32, KRBL@23, Mirza Intl@20 – all looking penny stocks, but not penny business. BUY

— Porinju Veliyath (@porinju) August 29, 2013

The said tweet of Porinju holds the World Record for the most profitable tweet ever because all the five stocks referred to in it have blossomed into magnificent mega multibaggers.

KRBL is itself up a mind-boggling 2500% (25-bagger) since then.

However, the ironical aspect is that Porinju himself did not see all the massive gains from KRBL percolate into his portfolio because he followed Shyam Sekhar’s advice and shifted allegiance to Piramal Enterprises.

KRBL@60 up 200% since I tweeted few months back. thanks my friend @shyamsek . am shifting to cash at a discount by acquiring Piramal.

— Porinju Veliyath (@porinju) April 16, 2014

@porinju The markets are smelling the aroma of basmationly now. Piramal is a great value play. A good switch.

— Shyam Sekhar (@shyamsek) April 16, 2014

Piramal Enterprises is also a multibagger though not to the same extent as KRBL.

KRBL is up 920% since then while Piramal Enterprises is up only 342%.

Later, Porinju made KRBL a template to explain how we should keep our eyes and ears open to stocks which may be quoting at ‘penny stock’ valuations even though they are in reality high-quality businesses.

Citing KRBL as an example Porinju Veliyath (@porinju) talks about how one should look out for leaders in businesses.https://t.co/G5VftzNYz1 pic.twitter.com/x2uRJxFKvu

— BloombergQuint (@BloombergQuint) December 17, 2017

Anil Kumar Goel resists temptation to cash in on profits from KRBL

Anil Kumar Goel is a real-life example of a long-term buy-and-hold investor.

He exemplifies Warren Buffett’s “Our holding period is forever” credo.

Anil Kumar Goel was first spotted in KRBL in March 2012 with a holding of 24,45,000 shares.

He has not only resisted the temptation to book the colossal gains that have accrued to him over the years but has instead invested more funds into the stock.

Presently, Anil Kumar Goel holds 93,00,000 shares while Seema Goel, his PAC, holds 25,87,000 shares.

The collective holding of 118,87,000 shares of the duo is worth a mind-boggling Rs. 713 crore.

No doubt, KRBL is the absolute crown jewel of Anil Kumar Goel’s portfolio.

KRBL is a compelling story of value migration towards branded business: Manish Bhandari

Manish Bhandari of Vallum Capital recommended KRBL in July 2015 on the logic that it is/ was a “compelling story of value migration towards branded business”.

He explained that KRBL has distinguished itself by nurturing brand basmati over the years. Its India Gate rice brand and its variant are the premium brands in the country. The flagship brand accounts for more than 140,000 tonne, more than 25% of volume sales and 40% of value of the company. What gives it that premium feel is that the brand is backed by years of experience of milling and ageing of rice by 18 months, as against one year for other variants, he said.

The recommendation was brilliant because KRBL is up 250% since then.

KRBL is now overvalued: Experts

The baffling aspect is that KRBL has been condemned as an overvalued stock by noted experts.

Sandip Sabharwal was very blunt.

“At this stage the stock is overvalued. The stock needs to correct to become more reasonably valued,” he said.

He opined that the fair value of the stock is Rs 450.

G Chokkalingam of Equinomics echoed this opinion.

“From the low of 2014, the stock has multiplied nearly 20 times and valuations are stretched at over 30 times PE. Retail investors should be cautious,” he warned.

Manish Bhandari defended KRBL on the basis that it has an impenetrable “moat”.

“Basmati rice is a daily consumable, requires ageing cycle of 18-24 months, huge inventory holding power by serious players and a brand to sell to consumers. Very few companies in India pass this difficult litmus test. This is the real moat in the business,” he said.

However, he did not express any opinion on whether KRBL is a “screaming buy” or not.

A hardcore value investor finding deep value in “Khushi Ram Behari Lal” at 600 bucks is pretty interesting.

— Arun Mukherjee (@Arunstockguru) February 14, 2018

Now researching, what crying bargain has @MohnishPabrai seen in KRBL at Rs 600/share and 33 times earnings.

— Rajeev K (@rk_health) February 13, 2018

My view….LT foods is in better place Vs KRBL with same top line numbers…bottom line is 50% less as compared to KRBL bcoz of debt…but now they are reducing there debt and debt to equity is 1.3 vs 2.5 till last year..we can see a multifold jump in bottom line

— jayesh kurseja (@jayesh_kursejaa) February 14, 2018

nothing wrong in it. Mr. Raamdeo Agarwal identified eicher at INR 2000 at USD 1 Bn M cap and stock is ~15X in last 5 years.

— Anoop Tulsyan (@atulsyan) February 14, 2018

Some case to be made this is a gr8 biz, basmati only India, Pak – geographic moat, massive FCF, brand, FMCG in making avail @ P/E of < 30 on owner's earnings -> may be a v.low risk, high LT reward situation.

— Alpha Seeker (@valueshadow) February 14, 2018

If at 14,000 Cr it has deep value, I am not sure how it's being ascertained at all!

— Abhishek Kumar (@marginalideas) February 14, 2018

The value may be unwinded based on some inside info..based on financials value is no where near…

— shashank yadav (@tautoo) February 14, 2018

KRBL is a “hidden gem”: Ambit Capital

In sharp contrast to the opinions of Sandip Sabharwal and G Chokkalingam that KRBL is overvalued, Ambit Capital has described the stock as a “hidden gem” implying that it is grossly undervalued.

Ambit has given cogent reasons in support of their proposition:

• KRBL’s practice of building inventory during the times of low rice prices has given it a competitive advantage.

• Early adoption of PUSA 1121 seeds, which are higher yielding and have shorter maturity time, helped establish its base.

• KRBL has also maintained stronger farmer relationships through end-to-end management of grains.

• Years of experience and aggressive advertising have led to a successful brand.

• Additionally, the company has developed long-term relationships with distributors in its key Middle East markets.

KRBL is an attractive investment proposition: Karvy

Karvy has recommended 10 high-quality mid-cap stocks to buy for 2018.

KRBL is one of them.

“KRBL Ltd. is a dominant player in the largest basmati rice consuming region – Saudi Arabia and Iran with export and domestic market shares at 25.0% and 31.0% respectively. Dominance of the company in terms of brand recall and presence in major regions makes it an attractive investment proposition,” Karvy has opined.

All Basmati stocks have a moat: HDFC Sec

HDFC Securities has conducted an indepth study of all the three basmati stocks in the Country, namely, KRBL, LT Foods (Daawat) and Chaman Lal Sethi.

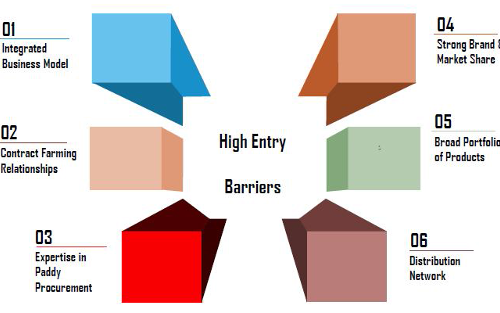

It has opined that all three companies have “moat” and that there are “huge entry barriers for new entrants”.

This is amplified in the following words:

“The Basmati players in India have built a robust profile which is difficult to replicate by any new entrant in the short term. Most players in the organized sector have an integrated business model and have forged strong relationships with farmers including contract farming which takes care of raw material requirements. They have built expertise in paddy procurement and state of the art manufacturing facilities. A wide number of brands have been launched with a wide distribution network. Expenses on advertisement and brand promotion have ensured huge brand recall resulting in huge base of loyal customers. The high level of working capital requirement dissuades new entrants.”

What about LT Foods alias Daawat?

Mohnish Pabrai’s green signal to the Basmati sector means that we have to also keep LT Foods alias Daawat in our radar.

LT Foods is the arch, albeit smaller, rival of KRBL.

It has blockbuster brands which are very popular amongst consumers.

It is one of the favourite stocks of Dolly Khanna though her present holding is not known.

LT Foods has also been attracting interest from heavy-duty funds.

A few months ago, distinguished FIIs and Mutual Funds such as SBI Mutual Fund, DSP Blackrock Mutual Fund, Reliance Mutual Fund, Societe Generale, Schroder Gaja, Morgan Stanley and Citigroup marched into the stock and made themselves at home.

LT foods – Allotment of equity shares to QIBs – List of allottees CC: @prashmundu @MoneyMystery @MrRChaudhary

BSE Link:https://t.co/aS1w7cJ443 pic.twitter.com/D8F4TfeZAY

— Rohan Gala (@RohanG90) December 26, 2017

LT Foods has also drawn up a clear-cut roadmap to double revenue to $1 Billion by 2022.

This clearly implies that LT Foods is walking on the same illustrious path as KRBL and is likely to shower multibagger gains upon investors.

Conclusion

It is obvious that novice investors like you and me are in no position to judge whether KRBL is indeed a “screaming buy” or not. Also, given the difference of opinion amongst the experts, it is better we stay on the sidelines and await a clear signal from Mohnish on whether we should clone his stock pick or not!

Two years back Dr. Vijay Malik had also analysed the stock of KRBL on my request.

Thanks to Vijay Sir for share his detail analysis .

we are looking forward, i.e., what happen in coming days. give me any idea for future at present.

Any idea about Kohinoor

similar line of business like as KRBL, thus bullish in LT Foods looks good also.