Alok Kejriwal, the whiz-kid internet entrepreneur and founder of Games2Win, holds merchant bankers and PMS managers in deep contempt.

He contemptuously refers to them as “Armani and Calvin Klein suited men and hot banking women” and pokes fun at what he calls their “churn your clients money and get rich syndrome”.

Alok Kejriwal has referred in detail to a shocking incident where he got ripped off by the smooth talking executives of Societe General Bank. They promised him the moon when taking his money and then shamelessly reneged from their obligations.

“Fire your bankers” Kejriwal advises because “private banking services only churn money via deals because it makes them fees”.

“My approach is to keep investing as and when I get liquidity, in the top listed mutual funds in the large cap ONLY EQUITY basket, and then SIT, SIT, SIT and SIT … Just invest in the top mutual funds for a MINIMUM 10 year horizon and the DO NOTHING” is the advice of the man who has made millions from the internet.

Why ONLY invest via Mutual Funds? 1 graph says it all! I'm gonna use this for my quiz – Chk http://t.co/r0hQIZWGay pic.twitter.com/q1P2VQdcOn

— Alok Kejriwal (@rodinhood) April 22, 2014

Franklin Templeton is another example that can be added to Alok Kejriwal’s rogues’ gallery of incompetent PMS managers.

Kayezad E. Adajania, the editor of Mint, has blown the lid of a scheme formulated by Franklin Templeton where also smooth talking salesmen connived to deprive investors of their hard-earned money.

Franklin Templeton floated a Private Equity Strategy Scheme and promised gullible investors that they could “Benefit from India’s untapped potential” by investing in companies with “good business”, “strong management” and “attractive valuation”.

As expected gullible investors flocked to the scheme like Bees attracted to honey. Within no time, Franklin Templeton raised a fortune of Rs.490 crore from about 1,000 investors. Each investor pumped in a minimum of Rs.40 lakh.

Today, eight long years after Franklin Templeton sold the rosy dreams, the investors are staring at a princely (aggregate) return of 0.26% on their investment.

What has added insult to injury is the fact that Franklin Templeton charged the poor investors 15-18% of the capital invested as management fees!

When Kayezad E. Adajania confronted Franklin Templeton and demanded an explanation for this sorry state of affairs, they provided a canned response without the slightest apology or embarrassment:

“Investing in private equity products involves significantly higher degree of risk compared to retail products like mutual funds. Franklin Templeton Private Equity Strategy (FTPES) was an offering targeted at the high-net-worth investor segment. Challenging market conditions during the initial years and the inability of some of the portfolio companies to keep up with changes in the business environment led to a mixed performance of the portfolio holdings in this strategy. This in turn has had an adverse impact on the overall returns at a portfolio level despite some successful exits. We are aligned with the interests of investors with an aim to fully exit the private equity strategy at the best possible value and continue to keep our investors informed on developments.”

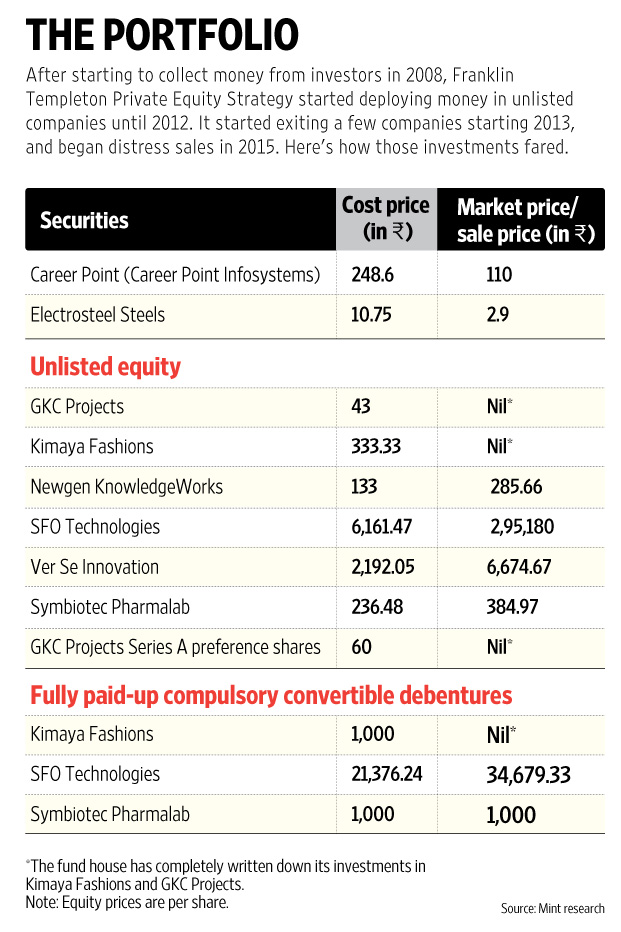

Undeterred by the robotic reply, Kayezad E. Adajania has dug deep into the innards of the Scheme and discovered that Franklin Templeton had invested the precious funds of the investors into junkyard stocks.

Franklin Templeton bought rubbish stocks like Career Point, Electrosteel Steels, GKC Projects, Kimaya Fashions, Newgen Knowledgeworks, SFO Technologies and several others whose names are never heard of.

(Image Credit: Mint)

The tragedy is that if the investors had not listened to Franklin Templeton and had invested the same funds in blue chip stocks like HDFC Bank, TCS, Bajaj Finance etc, they would today have mega multibaggers in their portfolio.

Anyway, the bottom line of this sordid episode is that novice investors like you and me should stay as far as possible from the smooth-talking suits that are out to rip us out of our hard-earned money. Instead, we have to follow Alok Kejriwal’s sensible advice and invest only in the best mutual funds. Better still, we should follow the footsteps of illustrious Gurus like Rakesh Jhunjhunwala, Radhakishan Damani, Ramesh Damani etc and invest our savings only in top-quality stocks.

This way, we can ensure that we have enough savings to see us through in our dotage!

Shameless is the only word that can describe farnklin temleton here.

15-18% charges with a returns of .26% in 8 years ?

Even if one would have spread his investment in top 10 blue chips , 8 years ago , it would have been great returns by just doing nothing .

Looks like those unfortunate investors learnt lesson of life , if its hard earned money, you need to take care of it .

Thanks,

Prashant

Very bad performance by PMS , although I as investor of Franklin India small cap fund investor is very happy with their performance.

Career point a rubbish stock ? It was also recommended by Ajay relan and this blog had even posted about it!

Another Choor PMS fund to loot the public money, not a single company in the portfolio is worth, ask for the accountability of the finds to the PMS manager.

Watch dog SEBI sitting quite.

Listen up people. Dont be so quick to blame Franklin. I have seen great companies being traded for 3-5 rupee gains from pathetic investors as well. I feel these type of investors are far worse. What does it say about an investor who looks to make 3% profit only from a potential 100 bagger. Instead of shouting aloud at suited EXPERTS, I have more disgust for traders who think they are so smart.

Kudos to you for exposing schemes like these !

A brilliant coverage to highlight HDFC MFs, in the garb of Templeton’s bad work. But there are many other which are not doing great.