Porinju Veliyath’s fav stocks bludgeoned by the Bears

Sonia Shenoy’s taut facial expression gave the game away.

Normally, her sparkling eyes and cheerful smile bring hope to the hearts of novices that all is well with the World.

This time, she could barely make eye contact.

“It is a midcap accident,” she mumbled, almost in a whisper, her shoulders slumped, eyes moist with emotion.

todays midcap accident https://t.co/2ggVv1DyXN

— Sonia Shenoy (@_soniashenoy) October 15, 2019

Sonia was referring to Va Tech Vabag, one of the high-conviction stocks of Porinju Veliyath.

The stock was a victim of a ruthless Bear attack after news filtered in that the new Government in Andhra Pradesh has cancelled contracts and/or refused to release payments for work done.

Porinju had bought Va Tech Wabag in the belief that it would be the “Next L&T” in the water processing sector.

However, L&T itself stormed the sector and torpedoed the business prospects of the incumbents.

Equity Intelligence' @porinju takes a massive bet on @vatechwabag , now owns 2.73 million shares (5.02%). pic.twitter.com/eue5rXsZcC

— Kush Katakia (@kushkatakia) March 16, 2018

Remembered the VA-Ter company!https://t.co/4BKymQCyN8

— Porinju Veliyath (@porinju) August 30, 2018

VA Tech Vabag continues to slide….read whats troubling ithttps://t.co/BrpAAXmcwQ

— Darshan Mehta (@darshanvmehta1) October 15, 2019

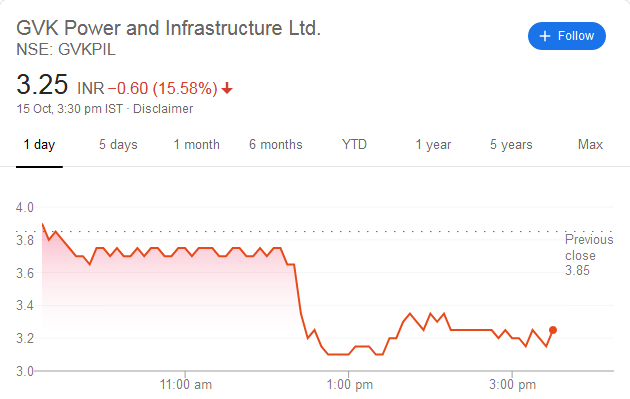

A similar disaster happened today in GVK Power and Infra.

When Porinju recommended the stock, his logic was flawless, namely, that there is an insatiable demand in the Country for infrastructure like Airports etc and that a leader like GVK would thrive.

What is driving @Porinju Veliyath’s optimism on debt-laden GVK?https://t.co/G5VftzNYz1 pic.twitter.com/0C976MHVld

— BloombergQuint (@BloombergQuint) December 17, 2017

However, what Porinju could not have foreseen is that the promoters would turn into alleged “Chors”.

Apparently, the Ministry of Corporate Affairs (MCA) is examining a complaint that there has been siphoning of funds, contracts given to related parties, issue of fake bills to inflate cost, and undue custom and excise duty benefits derived by raising bogus bills, etc.

The stock tanked a mammoth 16% by the EOD.

Kaya Ltd, which is promoted by the Blue Chip Marico, also had a bad day on the Bourses.

Porinju bought a massive truckload of the stock on the logic that it is at “inflection point” and can become a “Billion dollar co” in the foreseeable future.

#PorinjuTopPick | Pick 1: Kaya is our largest holding in the portfolio; at an inflection point. Kaya can become a billion dollar co over 5-6 years. @porinju #Budget2019 #BudgetSession pic.twitter.com/tGuv8K5HDA

— ET NOW (@ETNOWlive) February 1, 2019

Equity Intelligence holding in Kaya has now crossed the 15% mark. @porinju now holds almost a staggering 2 million shares. Bet big, bet hard on high conviction stocks. pic.twitter.com/QkciGQ2V50

— Kush Katakia (@kushkatakia) June 8, 2018

EQ's @porinju now owns a staggering 1751617 shares of Kaya Ltd. This works out to a massive 35% of the free float. This is what I would call "Putting money where your mouth is". https://t.co/EHarFRHfoJ

— Kush Katakia (@kushkatakia) April 18, 2018

Unfortunately, it appears the stock is presently suffering from a number of serious ailments such as stagnant sales, big losses and pathetic ROE/ROCE.

Not every consumption story would flourish.#Kaya Ltd, once touted to be the next big thing in wellness space, in doldrums.

Despite consistent efforts, unable to scale & encash that opportunity.

Marred with Stagnant sales, Big losses, Pathetic ROE/ROCE. pic.twitter.com/4qydrwtGZf

— MRIDUL SOMANI (@Mridulsomani2) September 29, 2019

Hopefully, Billionaire Harsh Mariwala, the visionary founder of Marico, will soon be able to pull out Kaya from the morass.

I made unpardonable mistakes

A few days ago, we saw Porinju humbly admitting that he had made a mistake in trusting that Chors will reform and shower multibagger gains upon minority shareholders (see I Burnt Fingers Badly With Chor Stocks: Porinju Veliyath Concedes Defeat & Vows To Stay Away From Chors & Invest Only In Cos With Integrity).

Now, Madhu Kela made the same admission.

“The last two years have been a tremendous learning from my personal perspective,” Madhu said.

“I have made a few unpardonable mistakes because after being in the market for so long, one is not expected to make that level of mistake. But this time around it was too vicious. It did not give us time to react,” he added.

Madhu explained that he put “excessive faith” on the promoters even though “the writing was clear on the wall”.

Though Madhu did not refer to any promoter by name, it appears he is referring to the promoters of IndiaBulls Housing Finance.

The stock has been on a deep dive and has eroded incalculable wealth after serious allegations of malpractices were made by whistle blowers.

MCA wakes up in Indiabulls case; allegations and reactions, all you want to know https://t.co/yrEhJSEBWe

— Subramanian Swamy (@Swamy39) September 19, 2019

Ghoda Ghas se dosti nahin kar sakta

Madhu Kela advised that we must keep emotions at bay when making investment decisions.

“You have to keep business and emotions separate. It is very important to have a good relationship but ghoda ghas se dosti nahi kar sakta.karega to khayega kya (Horse can’t make friends with grass or will go hungry),” he said emphatically.

#TheBigReset | Have learnt a lot from the market in last two years, need to keep business & emotions separate while investing, says @MadhusudanKela to @nikunjdalmia pic.twitter.com/viRYVlxdTQ

— ET NOW (@ETNOWlive) October 15, 2019

Forget the past, look ahead

Madhu advised that we should not keep obsessing over our past losses.

Instead, it is better to forgive and forget and look ahead.

“There is a whole road ahead of us. Let us not forget the optimistic side of India. We will see $10-trillion economy hopefully in our lifetime,” he said.

“There is much excitement ahead over the next 20 years. In that timeframe, one or two years of pain is not a big thing. I hope we emerge as stronger investors, better investors and do not commit the mistakes which we did,” he added.

How to identify winner companies

Madhu Kela set out a three-step formula for us to adopt whilst identifying winner companies:

(i) The new entrepreneur must adhere to the new corporate governance standards which the markets are prescribing. Apart from a good business model, the corporate governance practices should be at the highest level.

(ii) The Company should be prudent about allocation of capital.

(iii) The organisation and team they have built must be top-notch.

Don’t be foolishly brave, preserve capital

Madhu advised us not to rush to buy stocks in the belief that they are now quoting at bargain basement levels but instead to wait it out and let them consolidate.

“Let the market consolidate, let it recover a little bit then there will still be plenty of time to buy the risky companies,” he advised.

Disinvestment will revive sentiments

Madhu opined that disinvestment could be the catalyst which can change sentiments amongst investors.

“One thing which I was watching very keenly is disinvestment. At the end of the day, to do anything meaningful, even the government needs resources,” he said.

He also explained that the disinvestment of the PSU stocks will resolve problems about the fiscal deficit.

“All the talk about fiscal deficit can be a thing of the past,” he said.

#TheBigReset | Govt's measures to support #economy will take time to show results. However, planning strategic sales of select #PSUs is a big positive, says @MadhusudanKela to @nikunjdalmia pic.twitter.com/MmHcsw8qMK

— ET NOW (@ETNOWlive) October 15, 2019

Take bold bets in quality smallcap stocks

On the question whether we should invest in large-cap blue-chip stocks or fledgling small-cap stocks, Madhu made it clear that we have to be with the small-cap stocks if we want to boast of multibagger gains in our portfolios.

“I believe it is time to take bold bets in quality smallcaps,” he said with a big smile.

“Smallcap and midcap stocks will surely outperform over the next 3-5 years,” he added.

#TheBigReset | Feel that bull market is set to return; may take time, but opportunity is huge: @MadhusudanKela to @nikunjdalmia pic.twitter.com/9uL4CDdKkx

— ET NOW (@ETNOWlive) October 15, 2019

Always stay with Quality , sector leaders and proven blue chip secular growth business.Only those will talk of small cap stocks who are trapped in last bull run in these duds .Let them pay for their folly , so no need to be brave , as this will only help in exit of Third grade stock gurus from kachra cap stocks and you will be having a bleeding nose.Only Quality will survive.

Tci express is a smallcap. Why wouldn’t anyone invest in it. This is how you make money. Madhu.

GVK Stock down more 16%. What rubbish stock is recommended. 🙁

https://twitter.com/MadhusudanKela/status/1184483417636954113?s=19

see this it was not IBHF

Quality small cap Jamna auto….any si