Boys separated from Men

Yesterday, at 1420 hours IST, the BankNifty suddenly nose-dived a bone-crushing 500 points.

The move took everyone by surprise and caused great shock and confusion across Dalal Street.

Even knowledgeable observers were clueless as to the reason for the crash.

What happened there on Bank Nifty? Fell 500 points between 2.20-2.25.

This month now Bank Nifty is down 7%. This week also was down 2%

— Anuj Singhal अनुज सिंघल (@_anujsinghal) September 18, 2020

what as sell off in bank nifty

— Darshan Mehta (@darshanvmehta1) September 18, 2020

Some speculated that a basket selling order by an institution to comply with the FTSE balancing guidelines may be the culprit.

This sudden selling in Markets, Banking shares seems like a FTSE rebalancing basket sell order.

Lot of names were in Frontline shares, seems that selling is now getting absorbed !

— Yatin Mota (@YatinMota) September 18, 2020

Whatever may be the reality of the situation, everyone in Dalal Street remembered the grim warning that Sanjiv Bhasin, the veteran investor, had given a few days ago.

“At 11,300 there is greed written across the screen …. There is a 500-point correction waiting to happen and that will differentiate the men from the boys,” he had warned in an ominous tone.

That prediction has come true.

We are now extremely bullish on the market

It is obvious that now that the Boys have been sent home and stock prices have corrected to realistic levels, the Men have to start shopping.

“We are extremely bullish on the market,” Sanjiv Bhasin declared in his latest interview to ET.

Do a SIP in a Pharma stocks Mutual Fund

Pharma stocks have been on an unstoppable surge.

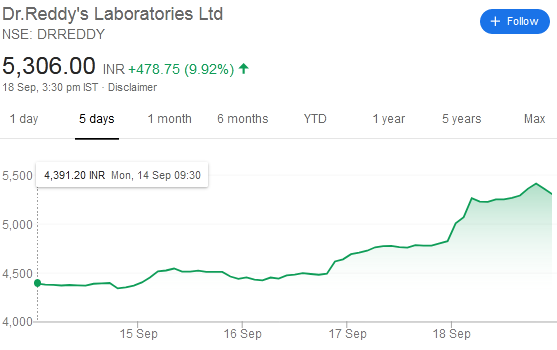

Dr. Reddy’s, the large-cap blue-chip behemoth, has been leading from the front after news came out that it has a deal for a blockbuster drug named ‘gRevlimid’.

The behemoth is up 21% in just the last five days.

Other powerhouse Pharma stocks like Divis Labs, Cipla, Torrent Pharma, Granules, Ajanta Pharma etc have also been surging.

The entire Pharma Index is up nearly 10% in just the last week with a YoY return of 55%.

Sanjiv Bhasin advised that we should buy a basket of Pharma stocks through a mutual fund instead of cherry-picking individual stocks.

“I am very bullish on Dr Reddy’s, Sun Pharma and the whole pack of pharma stocks including Cipla, Cadila,” he said.

“I have been suggesting for the last four months that please do a SIP in one of the good pharma funds because that way you will capture a lot of the stocks, rather than be independent on one,” he added.

CS on Pharma

DRL – TP raised to Rs 5750 (from Rs 5100), now value gRevlimid fullyCipla-Increase FY21E/FY22E EPS by 3%/4%

TP to Rs 835 to factor in higher vols of AlbuterolLupin – Increase FY21E/FY22E EPS by 6%/9%

TP Rs 930 to factor in higher vol of Albuterol@CNBCTV18News— Nimesh Shah (@nimeshscnbc) September 18, 2020

Big target price hike on @drreddys by Credit Suisse. Target raised to 5750 (highest ion street) from 5100. gRevlimid cashflows should be significant (US$700mn+) and more catalysts near term. Catalysts are Avigan, Suboxone markets and launching Vascepa in 2H.

— Darshan Mehta (@darshanvmehta1) September 18, 2020

Realty stocks are poised to surge to new highs

Realty stocks have been in the doldrums so far.

However, Sanjiv Bhasin suggested that their fortunes may now change.

“The proxy of gold at Rs 58,000 means that the real bull run will now start into fixed assets and the largest holders of land bank particularly DLF and Godrej Properties. I think the bull run has just started. I am extremely bullish on stocks like Ashok Leyland, DLF which have been my top picks and I think Ashok Leyland, DLF and Godrej Properties are the stocks which are going to make new highs in the next one two, three years,” he said.

IPOs are a Gold Mine. Even Warren Buffett is applying for them

Warren Buffett was one of the last of the old-school investors who were opposed to IPOs.

“IPO means ‘It is probably overpriced’,” he had once jokingly said.

However, even Warren could not resist the charms of IPOs.

He made his debut with the Snowflake IPO and raked in a mammoth gain of $1 Billion.

Warren Buffett's Berkshire Hathaway just made a fast $1 billion on Snowflake's surging IPO https://t.co/jK7tyiBUyE

— CNBC (@CNBC) September 16, 2020

Happiest Minds, the latest IPO, made a stellar listing with a mammoth gain of 100%.

Sanjiv Bhasin described IPOs as a “gold mine” He, however, cautioned us to remember that the craze for IPOs has to be taken with a pinch of salt.

“It tells you that you are in a bull market. Take all this with a pinch of salt that people will be waiting to buy dips”.

He also cautioned against indiscriminate chasing of the newly listed stocks.

“I would not subscribe to buying Happiest Minds at these prices. I would wait for price performance,” he advised.

Leave a Reply