Karvy was earlier accused by police of cheating hapless investors

The first sign that all is not well with the Karvy group came in June 2019 when a group of hapless investors rushed to the Bengalure police with the complaint that they had been cheated.

Apparently, the top brass of Karvy had promised investors returns of 18-20% and collected large sums of money.

However, when the returns stopped coming and cheques bounced, investors realized they had been taken for a ride.

The police swung into action and filed charges of criminal breach of trust and cheating against Abhijit Bhave, the CEO, and other top officials of the Karvy group.

The present status of the complaints and whether the investors have been able to recover any part of their money is not known.

Change in regime in AP spelt doom for the Karvy group

According to some knowledgeable sources, Karvy Realty bought large tracts of land in Amaravati, the new capital of Andhra Pradesh, in anticipation that Chandra Babu Naidu would storm back into power and they would make a killing.

However, the surprising victory of Y.S. Jagan Reddy upset all plans.

Jagan Mohan Reddy has been on a rampage and is reversing all of Chandrababu Naidu’s major decisions.

This led to the World Bank withdrawing its funding to the Amravati project which torpedoed all business plans.

Even the Lulu group, which is led by Billionaire M. A. Yusuff Ali, revoked its decision to invest Rs. 2200 crore in Andhra Pradesh.

With @ysjagan’s foolish decision, all efforts have been washed away. Such actions are destroying the investment climate & future of youngsters in AP. I express my deep regret to Lulu Group on behalf of the people of AP, more particularly people of Vizag (2/2)#LuluSaysByeByeAP

— N Chandrababu Naidu (@ncbn) November 21, 2019

Karvy pledged clients’ securities & took loans for the realty project

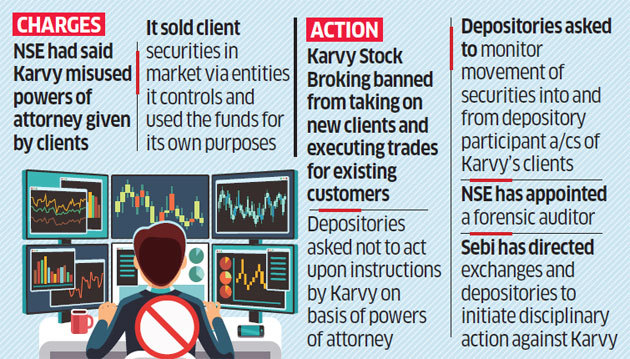

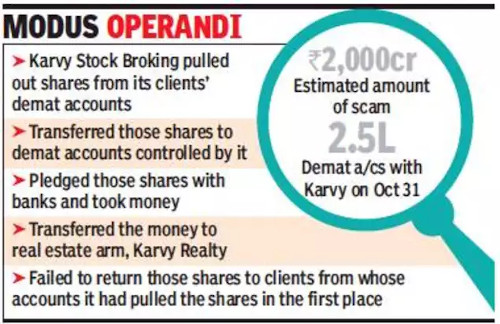

A reading of SEBI’s order reveals that Karvy allegedly hatched a devious plan to betray the trust of its clients and misuse their securities.

Apparently, Karvy raised funds by pledging the stocks held in the clients’ demat accounts and used the funds for its own purposes.

“The securities lying in the aforesaid DP account of KSBL, actually belong to the clients which are the legitimate owners of the pledged securities. Therefore, KSBL did not have any legal right to create a pledge on these securities and generate funds,” Ananta Barua, the Hon’ble WTD of SEBI, has observed in a grim tone.

Karvy also appears to have preyed on dormant accounts, where clients have not traded for a long time.

It transferred securities worth Rs. 27.8 Crore, off-market, from the beneficial owner accounts of 156 clients who have not executed a single trade with them.

Further, securities worth Rs. 116.3 Crore were transferred from 291 clients who have not traded with KSBL since June 01, 2019.

Not surprisingly, the funds were used for the ill-fated realty project.

“Prima facie a net amount of Rs. 1096 crores has been transferred by KSBL to its group company i.e. Karvy Realty Private Limited between from 01-April 2016 to 19-October-2019,” SEBI has noted.

Karvy’s clients are panic-stricken

Naturally, there is a pall of gloom over Dalal Street over the Karvy fiasco with investors worrying about the fate of their hard-earned money.

“This is a reputation loss for the market. Is investors’ portfolio secure with brokers? Whom to trust?” they asked in a mournful tone.

Karvy defaults. It is one of the largest broker, MF registrar. This is a reputation loss for the market. Is investors' portfolio secure with brokers? Whom to trust?

— Debashree Chatterjee (@debashree_ad) November 23, 2019

All are feeling scary now?

— EA7?? (@Equityanalyzer7) November 24, 2019

My tradng act 25501769 with Karvy(KSBL): Sold long term infra bond 10 days back. But Payout for Rs 74K daily canceled by Karvy for last 4 days. Really worried for hard earned money. Pray no big scam ahead. Sick help from Govt bodies @KarvyStock @SEBI_India @PMOIndia @FinMinIndia

— Jagdish Janardan Kaple (@JagdishKaple) November 21, 2019

Madam,karvy stocks Broking Ltd,Hyderabad misappropriated my funds amounting to Rs. 311,000 .it debited my Trading account 3661853 with this amount on https://t.co/6pUI3k3uZq is a fraud ,please help me

— dharam Pal Singh (@dharamP98439669) November 22, 2019

i am client of karvy..i did a payout on 11 november 2019..its been 2 weeks they didn't transfer the amount…i am asking my money not karvy's money…as SEBI rule within 2 days you have to pay the client….where is my money???..i want my money back…help me

— Joydeep Mazumder (@JoydeepMazumde6) November 22, 2019

No you haven’t contacted all your customers. I haven’t been contacted by Karvy and my payments are stuck for the last one month. DO NOT ask me to contact your customer care which is perpetually busy.

— Sneh G (@snehspace) November 18, 2019

I am a retail investor having stock trading a/c with Karvy (client ID 17632013). Despite several requests since 04th Oct, 2019 of payout of Rs. 1,99,990/- from my trading a/c, Karvy is not paying my hard earned money. Kindly help.

— Karamveer (@CAKaramveer) November 22, 2019

@KarvyStock

I have been placing request for transfer-out for last 15 days. Even contacted Karvy staff and as confirmed by staff, he has also placed request for fund transfer. However, till date no response, confirmation, credit to the account. Please transfer fund immediately.— Chiraag Patel (@ChiragMeb) November 24, 2019

kindly help me with karvy payout is all i ask

Please be informed that payout is not processed for my Client id : S29807 , This is the 19th day i waiting for my payout , kindly help

Regards

Abhilash

9980401697 pic.twitter.com/PRpWfurNKK— abhilash (@abhilashreddy87) November 19, 2019

Even with all the regulations, inspections, monitoring etc scams of larger and larger proportion keep on happening#KarvyBroking banned by #SEBI for transferring Rs 2000 Cr worth client shares to itself and using them to fund Karvy Realty.

Crazy— sandip sabharwal (@sandipsabharwal) November 23, 2019

Crisis may snowball?

Another worry plaguing Dalal Street is that Karvy may not be an isolated case.

Other brokers are probably also indulging in similar alleged nefarious practices.

In fact, two other brokers named ‘BMA Wealth Creators‘ and ‘Allied Financial Services‘ have already been suspended for alleged nefarious activities.

Also, if Karvy goes down, the ripple effect will be felt by its lenders.

ICICI Bank is doomed. It gave 875 crore of loan to Karvy just 1 month back. HDFC Bank has 200 crore exposure. Then IndusInd & Axis. Big names , This issue can escalate. pic.twitter.com/AuNm7p2NfN

— David (@Geodirectit) November 22, 2019

BMA wealth advisor is other broker who had similar issue recently https://t.co/LX7qaE3M0v

— David (@Geodirectit) November 23, 2019

Allied financial services , a broker sold client shares & dumped liability on IL&FS subsidiary ISSL that was about to be acquired by Indusind before this issue 1yr backhttps://t.co/WPwIi34hrR

— David (@Geodirectit) November 23, 2019

Five private banks have big exposure in #Karvy. Crisis may snowball into fresh round of defaults. https://t.co/nmjFusK1h7

— anshuman tiwari (@anshuman1tiwari) November 24, 2019

#Karvy continued to operate a separate subsidiary for commodity trading while many brokers have merged their commodity arm with the securities business, after commodity derivatives were designated "securities" by SEBI. https://t.co/l3kCgCkJ2X

— anshuman tiwari (@anshuman1tiwari) November 24, 2019

Karvy stays defiant, Denies misuse of clients’ securities

Surprisingly, despite the damning findings in SEBI’s order, Karvy claimed that “there is no instance where there has been misutilisation of client securities”.

It also argued that its action of investing in Karvy Realty is ‘fully compliant’ with SEBI’s regulations.

“There is no instance where there has been misutilisation of client securities. We have a track record of resolving investor complaints, and while we acknowledge delays in handling and resolution of certain cases, to characterise it as misutilisation is a travesty,” it said in a belligerent tone.

“We want to reiterate once again that nowhere in the SEBI order has an amount of Rs 2,000 crore been mentioned, and that this number together with the word default is extremely misleading and damaging to our reputation,” it added.

“There is no ban at all whatsoever, except a restriction on on-boarding new customers for a 21 day period. This is completely false and we will continue to service all our existing customers uninterruptedly,” it emphasized.

#karvy says Business as Usual. SEBI says Emergency hence Ex-parte order. Is the situation normal as #karvy wants everybody to believe?? #broker #default https://t.co/DJwPRlkwhw

— Palak Shah (@palakshahJourno) November 24, 2019

#Karvy statement: acknowledged it used to pledge shares in full compliance with then directives "as was standard practice across broking houses"

fact: No standard practice tat brokers follow in pledging of shares. It is full of scams across #broker #default— Palak Shah (@palakshahJourno) November 24, 2019

Karvy’s clients can still bail out and salvage something

Obviously, there is no merit in Karvy’s clients standing still like a Deer caught in the headlights.

They have to take proactive steps by rushing to the exit door and transfer their securities and funds to another reputed broker.

Neil Borate and Jayshree Upadhyay of Live Mint have explained the precise modus operandi for this in an article.

#SEBI has asked depositories to not honour Karvy instructions due to its violations of SEBI rules. But this leaves #Karvy clients in a right pickle, especially for trades conducted last week and not yet settled. Here’s what they can do #equity #StockMarket https://t.co/7LDXsa1FwK

— Neil Borate (@ActusDei) November 23, 2019

Zerodha issues soothing assurance and calms nerves

While other brokers have maintained a studied silence over the Karvy fiasco, Zerodha, which is founded by visionary Billionaire Nithin Kamath, has issued a much needed clarification as to the state of their affairs.

“This damning SEBI order against Karvy has come as a shock to everyone in the capital market ecosystem,” Nithin Kamath has rightly acknowledged.

Apparently, earlier, all brokers used to indulge in “margin funding“, i.e. they would pledge the client’s securities with a NBFC and utilize those funds to allow the client to buy stocks on margin.

Brokerages benefitted because they earned higher brokerage and interest income from the transaction.

SEBI realized this mechanism was prone to abuse and banned it in June 2019.

“We have never done margin funding and this regulation does not affect us,” Nithin Kamath has asserted.

He has also pointed out most financial irregularities have debt as the main catalyst.

The compulsion to repay borrowed money induces nefarious activities.

However, Zerodha has zero debt and so is not subject to any pressures.

Nithin Kamath has also clarified that not only does Zerodha not pledge client securities to NBFCs, it does not even keep client securities in its pool account.

All client securities are always in their respective Demats at all times, he has stated.

He has also clarified that Zerodha has never had issues in terms of securities not being credited to clients’ Demat accounts or their being moved out without authorization, or with client fund payouts.

“Our own funds are over 25% of all our client funds put together. This has to be among the highest in the industry in terms of skin in the game, all accrued from organic revenue. Zero external funding or borrowing,” he has added.

“There is no need for concern at Zerodha,” he has stated emphatically and in a soothing manner, bringing much needed solace to all inhabitants of Dalal Street!

Since many are asking us on if they should be concerned with their accounts with us after the SEBI order on Karvy, had to write this and explain why you should not be: https://t.co/bb8Tg8SXa7

— Nithin Kamath (@Nithin0dha) November 23, 2019

I think regulator should take most stringent measures to curb such practices. Every decade, we have one such blow-up at some securities broking firm which derails and demotivates entire investor community.

Is it a way for 5 trillion dollar economy.

No way.

Think about long term serious impact it has created among the investor fraternity.