Honda Siel Power Products, blue-chip MNC, attracts stalwarts

Honda Siel Power Products, a small-cap company with a market capitalisation of only Rs. 1,486 crore, has the rare distinction of attracting two visionary stock pickers in quick succession.

On 20th July 2017, Sunil Singhania’s Reliance Mutual Fund stormed the counter to scoop up a chunk of 89,800 shares.

This was followed by Kenneth Andrade’s Old Bridge Capital buying a chunk of 64,503 shares on 25th July 2017.

Aggressive increase in stake by Reliance Mutual Fund

As of 30th June 2017, Reliance Mutual Fund already holds a massive chunk of 4,98,270 shares of Honda Siel, comprising 4.91% of the equity.

The fact that the fund has added to this position speaks volumes of the confidence that Sunil Singhania has in the Company.

Other distinguished shareholders of Honda Siel

Param Capital Research Private Limited, which is the investment arm of Mukul Agrawal, the visionary investor, holds 1,26,869 shares as of 30th June 2017.

Lashit Lallubhai Sanghvi of Alchemy Capital fame holds 25,000 shares as of 31st March 2017. His present holding is not known.

Prasoon Harshad Bhatt and Jaya Harshad Bhatt, both low-profile investors, collectively hold a big stake in Honda Siel. However, the duo appears to have sold some of their stake to Reliance Mutual Fund and Old Bridge Capital.

Why is Honda Siel such a good buy?

Honda Siel has all the virtues that one expects in a high-quality stock.

First, it is promoted by Honda Motor Co, the Japanese engineering behemoth. Honda owns 66.67% of the equity.

This implies that one can expect high levels of corporate governance and transparency in the operations of the Company.

Second, Honda Siel has access to the latest state-of-the-art technology. This gives it an edge over its arch rivals like Cummins.

Third, it manufactures products like portable generating sets, internal combustion engines, pumping sets, water pumps etc for which there is no dearth of demand in a growing economy like India.

| HONDA SIEL POWER PRODUCTS LTD – KEY FUNDAMENTALS | |||

| PARAMETER | VALUES | ||

| MARKET CAP | (Rs CR) | 1,439 | |

| EPS – TTM | (Rs) | [*S] | 56.22 |

| P/E RATIO | (X) | [*S] | 25.24 |

| FACE VALUE | (Rs) | 10 | |

| LATEST DIVIDEND | (%) | 75.00 | |

| LATEST DIVIDEND DATE | 27 JUL 2017 | ||

| DIVIDEND YIELD | (%) | 0.53 | |

| BOOK VALUE / SHARE | (Rs) | [*S] | 417.87 |

| P/B RATIO | (Rs) | [*S] | 3.40 |

[*C] Consolidated [*S] Standalone

| HONDA SIEL POWER PRODUCTS LTD – FINANCIAL RESULTS | |||

| PARTICULARS (Rs CR) | MAR 2017 | MAR 2016 | % CHG |

| NET SALES | 198.21 | 193.98 | 2.18 |

| OTHER INCOME | 4.4 | 2.06 | 113.59 |

| TOTAL INCOME | 202.61 | 196.04 | 3.35 |

| TOTAL EXPENSES | 176.51 | 164.72 | 7.16 |

| OPERATING PROFIT | 26.1 | 31.32 | -16.67 |

| NET PROFIT | 13.14 | 15.36 | -14.45 |

| EQUITY CAPITAL | 10.14 | 10.14 | – |

(Source: Business Standard)

High RoE and high margins

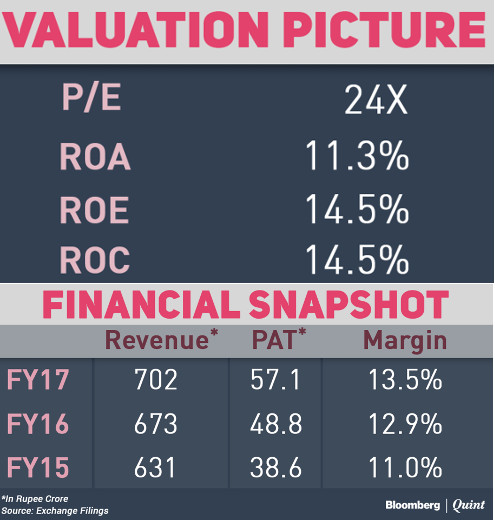

In so far as the financials are concerned, Darshan Mehta of Bloomberg has conducted a meticulous assessment of the figures.

He points out that Honda Siel boasts of a RoE of 14.5% which is quite reasonable.

It also enjoys a healthy margin of 13.5%. It is significant that the margins have improved from 11% in FY15 and 12.9% in FY16.

This implies that the Company is getting its act together through cost cutting and/or better product mix.

(Image credit: Bloomberg)

Cheap valuations compared to arch-rival Cummins

The noteworthy aspect is that Honda Siel is quoting at a valuation of 24x while its arch rival Cummins is demanding a P/E of 38x.

Prima facie, the valuations of Honda Siel appear to be throwaway given its MNC pedigree and high quality management.

It is also significant that while Cummins is lumbering under a market capitalisation of Rs. 27,000 crore, Honda Siel is nimble footed at a capitalisation of only Rs. 1,400 crore.

This implies that the potential of Honda Siel turning into a magnificent multibagger is more compared to that of Cummins.

Agriculture stocks offer huge opportunity for mega gains: Sunil Singhania and Kenneth Andrade

The duo of Sunil Singhania and Kenneth Andrade have made it amply clear on a number of occasions that the rural and agriculture sector is where the big money can be made over the next five to ten years.

Sunil Singhania explained the investment hypothesis with his characteristic eloquence:

“Agri is a big theme. The government is focussed on increasing rural income and ensuring that there is more stability as far as agri income is concerned. We have a good forecast for monsoon and also there is clear focus from the government to increase our irrigation facilities so the vagaries of monsoons are behind us. All this would mean that rural income would rise and therefore all agri-based themes whether it is rural consumption or agrochemicals or fertilisers should start to see much more stability and growth as we move forward”.

Kenneth Andrade has been even more eloquent on the subject.

“I think there is a very large opportunity in rural India. There are a lot of place in that economy. I think fertiliser is probably the largest consumed product out there. You have got agrochemicals at one end and you got seeds at the other end but more importantly 50% of the entire farmer’s expense goes into labour and if the stated intent by the government is to double the per capita of the farmer by 2022, you are going to see a lot of wage inflation down there. ”

Is Honda Siel a play on the agriculture boom?

Prima facie, the thrust by Honda Siel on the agriculture sector appears to have attracted the two stalwarts to it.

The Company has introduced new products such as the ‘Petrol Run Mini Tiller’, ‘2HP Engine’, ‘British Cutter’, etc which are necessary for the vast and growing agriculture and horticulture markets in the Country.

There is also massive demand potential from export markets such as the Middle East, Africa and South America.

The annual report confidently asserts that “Honda models are registering promising growth and acceptability across the country”.

Is Honda Siel walking in the footsteps of VST Tillers & Escorts Tractors?

Prima facie, Honda Siel appears to be walking in the illustrious footsteps of VST Tillers and Escorts, both of whom have made a massive fortune for investors by targeting the niche market of agriculture implements.

VST Tillers has given an eye-popping gain of 2085% (20x) over 10 years while Escorts has kept pace with a 500% (5x) gain in the same period.

Needless to say, the size of the market is so vast that all three companies can comfortably prosper without having to poach on each other’s customers’ base.

Conclusion

Assuming that agriculture is the main driving force behind the interest of Kenneth Andrade and Sunil Singhania in Honda Siel, we also need to urgently load up on agriculture stocks when they are still quoting at throwaway valuations. We have a wide variety of stocks from fertilizer, pesticide, agro-chemicals, tractors, seeds, milk, basmati rice, ready-made foods etc to choose from!

Just unable to understand rational of these gurus.

54% of Indian population is engaged in farming and majority of them are currently protesting due to decline in agri commodity prices post demonetisation.

Where is the money to buy pumps/gen sets?

Never trust any guru if he is not putting his own money in buying stocks. It’s easy to bet with investors money or give unsolicited advice. So I usually go for bets by Dolly khanna, Vijay Kedia or porinju (not equityintelligence) as they are sticking their neck out with their own money. Dolly khanna anyway does not give any advise. After that you apply your own judgement about the stock and then take decision…

Valuepicker,

I am trying to understand rational of gurus NOT about whom to follow.

If rise in farmers’ income is macro theme someone is assuming (that too due to DBT/Crop Insurance and NOT due to rise in agri commodity prices) I really sympathise to Guru’s investors.

Always do your own research thoroughly.

If you want to load up on agri stocks, grab Emmbi Industries with both hands. I have recommended it here when it was at 75 and subsequently posted 5 more messages (you can do a search with my name and Emmbi) here giving different reasons why Emmbi is good. It is quoting at 190 close last Friday 28th July’17. Emmbi is the only Indian company which supplies giant pondliners. The only other company is Owens Corning from the US. As you know, even if there are adequate rains, there is widespread water scarcity in the country. Farmers are forced to store water which lasts them a full year. You may like to do more research yourself but let me chip in by saying these are the noted investment managers who have had one to one meetings with the management of the company in the past one month. Source – disclosure to stock exchanges – Ambit Pvt. Ltd, HSBC Mutual Fund, Nalanda Securities Pvt Ltd, Alchemy Capital Management, Insync Capital, Kitara Capital, Crest Wealth Management, Zeus Capital, JNJ Holdings, Equitree Capital, Value Quest Investment Advisors, Veda Investment Managers, IWealth advisors, BOB Capital Markets etc. Besides, KR Choksey and Company is covering the company very well and they are very gracious to host the concall with the management of the company every quarter. The first FII investment was done in this Q1. 8I Holdings of Singapore grabbed a smart 4% slice of equity and is reflected in the Q1 shareholding of the company.

A company that is flying under he radar is EPC irrigation.

kenneth andrade bought Shakti Pump in last 2-3 days. Please check.