Salutary practice of raking in big bucks and sharing stock ideas

Manish Bhandari’s USP is that he not only rakes in big bucks for himself and the deep-pocketed clients of the Vallum Capital PMS but he also generously offers stock recommendations to less privileged investors.

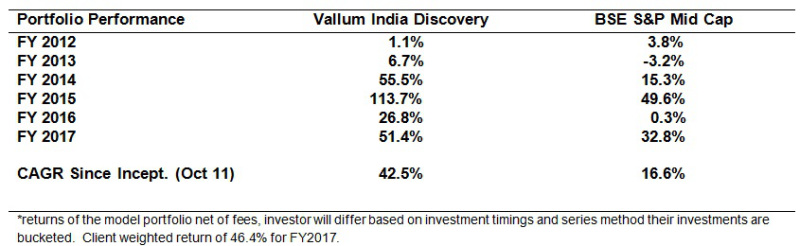

I reported earlier that in the financial year 2016-17, Vallum Capital has delighted its clients with a YoY return of 51%.

I also pointed out that this is not a flash-in-the-pan performance. Instead, for the period from October 2011, Vallum Capital has delivered an eye-popping CAGR return of 42.5%.

In contrast, the BSE S&P Mid-Cap has delivered a CAGR return of only 16.6%.

Manish Bhandari also has a long list of stocks that he has recommended which have delivered fantastic returns.

In conversation with Ramesh Damani, he revealed that he is bullish about Raymond and Siyaram Silk Mills.

This has worked out well with Siyaram Silk Mills and Raymond having delivered a YoY gain of 208% and 117% respectively.

KRBL, the leader in branded Basmati rice, was recommended as a “compelling story of value migration towards branded business”.

The stock is up 165% over 24 months and 112% over 12 months.

Deepak Fertilizers was recommended on the logic that it “stands to gain from its vertically integrated operations and leadership position in key specialty chemicals”.

The stock is up 85% on a YoY basis.

Some other winning stock recommendations include Pennar Industries, Aditya Birla Nuvo, PI Industries, Shilpa Medicare.

Axiscades Engineering Technologies, latest stock pick

Axiscades Engineering Technologies, a micro-cap with a market capitalisation of less than Rs. 800 crore, is Manish Bhandari’s latest stock pick.

On 7th December 2017, his ‘Master Portfolio Services Ltd – Vallum India Discovery Scheme’, bought 195,229 shares at Rs. 153.22 each, making an investment of Rs. 2.98 crore.

This was duly reported by Navin Shetty of CNBC TV18.

Axiscades engineering

Vallum capital (Manish Bhandari) buys 1.95 lac shares (0.55%) at 153/share in the co.— Navin Shetty (@Navin_Shetty1) December 7, 2017

Axiscades, the ex-favourite of Ashish Kacholia, Hiren Ved’s Alchemy Capital, Narendra Kumar Agarwal

In the past, Axiscades has attracted a number of eminent stock pickers.

In March 2015, Hiren Ved’s Alchemy Capital made aggressive forays and bought big chunks of the stock at Rs. 235 each.

Ashish Kacholia followed suit and also bought a massive chunk at the same time.

The wizards were drawn to Axiscades on the premise that it is a “niche aerospace defense precision engineering technology” and will see “very high growth” and “high profitability” in the foreseeable future.

Sadly, things did not go as planned. The lucrative defense deals did not materialize for one reason or the other and the stock has languished.

Ashish Kacholia, who held 3,00,000 shares as of 1st April 2016, appears to have got fed up with the lack of progress. He dumped his holding in a systematic manner and reduced his holding to Nil by 12th August 2016.

Alchemy India Long-term Fund held 5,00,000 shares as of 1st April 2017. It appears to have sold all or most of its holding as of 30th September 2017.

Narendra Kumar Agarwal has also been on a systematic disposal drive. He reduced hisholding of 3,75,000 shares as of 1st April 2016 to Nil by 23rd September 2016.

Acquisition by Axiscades of Mistral Solutions will be a game-changer?

Prima facie, Manish Bhandari appears to have been drawn to Axiscades because of its acquisition of a company named ‘Mistral Solutions’.

Mistral Solutions is said to be a ‘defence electronics firm’ which provides “embedded electronics technology solutions”.

The company has long standing partnerships with DRDO, HAL, Bharat Electronics and the likes and has been their chosen design and integration partner for aircraft subsystems.

Mistral has designed over 100 commercially-deployed products across verticals and has over 40 design wins in various Indian defence programmes.

Besides the Indian defense, Mistral has a significant presence in North America in sectors including homeland security, consumer electronics and networking. Mistral has partnerships with companies like Texas instruments, Air bus, Microsoft and Qualcomm.

Mistral has 300 employees and earned Rs 132 crore in revenue last year.

Axiscades paid Rs 175 crore to acquire Mistral Solutions.

According to Sudhakar Gande, vice chairman of Axiscades, the acquisition of Mistral will help Axiscades position itself as a significant player in defence offset technologies.

“This acquisition will enhance our competence in embedded electronics and improve our customer base in India …. Mistral’s competence in embedded (electronics) will also offer better cross-selling opportunities and help deepen relations with existing customers” Gande said.

Axiscades will achieve a 30-40% increase in revenue in the current financial year, he added.

Mritunjay Singh, the new CEO, will provide direction to Axiscades?

Another factor that may have enticed Manish Bhandari is the fact that Axiscades has appointed Mritunjay Singh as its CEO.

Mritunjay Singh has rich experience in the Infotech sector given that he was in senior positions in Infosys and Persistent Technologies.

He noted that Axiscades is “entering an exciting phase of growth and has a tremendous opportunity in creating synergies between Engineering and Automation/IoT” and assured that he will build a “new age engineering technology powerhouse that we all can be proud of”.

https://t.co/yExRIaAuBc great to see Indian defence looking for native tech companies. #IndiaUnstoppable

— Mritunjay Singh (@munjays) December 3, 2017

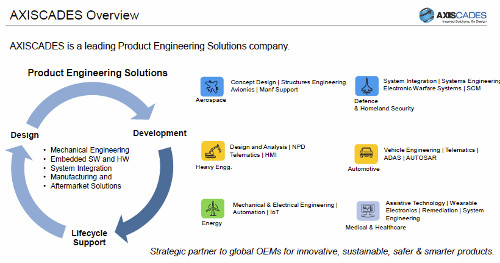

Investors’ presentation reveals business model

The latest investors’ presentation of Axiscades explains the entire business model in a succinct manner. It also throws light on the financial performance.

Axiscades Engineering has “very big scope” and is available at “very cheap valuation”: Ashish Kapur of Invest Shoppe

Ashish Kapur of Invest Shoppe has recommended a buy of Axiscades Engineering. His logic is quite sound:

“The company operates in various fields including energy, aerospace, defence, and marine. The company is attractively valued and the recent joint venture with the French company AS Systems Engineering gives it a good comparative edge especially in the energy space. The company is also very well spread geographically. It has operations in North America, Europe, and Asia Pacific. The real trigger going ahead could be its foray into defence. We believe that there is a very big scope going ahead and the company currently is available at a very cheap valuation. The company also enjoys very good operating margin and also has a very strong and healthy balance sheet. Given all that, this is a good stock to hold in one’s portfolio for the long run.”

Conclusion

Prima facie, Manish Bhandari’s acquisition of Axiscades Engineering appears to be sensible given the assurance by Ashish Kapur that the Company has “very big scope” and is available at “very cheap valuation”. If things fall into place and Axiscades snares a couple of big-ticket defense contracts, we could have another magnificent multibagger on our hands!

One can look at datamatics which has turnover twice as Axicades and already profitable .It has credible promoters and with high promoter stake. It’s available at same market cap as Axicades.

Based on my detail research of these are my picks in IT Sector

Small Cap- Datamatics

Mid Cap- Persistent Systems, Mindtree

Large Cap-TCS

L&T infotech is ugly duckling turning into swan… It has moved from 700 ipo price to above 1000. It trades at 15pe with high margin of safety.. Can turn out to be a multibagger in depressed IT sector with other midcaps overvalued..