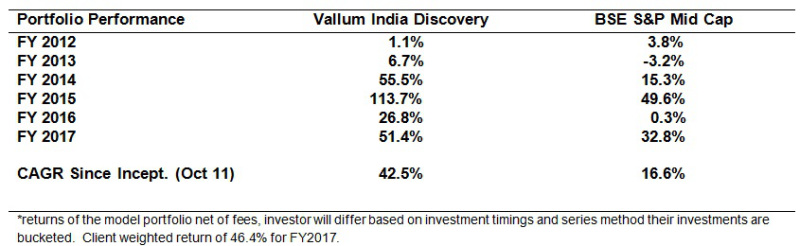

Consistent high returns from the Vallum India Discovery PMS Fund

While the 51% YoY gain is eye-popping, the relevant question to be asked is whether this is a one-time flash-in-the-pan or is a recurring one.

This is answered by the fact that since inception in October 2011, the Vallum India Discovery PMS Fund has delivered a CAGR return of 42.50% net of fees. In the same period, the BSE S&P Mid Cap Fund has delivered a gain of 16.6%.

So, there is no doubt that the Fund has consistently outperformed the benchmark index by a wide margin.

PMS Funds are cheaper than Mutual Funds?

Manish Bhandari has made the astonishing revelation that PMS Funds work out cheaper than mutual funds until a certain threshold level.

“We are comparable to a Mutual fund until a Compounded Annual Growth Rate (CAGR) of 16%-18% p.a is achieved for you, this has hurdle rate with high water mark, aligning our interest in a down turn”, he said.

He added that if one takes the average fee structure of five mid cap mutual funds, a proxy of mid cap performance, then in 7 out of 17 years, the PMS Fund has “charged less than a mutual fund”.

Of course, in years of outsize returns, the tables will be turned but investors will not mind because their own pockets will be bulging with gains.

Portfolio & investment strategy of the Vallum India Discovery Fund

Manish has revealed that the portfolio of the Discovery Fund has about 23-24 stocks with an allocation of 5% of the AUM to each.

The stocks are in companies with sales of Rs 3,000 crore, trailing PAT growth of 20%, market cap of 6,000 crore and ROE (return on equity) of 17%.

According to an investor’s presentation, the following were some of the stocks in the portfolio as of 31st March 2016:

|

Stock |

Date of Selling | % increase |

|

PI Industries |

Holding | 1804% |

|

Mayur Uniqouters |

28/03/2014 | 408% |

|

Smruthi Organics |

24/09/2014 | 312% |

|

Pennar Ind. |

Holding | 133% |

|

SKS Microfinance |

Holding | 70% |

|

Srikalahasthi Pipes |

Holding | 50% |

|

Indocount Ind. |

Holding | 6% |

|

Aarti |

17/11/14 | 0% |

|

Shipa Medicare |

Holding | -7% |

|

Prism |

27/04/15 | -19% |

|

TCPL |

Holding | -34% |

|

PRAJ |

31/03/2014 | -46% |

As one can see, the portfolio as of 31st March 2016 had stocks like PI Industries, Pennar Industries, SKS Microfinance, Srikalahasthi Pipes Indocount Industries, Shipa Medicare and TCPL in it.

We can assume that these stocks also form part of the portfolio as of 31st March 2017 since nothing has changed from an operational or valuation point of view to make these stocks unattractive.

Stocks that contributed to the stellar gains

Manish has chosen not to reveal the names of the favourite stocks in the portfolio. However, this is no hurdle for us given our superior sleuthing ability.

KRBL – 99% YoY gain

Manish wrote a detailed article in Outlook Business which he described KRBL as a “compelling story of value migration towards branded business” and recommended a buy.

In the latest newsletter he says that “The company has improved its brand positioning, retained market leadership, and launched a new high protein diet product for health conscious customers”.

He adds that:

“We strongly believe the best is yet to come for this business and this represents one of the significant undervalued FMCG opportunity in your portfolio”.

It is notable that a number of other ace investors such as Porinju Veliyath, Shyam Sekhar and Ekansh Mittal of Katalyst Wealth are also gung ho about basmati stocks such as LT Foods, Chaman Lal Setia etc.

Shilpa Medicare – 37% YoY Gain

Manish called Shilpa Medicare his “best pick for 2015” on the basis that the then impending FDA approval would catapult the fortunes of the Company.

In the latest news letter, Manish states that “The Oncology-led research pharmaceutical company, has received US FDA approval for commercial start of their formulation plant and rolled in two high potential acquisitions with itself”.

It is notable that Daljeet Kohli, who first recommended a “strong buy” of Shilpa Medicare in April 2014, has called it his “Best pick for 2017” in Outlook Business.

“The time has come for Shilpa Medicare to reap the benefits of the hard work done by its management over the past few years,” Daljeet said in his characteristic soft spoken voice.

Shilpa Medicare also enjoys the distinction of being awarded the prestigious title of potential 100-Bagger by Motilal Oswal.

Also, the stock is a “high conviction bet” for Hitesh Patel, one of the renowned experts of the valuepickr forum.

“Market leader in gear shifter” – Lumax Auto Technologies?

Manish has described one of the winners in the portfolio as an “auto ancillary company, market leader in gear shifter”.

I am not certain but this could be a reference to Lumax Auto Technologies, which is said to be leader in gear shifters.

Lumax Auto Technologies is also one of Daljeet Kohli’s favourites. He called it his “Best pick for 2015”.

The stock has given a 55% gain on a YoY basis.

Lumax Auto Technologies has also been recommended by Rajat Sharma of Sana Securities as an “excellent stock” owing to its “great financials” and “cheap valuations”.

Lumax Auto Technologies – great financials, cheap valuations, market cap of 691 crores. Excellent stock.

— Rajat Sharma (@SanaSecurities) April 5, 2017

New additions to the portfolio in FY2016-17

Manish has revealed that five stocks were added to the portfolio in FY2016-17. Some of the names are easy to guess while others are difficult.

Exide Industries

Manish has not named Exide Industries though he described it as a “leading battery producing company in India, a duopolistic industry”. He adds that “The change of guard in professional management with superior addressable market share gaining strategy in battery and among few with 100% ownership in growing insurance business has contributed in generating returns during the course of the years”.

“The management will be firing from many cylinders; this company will see remarkable turnaround,” he emphasizes.

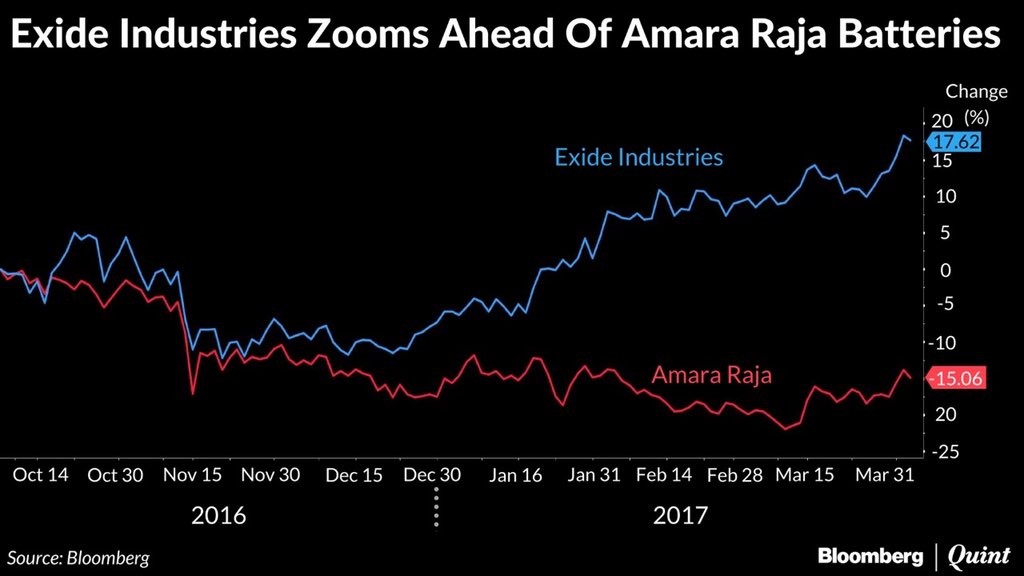

It is notable that when Exide was lagging behind its arch rival Amara Raja Batteries, some experts had opined that Exide should be bought because it was “All charged for a comeback”.

This has come true with Exide having delivered a YoY gain of 69% as compared to the flat return of Amara Raja Batteries.

(Image credit: Bloomberg)

Some other stocks referred to by Manish include the following:

(i) A “market leader in the electrode business, a proxy to the recovery of steel manufacturing by Electric Arc Furnace (EAF) business, globally”. This could be a reference to Transformers & Rectifiers whose management has assured that “Arc furnace transformers to drive business”;

(ii) “leading private sector bank, whose charismatic founder has been able to navigate the bank thorough most difficult times of the economy. The bank is a powerhouse in arranging the bouquet of a diversified financial product in front of customers; while gaining markets share”. This may be a reference to Yes Bank or to IndusInd Bank, both of whom have had “charismatic founders”;

Stocks recommended by Manish Bhandari

Manish recommended Deepak Fertilizers as his “best pick for 2017” on the logic that “Deepak Fertilisers stands to gain from its vertically integrated operations and leadership position in key specialty chemicals”.

The recommendation has worked out well with the stock having given a gain of 69% on a YoY basis and 28% since January 2017.

In an interview with Ramesh Damani, he recommended an investment in Siyaram Silk Mills and Raymond on the basis that these stocks are in “pole position” to take off as and when the imminent revival in the sector happens.

Incidentally, Siyaram Silk Mills is a favourite of Dolly Khanna and Sunil Singhania as well.

Siyaram Silk Mills has done well with a 60% YoY gain.

Shortage of good stocks coming soon, so hold on tight to existing investments

Manish has issued the chilling warning that “India is likely to witness shortage of quality investable companies in the future”.

He advises us to refrain from flipping stocks on the basis that “relative value trade, pitting one company against another without a deep dig, is not going to yield sustainable return”.

Instead, we should “hold on to the good companies you have discovered rather attempting to find new gem”, he opines.

Buy Yes bank,Kotak bank,DHFL,ICICI insurance, Asian paints,RIL,Rel Capital, L&T Finance, L&T,ITC ,Ultratech cement , Vardhman textiles and count your returns after 3 Years ,which will be more than many mutual funds and PMS of experts.

wow..i have small quantities of all the above except vardhman..felt happy reading it.

am recent entry to this board..can u tell me a bit about the stocks i hold and are they good to hold ..long term investor here

rbl bank, bajaj finance, bajaj finserve, lumax industries, rane brake linings, maruti, eicher, ultratech,reliance,akshar chem, bhageria industries, guj alkali, deep industries, dcm shriram,steel stripe wheel, ucal fuels, asian paints, kansai nerolac, lupin, sun pharma, aurobindo, dishman pharma,cera sanitary,bodal chemicals, ghcl,whirlpool, sbi, yes bank, indusind bank, dcb bank, federal bank, lakshmi vilas,hero motor corp, nile, pondy oxides, pnb gilts, kotak mahindra, lic housing finance,tata motors, fiberweb india, nocil, l&t finance holdings, manappuram, asahi songwon, nmdc, hind zinc, moil, EIL

yes number of stocks are lot but amounts in each are small 🙂 tried to diversify and sectors are bfsi/banks/nbfc, auto and auto ancillaries, chemicals and agri ..

picked these stocks after extensive reading and following boarders on money control and reading recos and seeing parameters of above on screener.in

BTW I love this site..thanks to the admin..its so comprehensive..too bad i discovered it very late

During the year, we have made investment in electrode business, market leader in India, a proxy to the recovery of steel manufacturing by Electric Arc Furnace (EAF) business, globally :::—-Graphite

Our bet in transformer sector has not yet played out due to the slow pace of investment-led revival of business cycle led by state utilities. We are monitoring the situation, carefully. The business has cash and liquid investments equivalent to the market capitalization of the company. It has designed innovative product in electrical motor business and we have suggested them to get into smart meter business.::::———-Voltamp

Well defined portfolio of stocks

was this to me or kharb?

is anybody invested with them who can share their experience pl share your details or reach me on djrish@gmail.com

i had approached them but didnt get the confidence

Wish to invest about 30 lakhs in large cap & mid Cap PMS

please give details of vallum PMS